- France

- /

- Infrastructure

- /

- ENXTPA:GET

How Does Getlink Stack Up After Recent Cross-Channel Transport Agreement?

Reviewed by Simply Wall St

If you’re wrestling with what to do next on Getlink, you’re not alone. The company’s share price has certainly kept investors on their toes lately. Over the last week, the stock edged up by 1.2%, hinting at fresh optimism. Zoom out a bit further, and the picture gets choppier. A dip of nearly 6% in the past month was followed by a modest 1.6% gain year-to-date, and, for the long-haulers, a 47.3% return over five years. These figures reflect both the volatility and potential that come with owning a stock tightly linked to European infrastructure and cross-Channel transport. Recent shifts in market sentiment, particularly with new transport agreements and a steady uptick in cross-border travel, may help explain some of this price action. Still, when we size up Getlink’s appeal versus its price, the numbers suggest a cautious approach: out of six major valuation checks, Getlink is flagged as undervalued in just one, for a current valuation score of 1.

This sets the stage for a closer look at valuation itself. Next, we’ll break down how Getlink measures up across several commonly used market yardsticks, and also explore why there may be a smarter way to make sense of how the company is really valued.

Getlink scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Getlink Discounted Cash Flow (DCF) Analysis

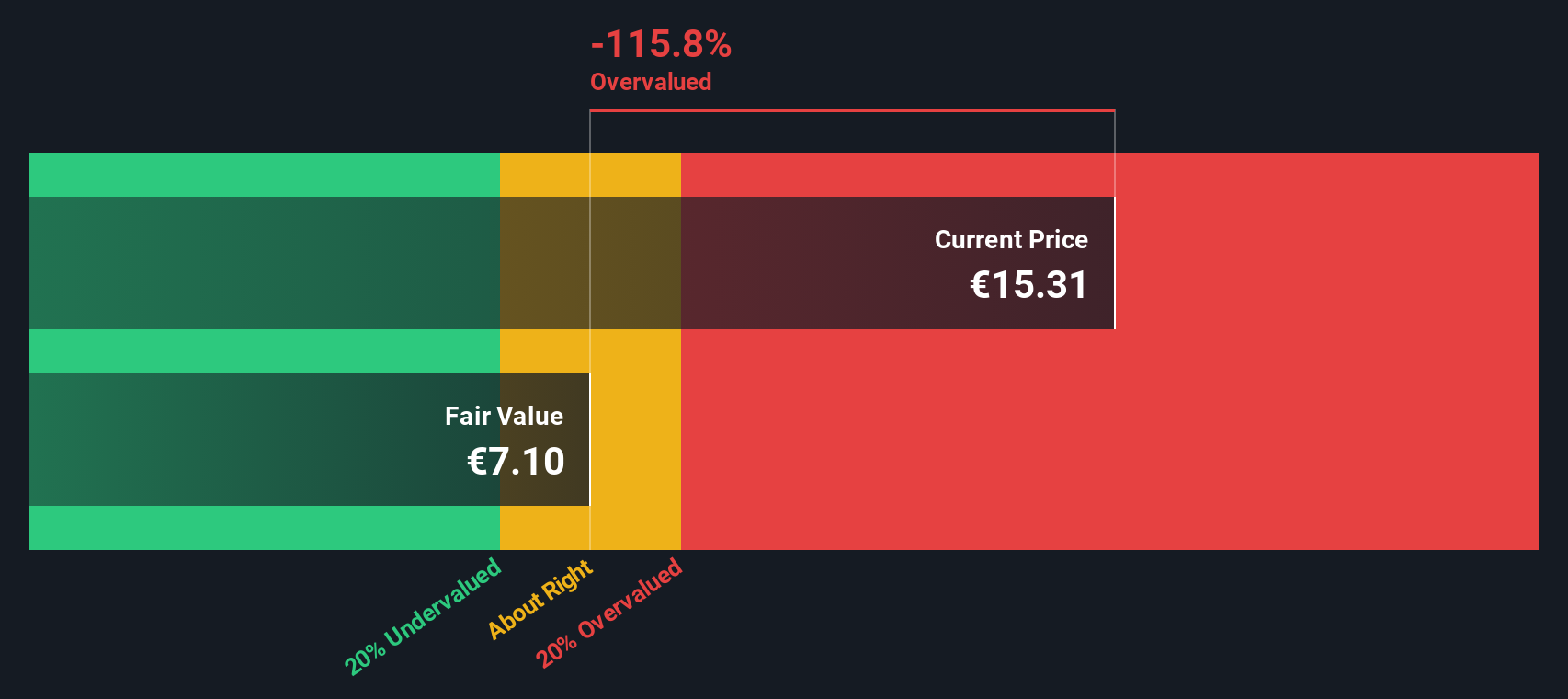

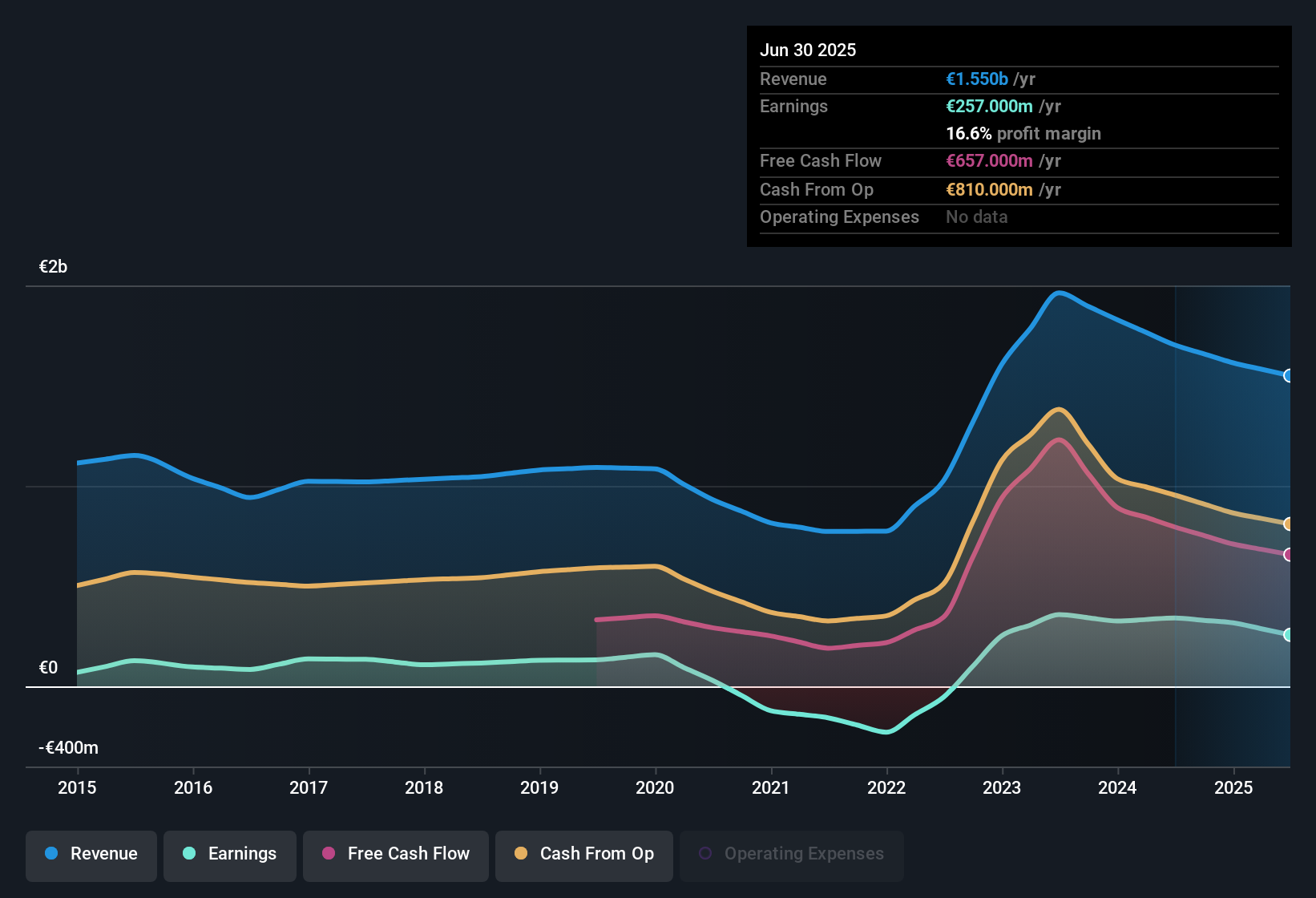

The Discounted Cash Flow (DCF) model aims to estimate a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. For Getlink, this approach uses a 2 Stage Free Cash Flow to Equity model. It begins with the company's current Free Cash Flow, then factors in analyst forecasts for the next several years and extends further using educated projections.

In 2023, Getlink's Free Cash Flow stood at €672.2 Million. Analyst estimates reach as far as 2027, forecasting an annual Free Cash Flow of €381.6 Million by that time. Beyond those five years, the projections shift to more modest growth, reaching roughly €276.2 Million by 2035. All future amounts are discounted back to present value.

Using this model, the estimated intrinsic value per share is €6.88. When compared to Getlink's current share price, this implies that the stock is trading at a premium of 130.7% over its calculated fair value. This suggests it is significantly overvalued based on these cash flow assumptions.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Getlink.

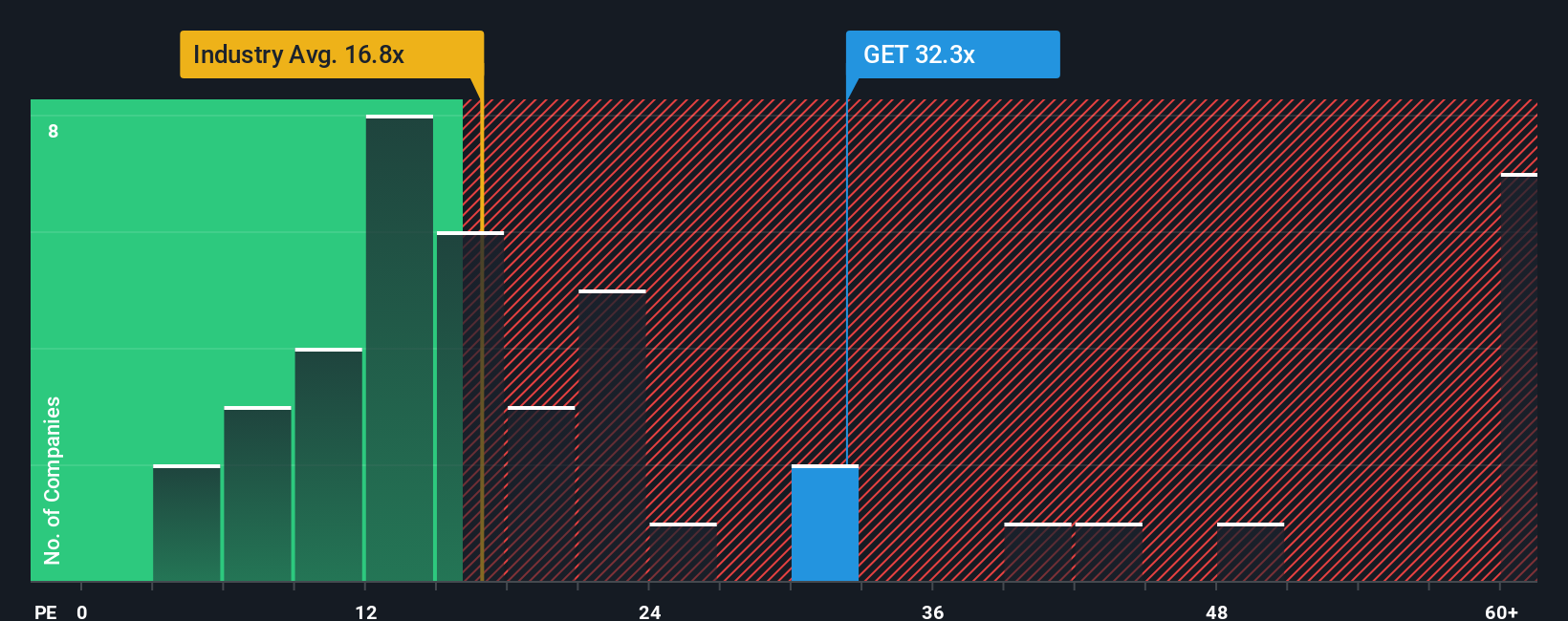

Approach 2: Getlink Price vs Earnings

For established, profitable companies like Getlink, the Price-to-Earnings (PE) ratio is often considered one of the most reliable ways to gauge valuation. This metric helps investors understand how much they are paying for each euro of profit the company generates. A higher PE can signal growth optimism or lower risk, while a lower PE might reflect slower prospects or additional business uncertainty.

Currently, Getlink’s PE ratio stands at 33.5x. This is noticeably above the Infrastructure industry average of 15.1x, and also exceeds the average among its peers, which sits at 38.1x. On the surface, this could suggest that Getlink is priced at a premium, perhaps for its growth potential or perceived resilience. However, comparing to broad industry or peer groups does not account for company-specific factors like earnings quality, size, unique risks, or margins.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, calculated to be 18.9x for Getlink, incorporates not just industry context and market cap, but also factors like growth forecasts, profit margins, and company-specific risks. This makes it a more tailored and holistic benchmark for the company’s current valuation. When Getlink’s actual PE of 33.5x is compared against the Fair Ratio of 18.9x, the difference suggests the shares are priced significantly higher than justified by fundamentals alone.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Getlink Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story about a company that goes beyond the numbers, connecting what you believe about Getlink’s future with your own forecast for its revenue, earnings, and margins. This ultimately shapes what you see as fair value. Narratives turn investing into a more accessible and dynamic process by helping you visualize how your unique expectations stack up against the current market price, all in a format that's easy to use on Simply Wall St’s Community page alongside millions of other investors.

With Narratives, you get real-time updates as news or new earnings are released, so the story and your decision adapt as the facts evolve. This means you can confidently decide to buy or sell by directly comparing your fair value forecast to the latest market price. For instance, some investors might craft an optimistic Getlink Narrative forecasting rapid passenger recovery and assign a high fair value, while others may be more cautious and set a much lower estimate. Narratives empower you to make investment choices that match your perspective, with clarity and flexibility.

Do you think there's more to the story for Getlink? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GET

Getlink

Engages in the design, finance, construction, and operation of fixed link infrastructure and transport system in France and the United Kingdom.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives