High Growth Tech Stocks in France to Watch This October 2024

Reviewed by Simply Wall St

As global markets respond positively to China's new stimulus measures, European indices, including France’s CAC 40 Index, have seen significant gains. This optimistic market environment provides a fertile ground for identifying high-growth tech stocks in France that show strong potential amidst these favorable conditions. A good stock in this context often demonstrates robust innovation, solid financial health, and the ability to capitalize on emerging trends such as artificial intelligence and increased demand for technology solutions.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 17.24% | 33.75% | ★★★★★☆ |

| Archos | 25.98% | 77.41% | ★★★★★☆ |

| Valneva | 28.00% | 25.49% | ★★★★★☆ |

| Valbiotis | 33.52% | 39.79% | ★★★★★☆ |

| Munic | 26.73% | 149.96% | ★★★★★☆ |

| VusionGroup | 28.35% | 82.32% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

We'll examine a selection from our screener results.

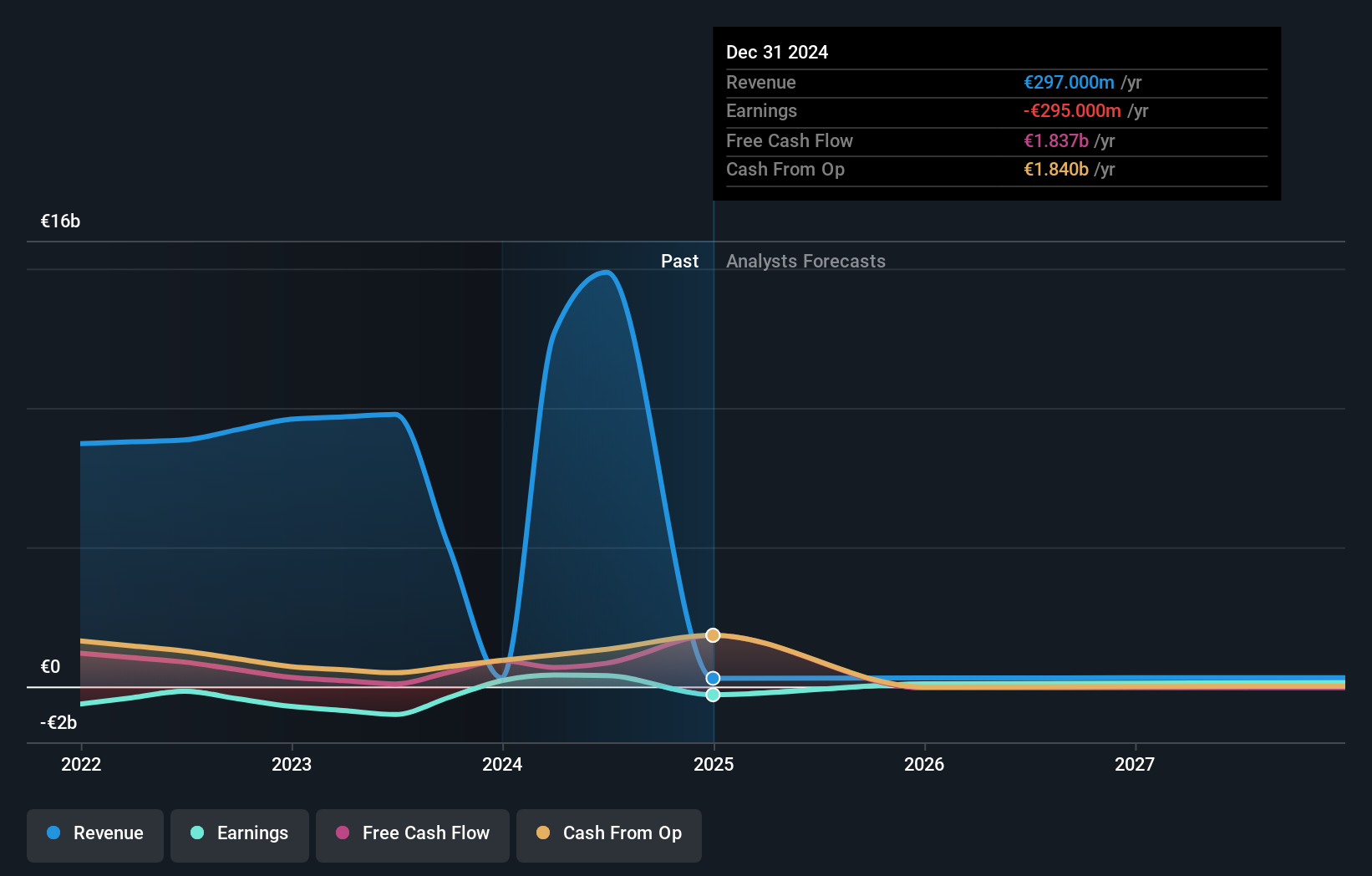

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market cap of approximately €1.29 billion.

Operations: OVH Groupe S.A. generates revenue primarily through its Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web cloud & Other (€185.43 million) segments. The company operates globally, offering a range of cloud services and dedicated server solutions to various clients.

OVH Groupe, navigating the dynamic tech landscape in France, showcases a nuanced growth trajectory with its revenue expected to expand by 9.7% annually, outpacing the French market's average of 5.7%. Despite current unprofitability, projections are optimistic as earnings could surge by an impressive 101.1% per year. The firm's commitment to innovation is evident in its R&D spending trends which significantly contribute to its developmental strategies and future prospects in the competitive tech arena. With a highly volatile share price recently, it reflects the market's reactive nature to both its fiscal dynamics and sectoral shifts. OVH’s strategic emphasis on R&D not only underscores its pursuit for advancement but also aligns with industry demands for continual evolution and adaptation.

- Dive into the specifics of OVH Groupe here with our thorough health report.

Review our historical performance report to gain insights into OVH Groupe's's past performance.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE is an entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa and has a market cap of approximately €10.46 billion.

Operations: Vivendi SE generates revenue primarily from its Canal+ Group (€6.20 billion), Havas Group (€2.92 billion), and Gameloft (€304 million) segments, among others. The company's cost structure varies across these diverse operations, influencing its overall financial performance.

Vivendi SE, amidst a robust French tech sector, is making significant strides with its revenue projected to increase by 9.4% annually, surpassing the national average growth of 5.7%. This surge is complemented by an anticipated earnings growth of 30.6% per year, reflecting a strong profitability outlook. The company's dedication to innovation is underscored by its R&D investments which have been pivotal in driving these financial metrics forward. Recently, Vivendi has also repurchased shares worth €184 million, signaling confidence in its future trajectory and commitment to shareholder value. Moreover, the potential listing of Groupe Canal Plus hints at strategic restructuring aimed at enhancing corporate focus and market presence.

- Click to explore a detailed breakdown of our findings in Vivendi's health report.

Assess Vivendi's past performance with our detailed historical performance reports.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America and has a market cap of €2.47 billion.

Operations: VusionGroup S.A. generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €830.16 million. The company operates across Europe, Asia, and North America.

VusionGroup, amidst a competitive tech landscape in France, demonstrates robust growth with its revenue expected to surge by 28.4% annually, outpacing the national tech sector's average of 5.7%. This growth is underpinned by significant R&D investments, amounting to an impressive ratio of R&D expenses to revenue which reflects the company's commitment to innovation and technological advancement. With earnings projected to grow at an annual rate of 82.3%, VusionGroup's strategic focus on expanding its digital shelf label technology through partnerships like that with Ace Hardware showcases its ability to adapt and thrive in dynamic retail environments. The recent deployment across over 5,000 Ace locations not only enhances operational efficiency but also positions VusionGroup at the forefront of retail innovation, promising continued relevance and market penetration in the evolving tech ecosystem.

- Click here to discover the nuances of VusionGroup with our detailed analytical health report.

Examine VusionGroup's past performance report to understand how it has performed in the past.

Taking Advantage

- Click this link to deep-dive into the 41 companies within our Euronext Paris High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIV

Vivendi

Operates as an entertainment, media, and communication company in France, the rest of Europe, the Americas, Asia/Oceania, and Africa.

Excellent balance sheet with reasonable growth potential.