Despite recent market volatility and economic slowdown concerns, the French tech sector remains a focal point for investors seeking high-growth opportunities. This article will explore three promising French tech stocks that have shown resilience and potential in the face of broader market challenges, emphasizing innovation and strong fundamentals as key indicators of their growth prospects.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 12.59% | 27.33% | ★★★★★☆ |

| Cogelec | 11.33% | 23.96% | ★★★★★☆ |

| VusionGroup | 21.32% | 25.74% | ★★★★★★ |

| Valneva | 24.22% | 28.34% | ★★★★★☆ |

| Munic | 26.68% | 149.10% | ★★★★★☆ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA provides industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.08 billion.

Operations: Lectra SA generates revenue from the Americas (€172.65 million) and Asia-Pacific (€118.54 million) regions, with a segment adjustment of €209.13 million. The company focuses on industrial intelligence solutions tailored to fashion, automotive, and furniture sectors across these markets.

Lectra's recent earnings report highlights a mixed performance, with half-year sales increasing to €262.29 million from €239.55 million, yet net income saw a 13.57% decline to €12.51 million. Despite this, the company's R&D expenses reflect its commitment to innovation; in 2023 alone, Lectra invested €28 million in R&D, representing approximately 10% of its revenue. This focus on technology development supports their forecasted revenue growth of 10.4% annually and an impressive earnings growth rate of 29.3%, outpacing the French market average significantly.

- Delve into the full analysis health report here for a deeper understanding of Lectra.

Explore historical data to track Lectra's performance over time in our Past section.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

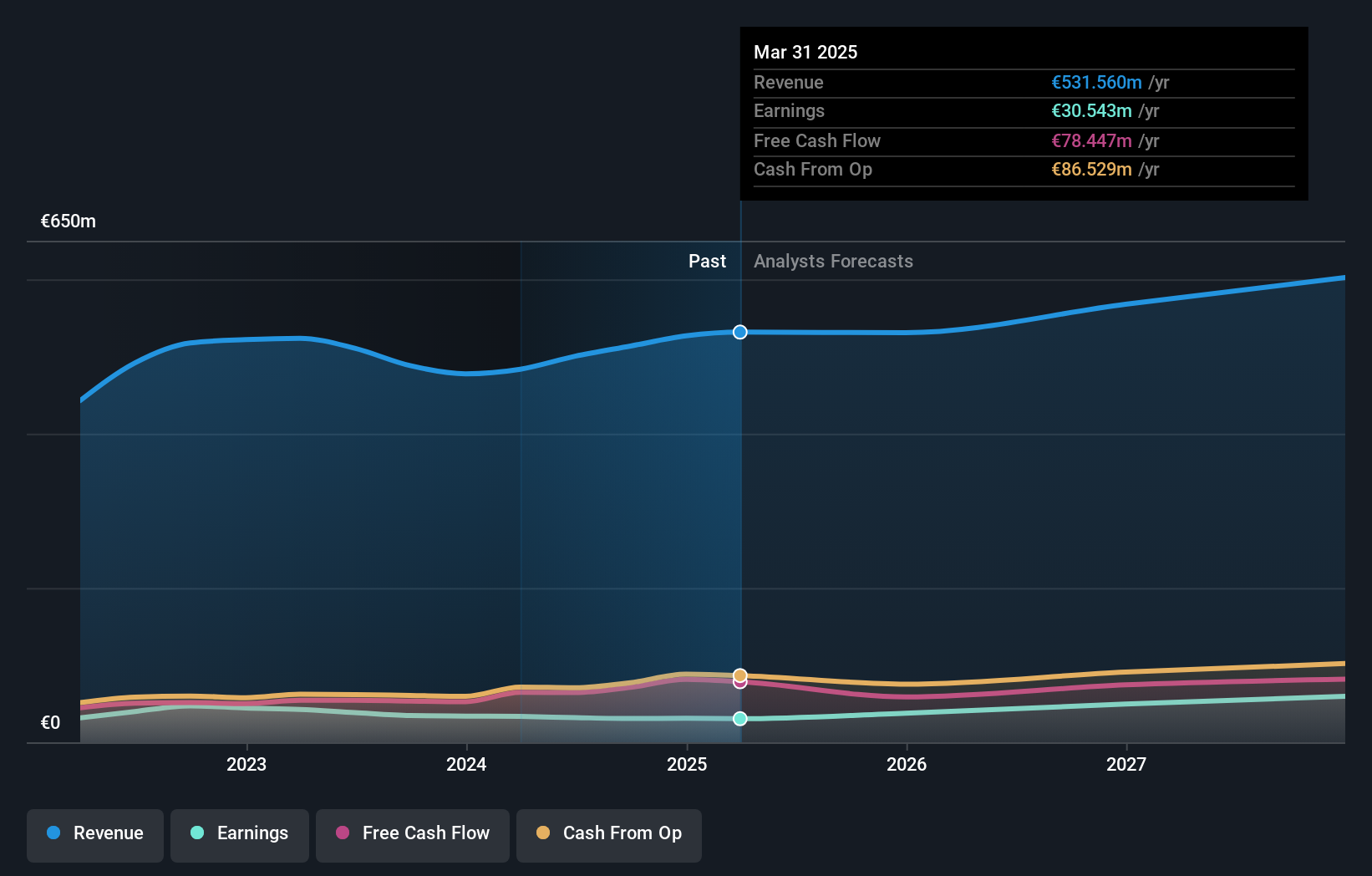

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally with a market cap of approximately €1.16 billion.

Operations: OVH Groupe S.A. generates revenue primarily from three segments: Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web cloud & Other services (€185.43 million). The company focuses on providing a range of cloud-based solutions to a global clientele, leveraging its extensive infrastructure to support diverse business needs across these segments.

OVH Groupe's revenue is forecast to grow at 9.7% per year, outpacing the French market's 5.8% growth rate, though it remains unprofitable. The company’s recent introduction of third-generation Advance Bare Metal servers powered by AMD EPYC 4004 Series processors highlights its commitment to innovation and performance optimization, catering to demanding workloads with up to 16 cores and 32 threads. With R&D expenses reflecting a significant investment in technology development, OVH Groupe continues positioning itself for future profitability within the tech industry.

- Take a closer look at OVH Groupe's potential here in our health report.

Gain insights into OVH Groupe's historical performance by reviewing our past performance report.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America and has a market cap of €2.35 billion.

Operations: VusionGroup S.A. generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €801.96 million. The company's operations span Europe, Asia, and North America.

VusionGroup's recent partnership with Ace Hardware highlights its innovative digital shelf label (DSL) technology, enhancing operational efficiency and customer experience across over 5,000 U.S. stores. With revenue forecasted to grow at 21.3% per year and earnings expected to increase by 25.7% annually, the company's technological advancements are driving significant growth. The company’s R&D expenses reflect a robust commitment to innovation, ensuring sustained progress in the tech-driven retail sector.

- Dive into the specifics of VusionGroup here with our thorough health report.

Examine VusionGroup's past performance report to understand how it has performed in the past.

Summing It All Up

- Dive into all 45 of the Euronext Paris High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, and furniture markets in Northern Europe, Southern Europe, the Americas, and the Asia Pacific.

Good value with reasonable growth potential.