Is Euronext 150 Inclusion Altering the Investment Case for ID Logistics Group (ENXTPA:IDL)?

Reviewed by Sasha Jovanovic

- ID Logistics Group SA was recently added to the Euronext 150 Index, highlighting its growing profile among the largest listed companies in Europe.

- Index inclusion can act as a catalyst for wider institutional investor attention, reflecting the company's perceived stability in the logistics sector.

- We'll explore how Euronext 150 membership could influence ID Logistics Group's investment narrative and future investor perception.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is ID Logistics Group's Investment Narrative?

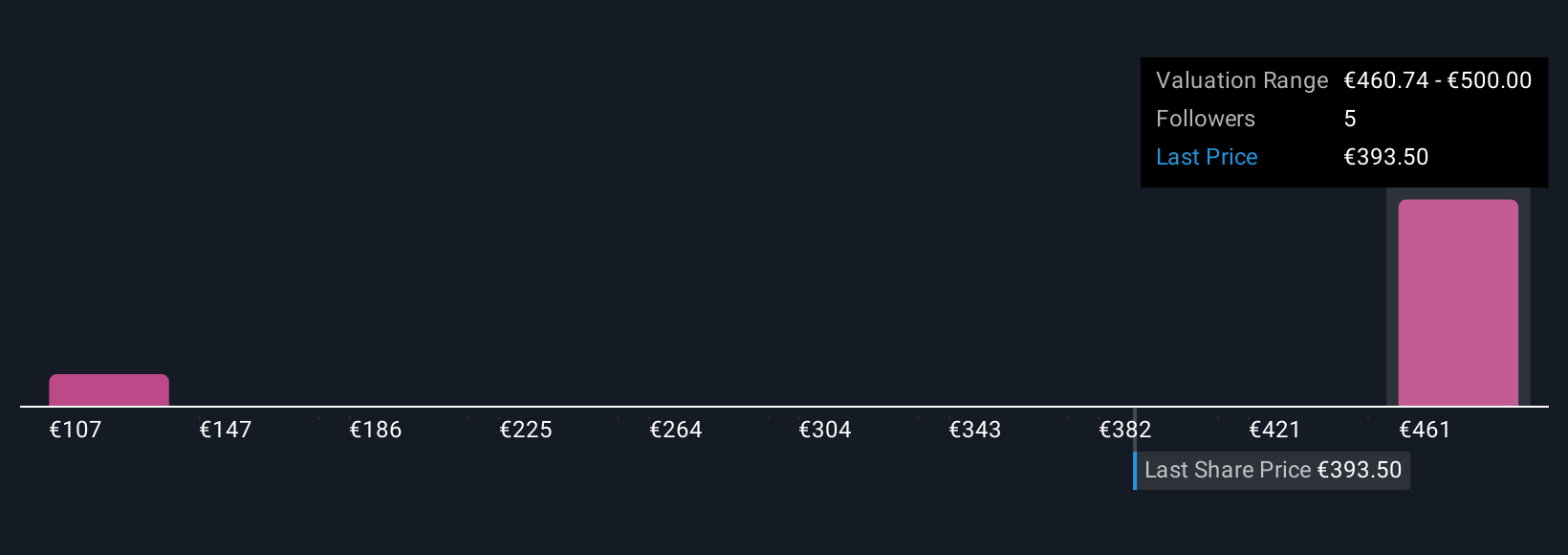

To be a shareholder in ID Logistics Group today, you’d likely need to focus on its narrative as a steadily expanding logistics specialist gaining visibility in Europe, supported by ongoing international growth like its recent move into the Canadian market. The fresh addition to the Euronext 150 Index puts the company in the same league as some of the continent’s biggest names, which could lead to more institutional interest and may help its shares close the gap to consensus analyst price targets. However, while index inclusion boosts the profile, it doesn’t change the reality that ID Logistics trades at a much higher earnings multiple than the sector average. This is still a business with thin profit margins and a history of growing a little bit slower recently than over its longer track record. Short-term, activity around index rebalancing could bring volatility, but the biggest risks remain the high valuation and competition sharpening pressures on profit margins, not the index news itself.

Yet it’s the persistence of slim profit margins that could matter most for investors.

Exploring Other Perspectives

Explore 4 other fair value estimates on ID Logistics Group - why the stock might be worth as much as 30% more than the current price!

Build Your Own ID Logistics Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ID Logistics Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free ID Logistics Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ID Logistics Group's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IDL

ID Logistics Group

Provides contract logistics services in France and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives