- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme And 2 Other Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

As the European Central Bank's recent interest rate cuts have buoyed major stock indexes, France's CAC 40 Index has seen a modest increase, reflecting a broader optimism in the region. Amidst these shifting economic conditions, small-cap stocks with robust fundamentals present intriguing opportunities for investors seeking stability and growth potential. In this context, Électricité de Strasbourg Société Anonyme and two other lesser-known companies stand out as promising candidates due to their strong financial health and strategic positioning within their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative | 10.84% | 3.22% | 6.38% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| ADLPartner | 82.84% | 9.86% | 16.18% | ★★★★★☆ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Vaziva Société anonyme | 8.03% | 68.56% | 431.41% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme focuses on supplying electricity and natural gas to individuals, businesses, and local authorities in France, with a market capitalization of €763.54 million.

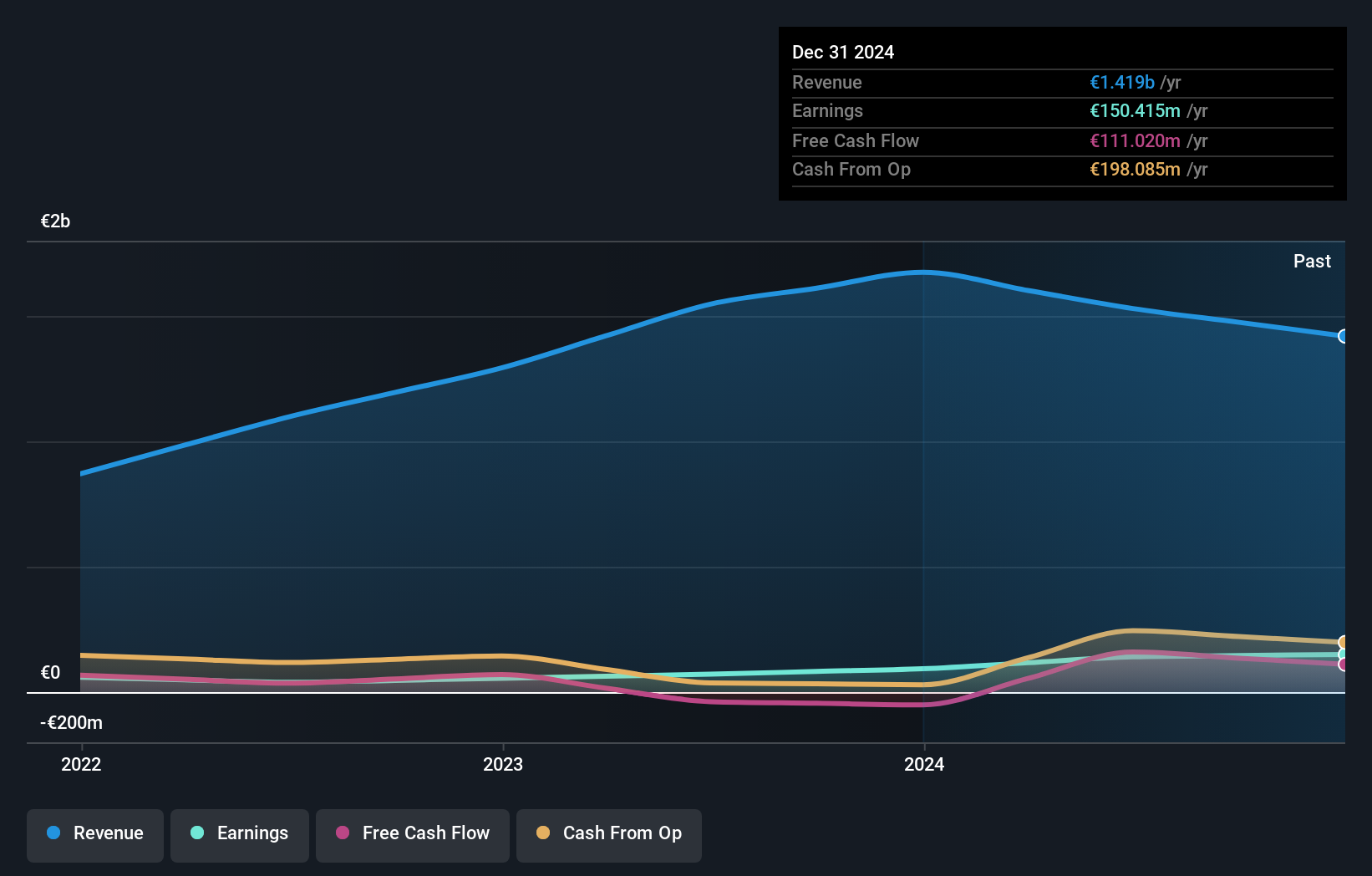

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily from the production and distribution of electricity and gas, contributing €1.24 billion, followed by its role as an electricity distributor with €302.94 million. The company exhibits a focus on these core segments for its income streams.

Électricite de Strasbourg, a smaller player in the French market, is showing promising signs with earnings growth of 96.7% over the past year, outpacing the Electric Utilities industry. The company appears to be trading at a significant discount, about 93.8% below its estimated fair value. Recent performance highlights include net income rising to €79.29 million from €31.87 million and basic earnings per share climbing to €11.06 from €4.45 year-over-year for the half-year ending June 2024, despite sales and revenue seeing reductions compared to last year at €762.92 million and €823.43 million respectively.

Société Fermière du Casino Municipal de Cannes (ENXTPA:FCMC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Société Fermière du Casino Municipal de Cannes operates casinos and hotels in France with a market capitalization of €236.50 million.

Operations: The company's primary revenue streams are from its hotel business, generating €127.84 million, and casinos, contributing €17.25 million. The hotel segment significantly outweighs the casino operations in terms of revenue generation.

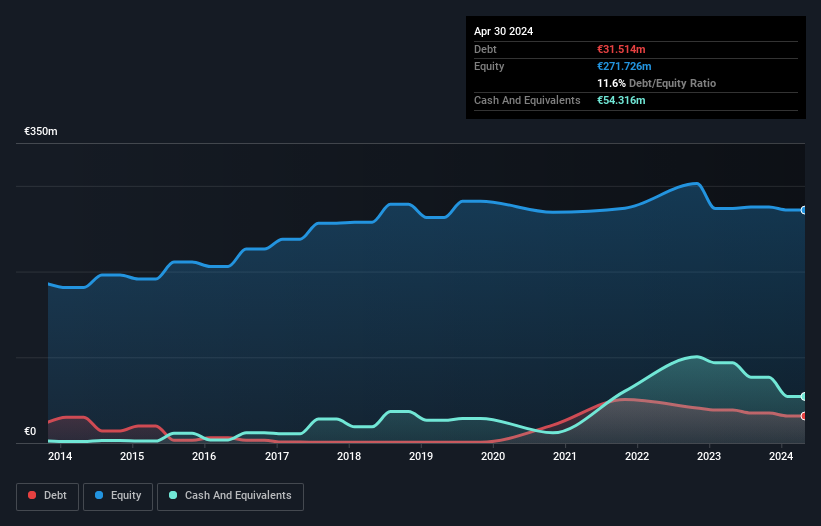

Nestled in the vibrant hospitality sector, Société Fermière du Casino Municipal de Cannes has seen its earnings surge by 58% over the past year, outpacing the industry average of 4.5%. The company appears to be trading at a compelling value, approximately 27.3% below its estimated fair value. Despite an increase in debt to equity from 0.3 to 11.6 over five years, it holds more cash than total debt and generates high-quality earnings. With interest payments well-covered by profits and positive free cash flow of €16.59 million as of October 2024, financial stability seems assured for this small-cap entity.

NRJ Group (ENXTPA:NRG)

Simply Wall St Value Rating: ★★★★★★

Overview: NRJ Group SA is a private media company that operates as a publisher, producer, and broadcaster in France and internationally, with a market capitalization of €575.85 million.

Operations: NRJ Group generates revenue primarily from its Radio segment (€243.01 million), followed by Television (€78.63 million) and Circulation (€77.62 million). The company's net profit margin is a key financial metric to consider when evaluating its profitability.

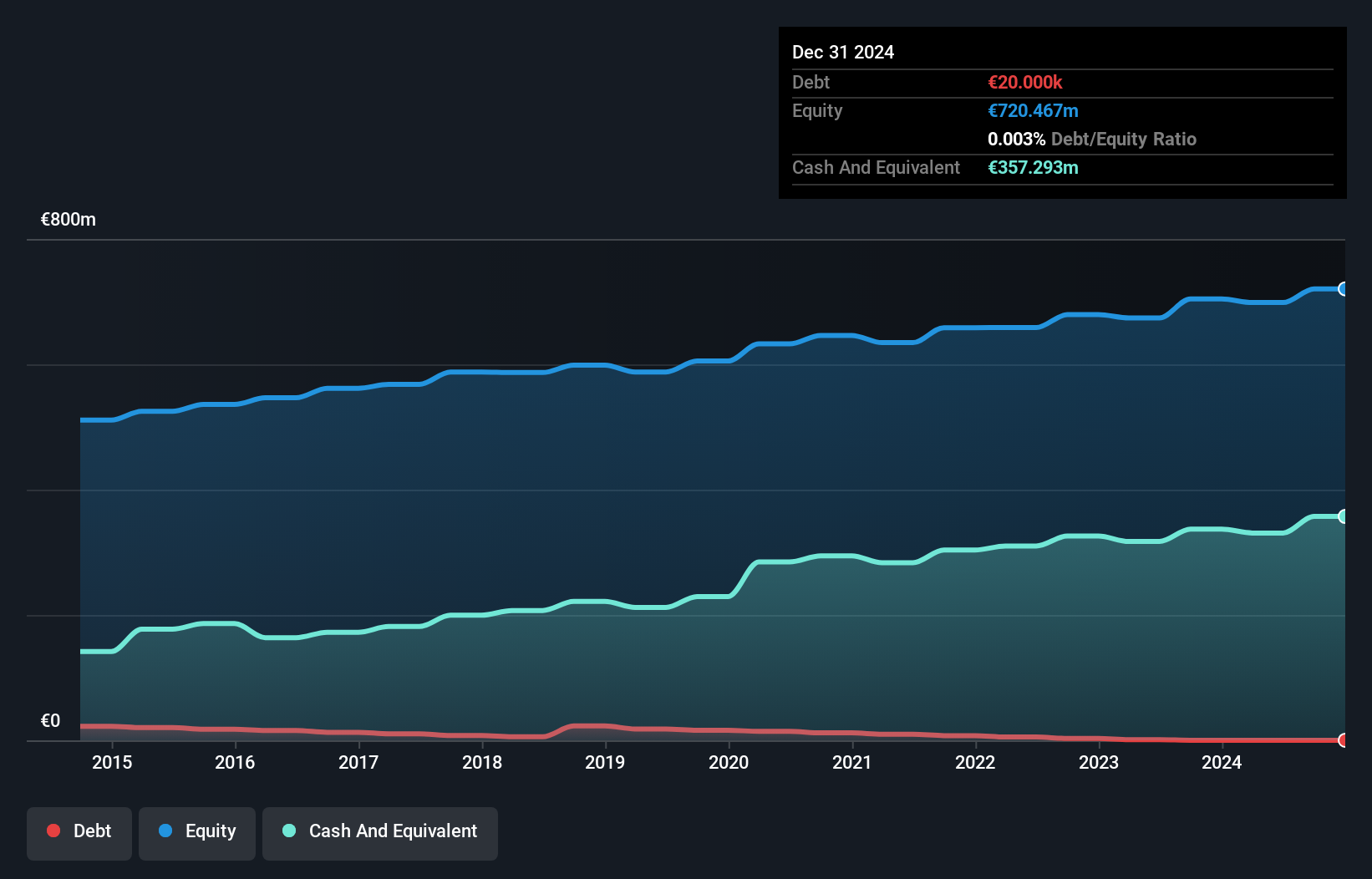

NRJ Group, a nimble player in the media sector, has demonstrated financial resilience with earnings growing 12.5% annually over five years and reducing its debt-to-equity ratio from 3.1 to zero. Recent half-year results show sales at €199 million, up from €192 million last year, while net income rose to €20 million from €15.2 million. Despite not outpacing industry growth last year, NRJ's solid cash position surpasses its total debt and trades at nearly 40% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in France's media landscape.

- Click here and access our complete health analysis report to understand the dynamics of NRJ Group.

Explore historical data to track NRJ Group's performance over time in our Past section.

Summing It All Up

- Unlock more gems! Our Euronext Paris Undiscovered Gems With Strong Fundamentals screener has unearthed 36 more companies for you to explore.Click here to unveil our expertly curated list of 39 Euronext Paris Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Outstanding track record with excellent balance sheet and pays a dividend.