- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

3 Euronext Paris Dividend Stocks Yielding Up To 8.1%

Reviewed by Simply Wall St

As European markets respond to the European Central Bank's recent interest rate cut, France's CAC 40 Index has seen a modest rise, reflecting broader expectations for continued monetary easing. In this environment of shifting economic policies and inflation dynamics, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those looking to navigate the current market landscape.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.73% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.93% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.11% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.19% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.33% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.59% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.86% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.00% | ★★★★★☆ |

| Infotel (ENXTPA:INF) | 4.73% | ★★★★☆☆ |

| Rexel (ENXTPA:RXL) | 4.68% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top Euronext Paris Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

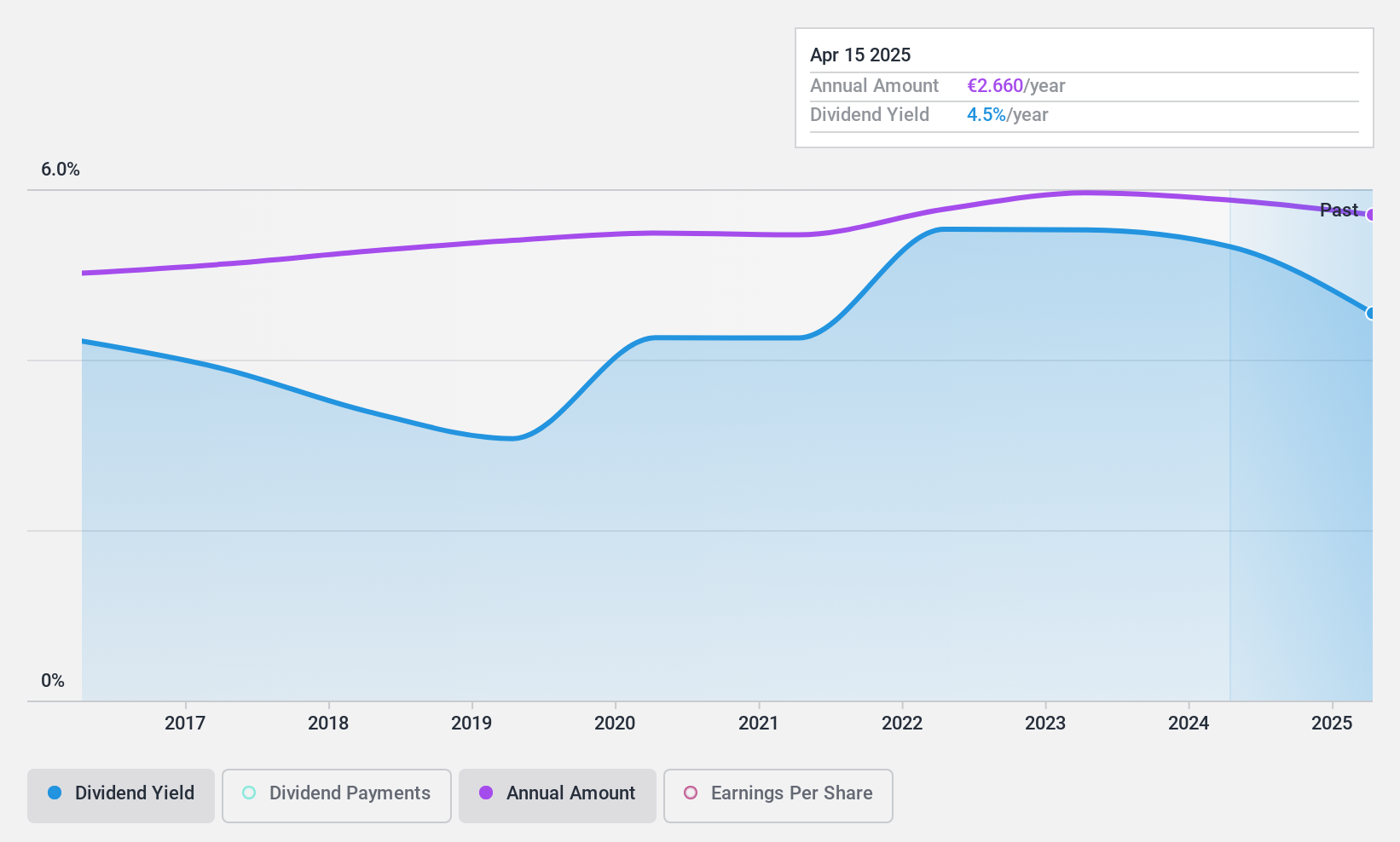

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client segments in France, with a market cap of approximately €978.95 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates revenue through its provision of banking products and services to a wide array of clients, including individuals, professionals, associations, farmers, businesses, private banking customers, and public and social housing community clients in France.

Dividend Yield: 5.5%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a reliable dividend yield of 5.54%, supported by a low payout ratio of 29.8%, indicating good earnings coverage. The company's dividends have been stable and growing over the past decade, although they are slightly below the top tier in France. Recent earnings showed net income growth to €114.91 million, reinforcing its ability to maintain dividend payments despite a slight dip in net interest income.

- Take a closer look at Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's potential here in our dividend report.

- According our valuation report, there's an indication that Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's share price might be on the cheaper side.

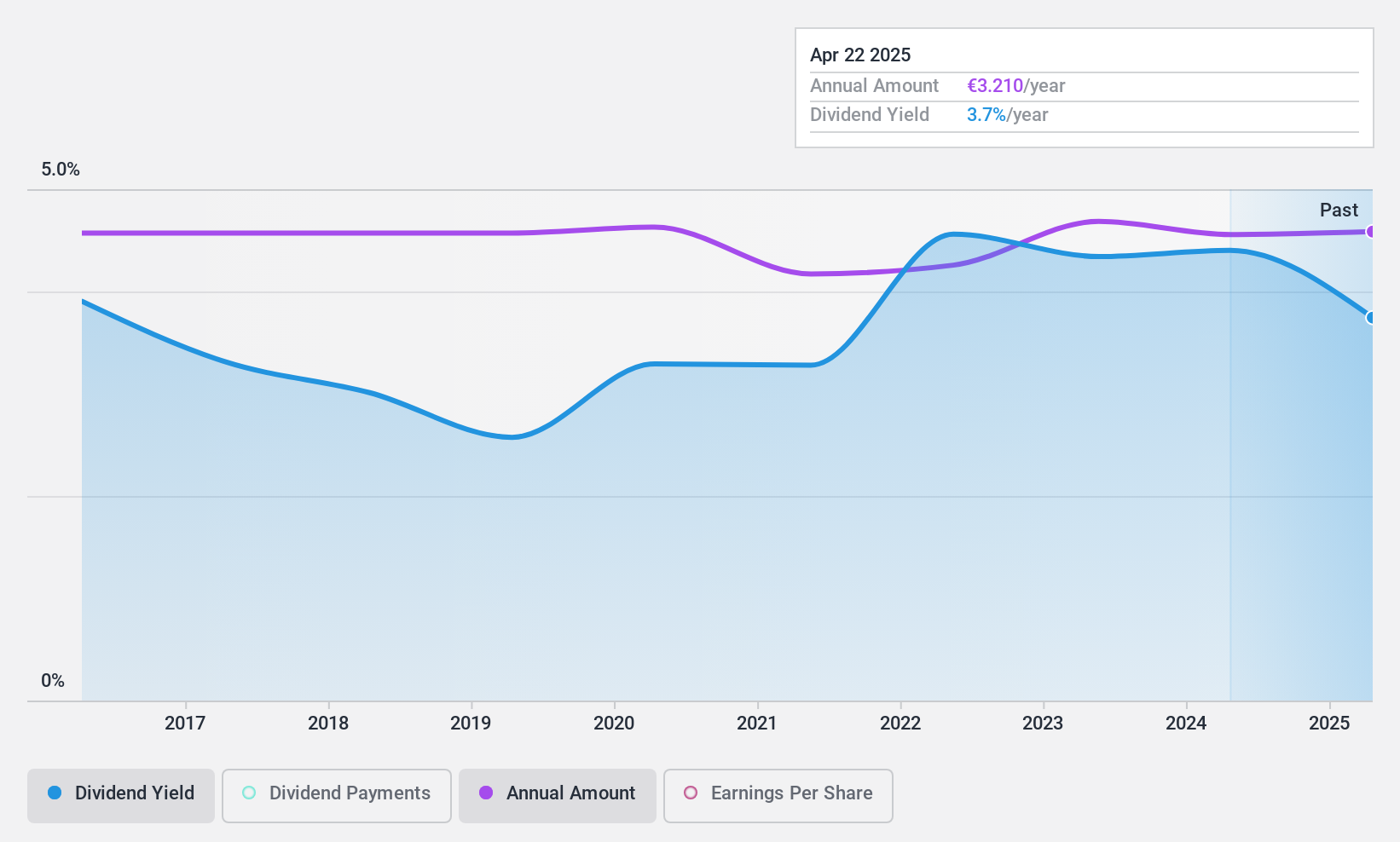

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market cap of €438.77 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative generates its revenue primarily from Proximity Bank, contributing €254.46 million, and Management for Own Account and Miscellaneous activities, adding €94.09 million.

Dividend Yield: 4.6%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative provides a reliable dividend yield of 4.56%, with dividends that have been stable and growing over the past decade. The low payout ratio of 17.9% suggests strong earnings coverage, though the yield is below France's top tier. Recent earnings reported net interest income growth to €92.82 million, while net income remained steady at €66.09 million, supporting its dividend sustainability.

- Get an in-depth perspective on Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative's performance by reading our dividend report here.

- Our valuation report unveils the possibility Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative's shares may be trading at a discount.

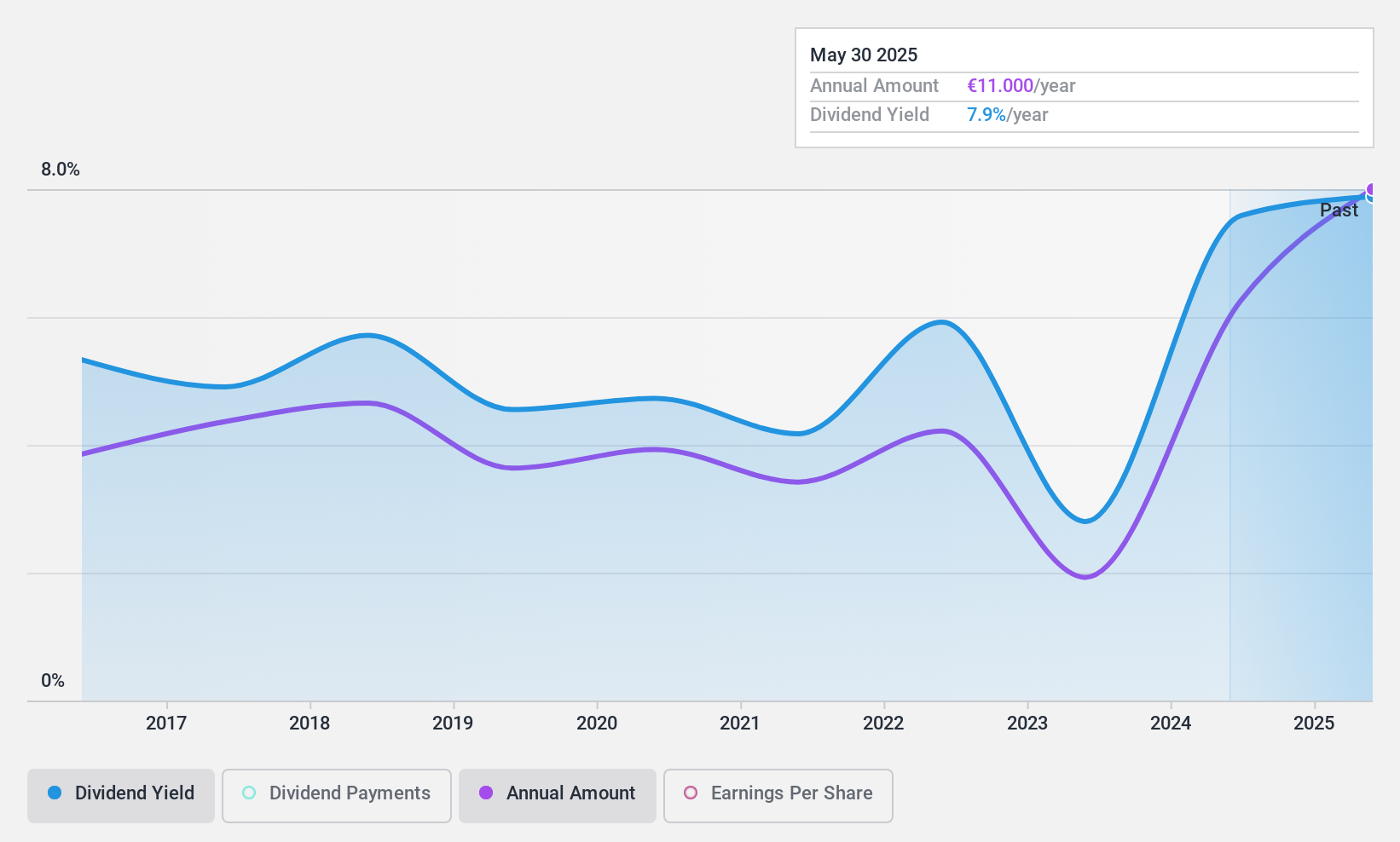

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €759.95 million.

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily from the production and distribution of electricity and gas (€1.24 billion) and as an electricity distributor (€302.94 million).

Dividend Yield: 8.1%

Électricité de Strasbourg Société Anonyme offers a dividend yield of 8.11%, placing it in the top 25% of French dividend payers. Despite this, its dividends have been volatile over the past decade, with significant annual drops exceeding 20%. However, recent earnings improvements—net income rose to €79.29 million—suggest stronger coverage for dividends, supported by a low payout ratio of 43.8% and cash payout ratio of 38.6%, enhancing dividend sustainability despite past unreliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Électricite de Strasbourg Société Anonyme.

- Insights from our recent valuation report point to the potential undervaluation of Électricite de Strasbourg Société Anonyme shares in the market.

Turning Ideas Into Actions

- Navigate through the entire inventory of 31 Top Euronext Paris Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Outstanding track record with excellent balance sheet and pays a dividend.