Top Growth Companies With High Insider Ownership On Euronext Paris

Reviewed by Simply Wall St

In a period marked by mixed economic signals and fluctuating market indices, the French CAC 40 Index has experienced slight declines amid broader European market volatility. Despite these challenges, certain growth companies with high insider ownership have continued to capture investor interest on Euronext Paris. A good stock in this context is characterized by strong growth potential and significant insider ownership, which often indicates confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

| VusionGroup (ENXTPA:VU) | 13.5% | 25.7% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 35.1% |

| STIF Société anonyme (ENXTPA:ALSTI) | 10.7% | 28.5% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| Munic (ENXTPA:ALMUN) | 29.4% | 149.2% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 69.6% |

We're going to check out a few of the best picks from our screener tool.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company in France that develops long-acting injectables across various therapeutic areas, with a market cap of €464.39 million.

Operations: MedinCell generates €11.95 million in revenue from its pharmaceuticals segment.

Insider Ownership: 16.4%

Earnings Growth Forecast: 69.6% p.a.

MedinCell, a French growth company with high insider ownership, is forecast to achieve significant revenue growth of 43.8% annually, outpacing the broader market. Despite recent setbacks, including a Phase 3 trial for F14 not meeting its primary endpoint and declining sales and revenue for the fiscal year ending March 2024, MedinCell's innovative drug delivery technologies show promise. The company is expected to become profitable within three years, reflecting strong potential despite current challenges.

- Take a closer look at MedinCell's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, MedinCell's share price might be too optimistic.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers public and private cloud, shared hosting, and dedicated server products and solutions globally, with a market cap of €1.12 billion.

Operations: The company's revenue segments are comprised of Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud & Other (€185.43 million).

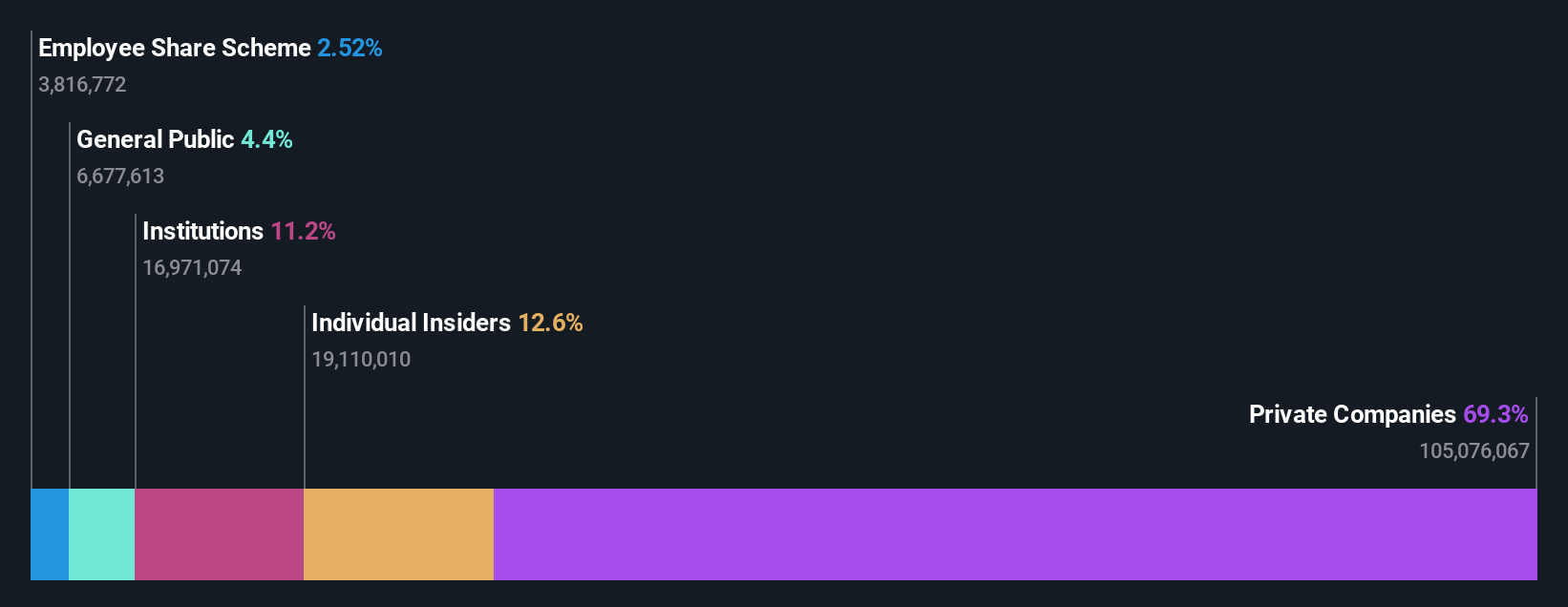

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.1% p.a.

OVH Groupe, with substantial insider ownership, is trading at 23.8% below its estimated fair value and is forecast to grow earnings by 101.12% annually, becoming profitable within three years—outpacing the market. Despite recent share price volatility and a low return on equity forecast (1.7%), OVH's revenue growth of 10% per year surpasses the French market average. Recent innovations include new high-performance AMD EPYC-powered servers, enhancing their competitive edge in cloud services.

- Click to explore a detailed breakdown of our findings in OVH Groupe's earnings growth report.

- In light of our recent valuation report, it seems possible that OVH Groupe is trading behind its estimated value.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of €2.20 billion.

Operations: VusionGroup S.A. generates €801.96 million in revenue from installing and maintaining electronic shelf labels across Europe, Asia, and North America.

Insider Ownership: 13.5%

Earnings Growth Forecast: 25.7% p.a.

VusionGroup's high insider ownership aligns with its robust growth prospects, as revenue is forecast to grow 21.3% annually, outpacing the French market. Despite recent share price volatility, earnings are expected to rise by 25.7% per year over the next three years. Recent partnerships like Hy-Vee's implementation of VusionGroup’s digital solutions highlight its innovative edge and potential for sustained growth in retail technology solutions. Analysts predict a significant stock price increase of 39.8%.

- Dive into the specifics of VusionGroup here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that VusionGroup is priced higher than what may be justified by its financials.

Next Steps

- Get an in-depth perspective on all 25 Fast Growing Euronext Paris Companies With High Insider Ownership by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

Good value with reasonable growth potential.