Should Investors Rethink Air France-KLM Amid 13% Pullback and Strong 2025 Recovery Prospects

Reviewed by Bailey Pemberton

If you’re sitting on the fence about Air France-KLM stock, you’re not alone. This stock has certainly kept investors debating their next move. In the past year, shares have soared over 41%, and if you’ve held on since January, you’re up more than 42%, despite recent turbulence with a 12.8% dip in the last thirty days. It’s been a classic case of rapid recoveries and fresh risks, as market sentiment shifts with every new headline in the aviation sector, from evolving travel patterns to oil price volatility and renewed discussions around airline consolidation in Europe.

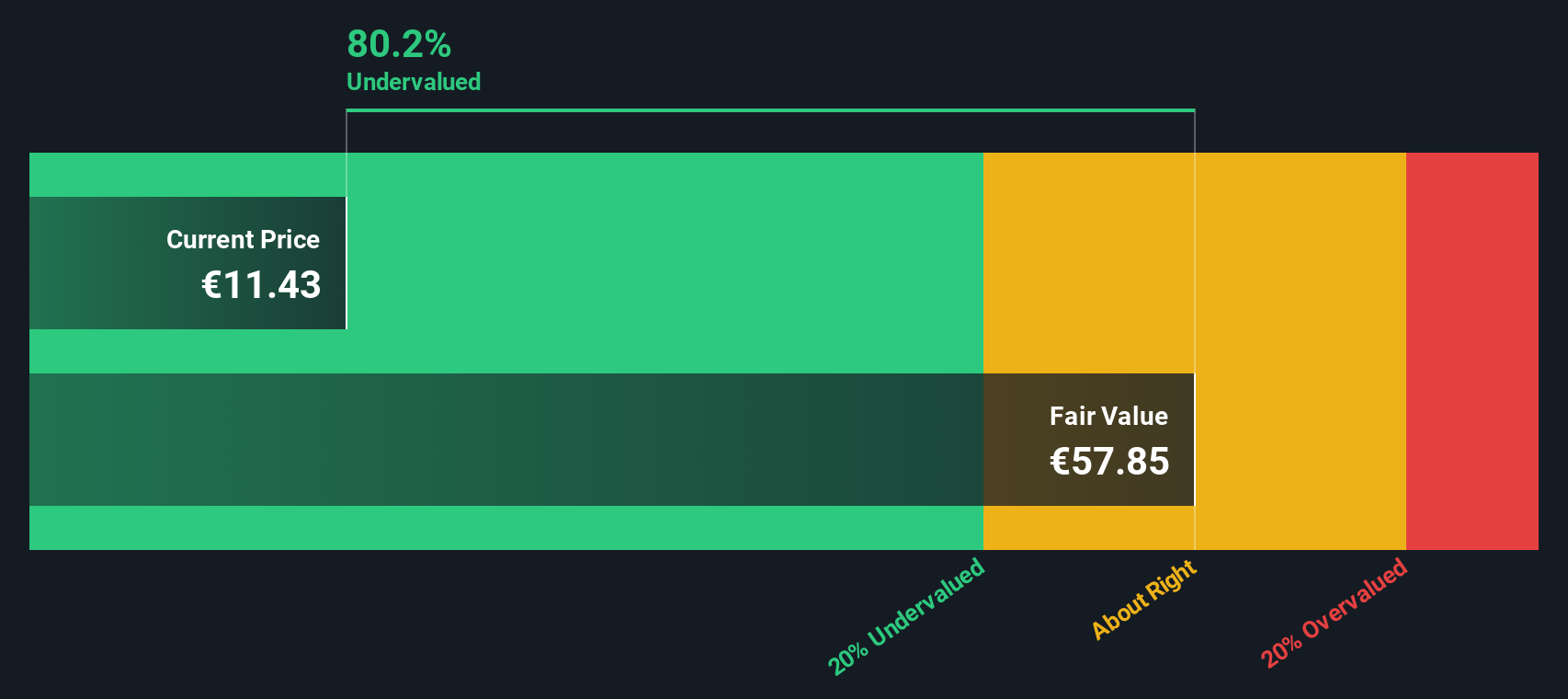

What’s especially interesting is that, even after such a dramatic year-to-date climb, Air France-KLM comes out strong by most measures of valuation. On a scale where the highest undervaluation score is 6, the company lands an impressive 5, signaling that it’s undervalued in five out of six key checks. That’s not something you see every day for a business that’s just rallied over 40% in twelve months.

But is that the whole story? Let’s break down the main valuation approaches that investors use to size up Air France-KLM, and after that, I’ll share an even more powerful way to think about what this score means for you.

Why Air France-KLM is lagging behind its peers

Approach 1: Air France-KLM Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting future cash flows and discounting them back to their present value. For Air France-KLM, this involves projecting how much cash the business will generate annually, then calculating what those future euros are worth today based on risk and time.

Currently, Air France-KLM reports a trailing twelve-month Free Cash Flow (FCF) of €1.03 billion. Looking ahead, analyst estimates project annual cash flows to remain strong. In 2028, for example, forecasts suggest around €794 million in FCF, and by 2035, Simply Wall St’s model extrapolates further growth up to €1.4 billion. While analysts typically provide forecasts for up to five years, later years are modeled based on expected growth trends.

When all projected cash flows are discounted to the present, the DCF model calculates an intrinsic fair value of €37.94 per share. Compared to where the stock is trading now, this suggests the stock is 69.7% undervalued based on this approach. For those seeking deeply discounted opportunities, that represents a compelling margin of safety.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Air France-KLM is undervalued by 69.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Air France-KLM Price vs Earnings

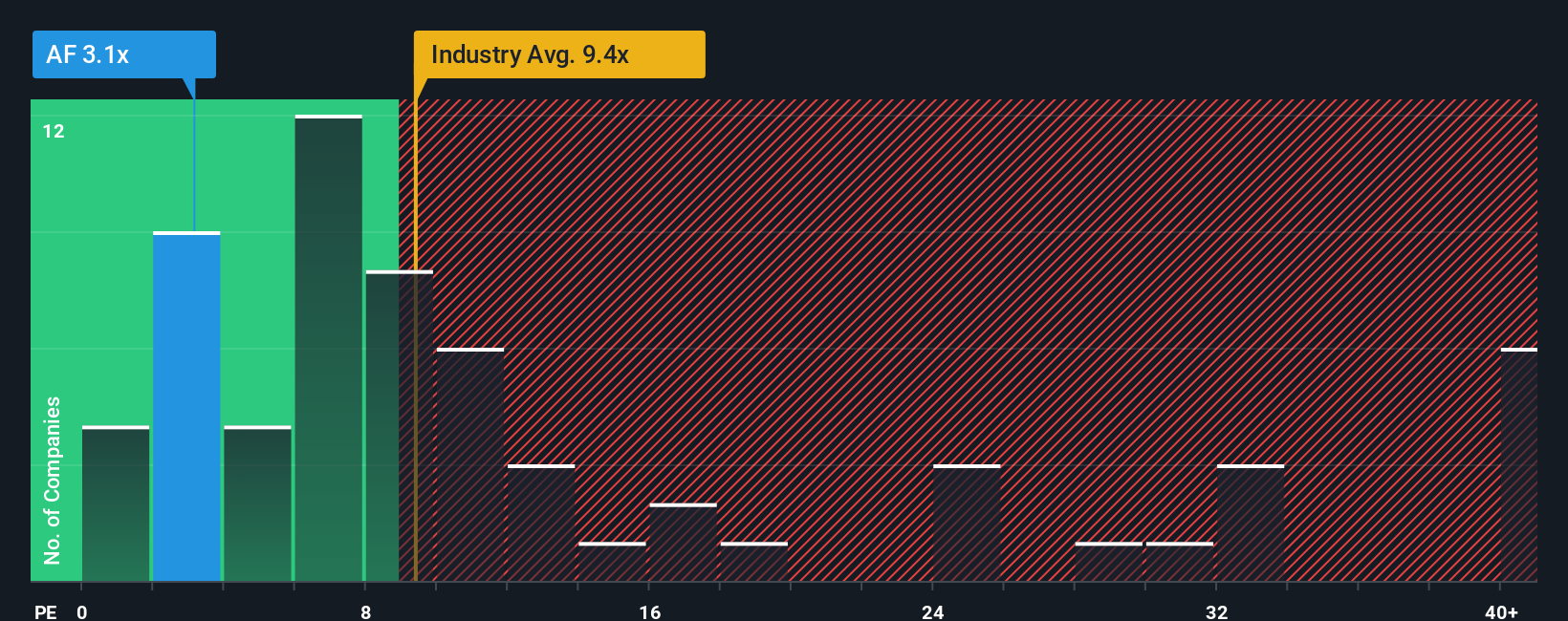

The Price-to-Earnings (PE) ratio is a classic valuation tool, especially for companies that are already generating healthy profits like Air France-KLM. This metric tells investors how much they are paying today for €1 of current earnings, which is especially useful when comparing established, profitable airlines.

Growth prospects and company-specific risks play a significant role in determining what counts as a “normal” PE ratio. Companies with higher growth potential, stronger margins, or a safer business often justify higher PE multiples, while riskier or slower-growing firms generally command lower ratios.

Currently, Air France-KLM trades at a notably low PE ratio of 3.16x. For context, the average PE for European airlines is 9.30x, while Air France-KLM's peer group is even higher at 53.67x. This large gap indicates that investors are pricing in more caution or skepticism for Air France-KLM compared to its rivals.

Simply Wall St’s proprietary “Fair Ratio” for Air France-KLM stands at 14.02x. This figure factors in not just broad industry comparisons, but also the company’s unique growth outlook, profit margins, size, and risk profile. This approach is more insightful than relying on blanket averages because it is tailored to the company’s own financial realities and future prospects.

With Air France-KLM’s actual PE sitting well below its Fair Ratio, the data suggests that investors may be undervaluing its future potential based on the company’s current fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Air France-KLM Narrative

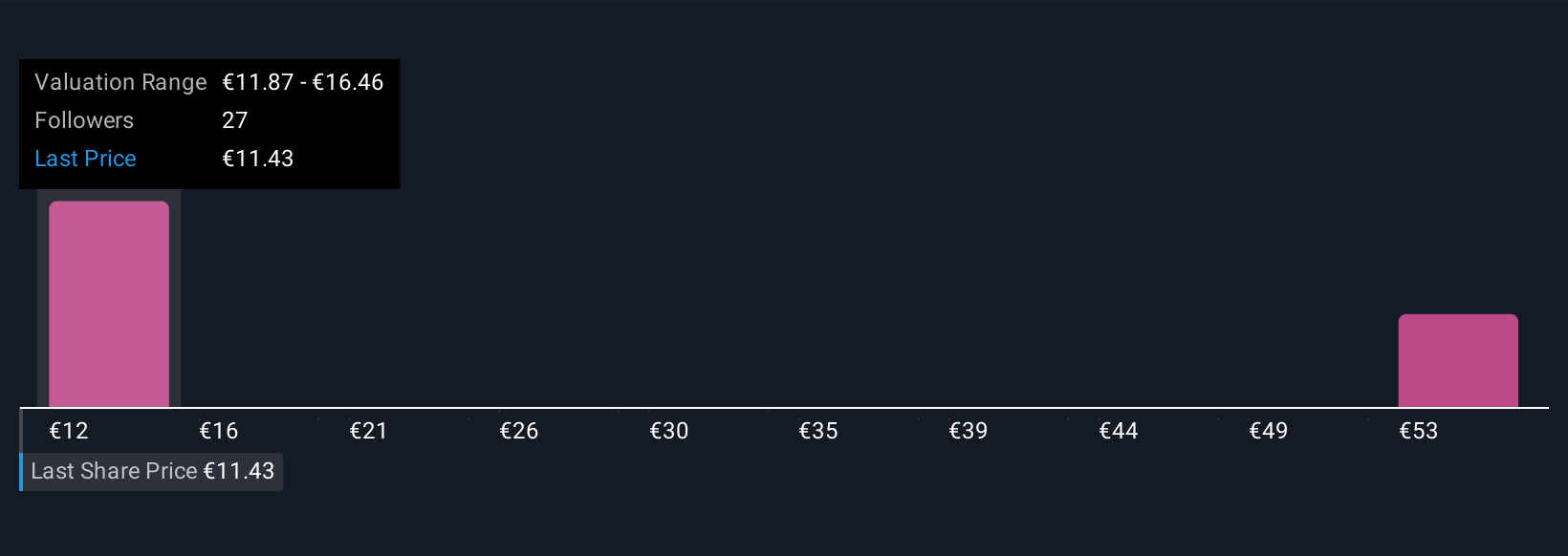

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story or perspective on a company, including the reasons driving your assumed fair value, growth expectations, and outlook on future profits and margins. Narratives take you beyond numbers, linking what you believe about Air France-KLM’s business to a clear financial forecast and a fair value price.

Narratives are designed to be easy and accessible, and they are readily available for millions of investors on Simply Wall St’s Community page. They help bridge the gap between headlines and investment action, allowing you to compare your Fair Value with the current price and consider if now is the right time to buy or sell. The best part is that Narratives update dynamically whenever there is breaking news or earnings releases, so your view is always current.

For Air France-KLM, some investors believe its biggest upside comes from a faster than expected recovery in international travel, while others are cautious and factor in higher fuel costs or ongoing market risks, resulting in widely different fair value estimates. With Narratives, you can weigh these differing perspectives and choose the story and strategy that resonates with you.

Do you think there's more to the story for Air France-KLM? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AF

Air France-KLM

Provides passenger and cargo transportation services worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives