- Denmark

- /

- Life Sciences

- /

- CPSE:GUBRA

Undiscovered European Gems to Explore in November 2025

Reviewed by Simply Wall St

As European markets navigate a landscape marked by cautious optimism following the reopening of the U.S. federal government, key indices like the STOXX Europe 600 have shown resilience with a modest rise, despite cooling sentiment around artificial intelligence investments. In this environment, discerning investors may find opportunities in lesser-known stocks that demonstrate strong fundamentals and adaptability to shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Gubra (CPSE:GUBRA)

Simply Wall St Value Rating: ★★★★★★

Overview: Gubra A/S is a biotech company specializing in pre-clinical contract research and peptide-based drug discovery targeting metabolic and fibrotic diseases across Europe, North America, and internationally, with a market cap of DKK7.47 billion.

Operations: Gubra generates revenue primarily from its CRO segment, contributing DKK218.31 million, and a significantly larger portion from the D&P segment at DKK2.42 billion.

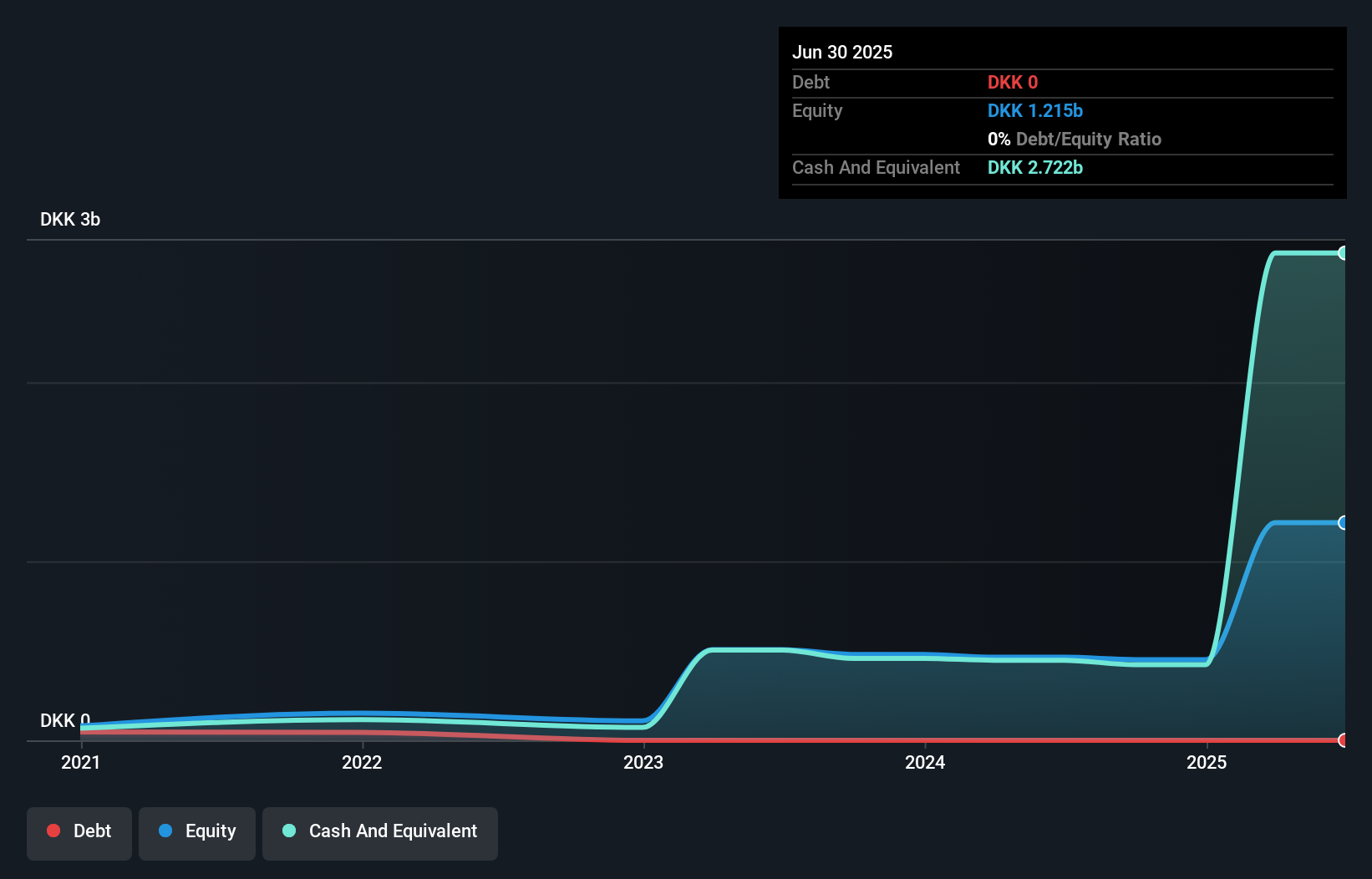

Gubra, a biotech firm specializing in preclinical contract research and peptide-based drug discovery, recently reported impressive financial results with half-year sales reaching DKK 2.49 billion compared to DKK 120.63 million the previous year. Net income soared to DKK 1.76 billion from a net loss of DKK 20.14 million last year, showcasing its newfound profitability and high-quality earnings despite market volatility. The company's debt-free status and low price-to-earnings ratio of 4.3x indicate good value relative to peers in the Danish market (14.6x). However, forecasts suggest an average annual earnings decline of 80% over the next three years as Gubra navigates volatile markets and concentrated revenue streams while expanding its proprietary peptide pipeline to diversify income sources beyond core CRO services.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme is involved in providing electricity and natural gas to individuals, businesses, and local authorities in France, with a market capitalization of approximately €1.24 billion.

Operations: The primary revenue streams for Électricite de Strasbourg Société Anonyme are from the production and marketing of electricity and gas, generating €1.02 billion, and distribution activities contributing €329.54 million. The company has a market capitalization of approximately €1.24 billion.

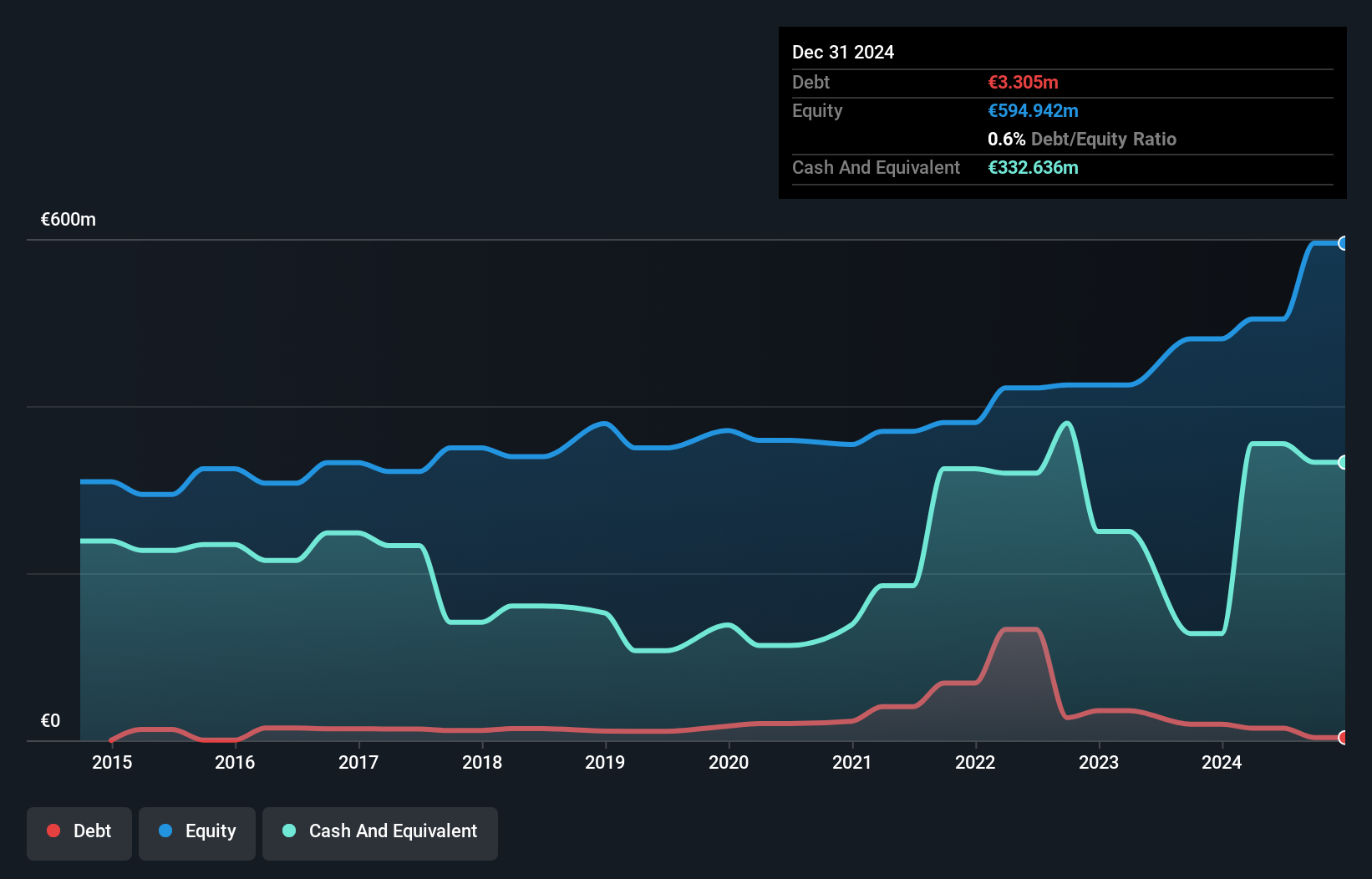

Électricite de Strasbourg, a smaller player in the European electric utilities sector, showcases promising financial health. Its earnings have grown by 10% over the past year, outpacing the industry’s negative trend. The company has significantly reduced its debt-to-equity ratio from 5.6 to 0.5 over five years and holds more cash than total debt, indicating robust financial management. Recent half-year results showed net income at €84 million compared to €79 million last year, with basic earnings per share rising to €11.76 from €11.06. Trading at a substantial discount of about 58% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this space.

Odfjell Drilling (OB:ODL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Odfjell Drilling Ltd. operates mobile offshore drilling units mainly in Norway and Namibia, with a market cap of NOK19.83 billion.

Operations: Odfjell Drilling generates revenue primarily from its own fleet, contributing $681.40 million, and an external fleet, adding $175.30 million. The company's net profit margin reflects financial performance trends over time.

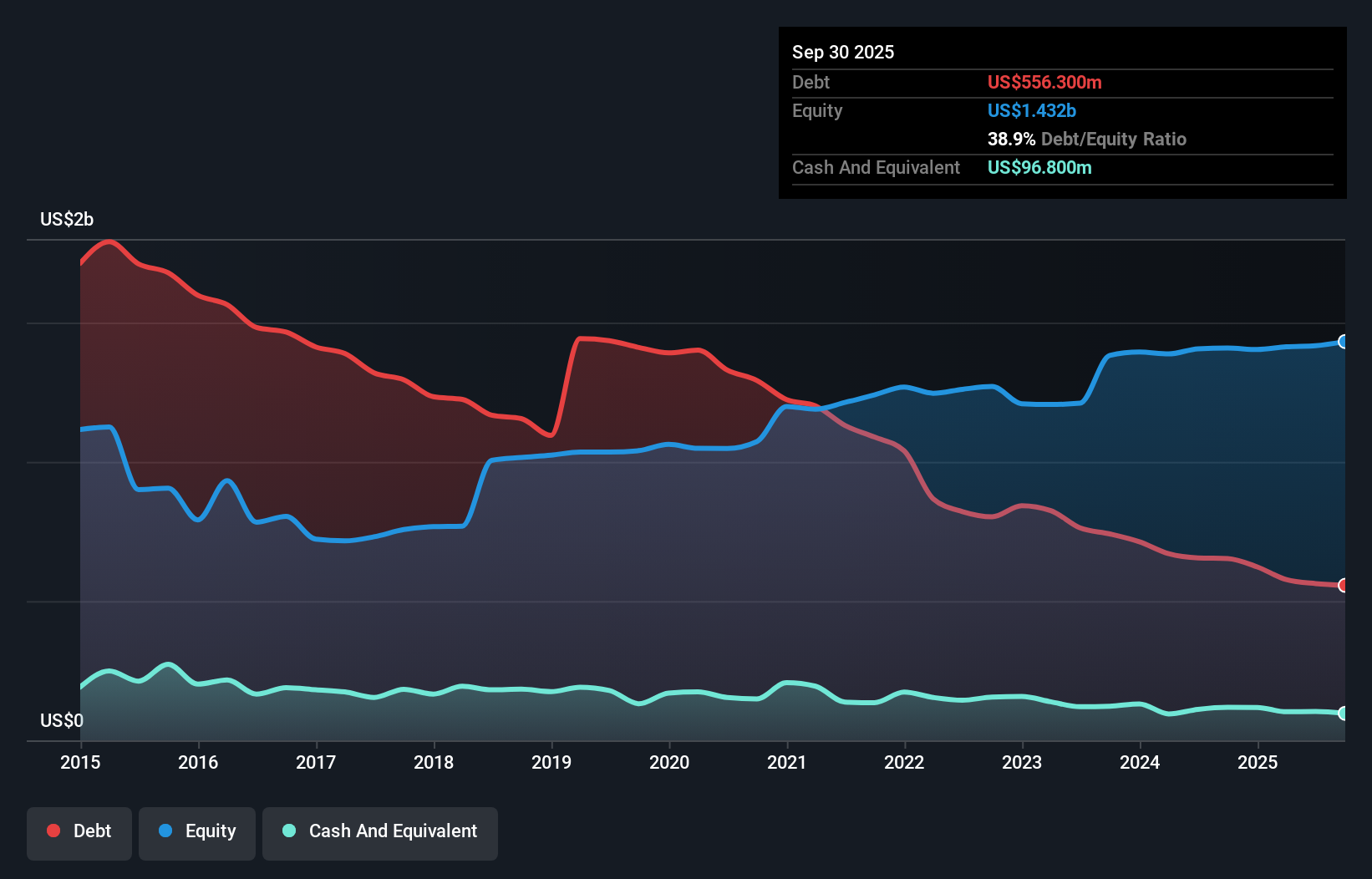

Odfjell Drilling, a notable player in the energy services sector, showcases strong financial health with a net debt to equity ratio of 32.1%, deemed satisfactory. The company has demonstrated impressive earnings growth of 94.3% over the past year, significantly outpacing industry averages. Trading at 52.3% below its estimated fair value enhances its investment appeal. Recent earnings reports reveal substantial improvements: third-quarter sales reached US$233.7 million compared to US$186.5 million last year, while net income rose to US$55.1 million from US$19.1 million previously, reflecting robust operational performance and strategic positioning within the market landscape.

Summing It All Up

- Access the full spectrum of 319 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GUBRA

Gubra

A biotech company, focuses on the pre-clinical contract research and peptide-based drug discovery within metabolic and fibrotic diseases in Europe, North America, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives