- France

- /

- Infrastructure

- /

- ENXTPA:ALTOU

Touax SCA (EPA:TOUP) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Touax SCA (EPA:TOUP) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

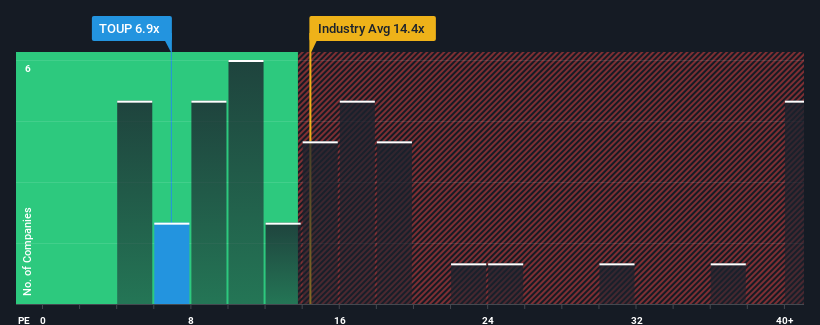

Following the heavy fall in price, given about half the companies in France have price-to-earnings ratios (or "P/E's") above 16x, you may consider Touax as a highly attractive investment with its 6.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times haven't been advantageous for Touax as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Touax

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Touax's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 52% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 40% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 65% over the next year. With the market only predicted to deliver 17%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Touax's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Touax's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Touax currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Touax (of which 1 is potentially serious!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Touax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALTOU

Touax

Engages in the provision of operational leasing, sales, and management of standardized mobile equipment worldwide.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives