As European markets continue to rally and inflation nears the European Central Bank's target, France's CAC 40 Index has seen a modest gain of 0.71%, reflecting broader positive sentiment. This article will explore three high-growth tech stocks in France for September 2024, focusing on companies that show strong potential in an environment where economic indicators are supportive of growth. In light of the current market conditions, a good stock typically exhibits robust earnings growth, innovative capabilities, and resilience against economic fluctuations.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 16.18% | 35.08% | ★★★★★☆ |

| Cogelec | 11.32% | 24.06% | ★★★★★☆ |

| VusionGroup | 21.32% | 25.74% | ★★★★★★ |

| Munic | 26.68% | 149.17% | ★★★★★☆ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Valneva | 24.22% | 28.34% | ★★★★★☆ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

| beaconsmind | 31.75% | 106.73% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA provides industrial intelligence solutions for fashion, automotive, and furniture markets in Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of approximately €1.07 billion.

Operations: The company generates revenue from various regions, including the Americas (€172.65 million) and Asia-Pacific (€118.54 million). It offers industrial intelligence solutions tailored to fashion, automotive, and furniture markets across these regions.

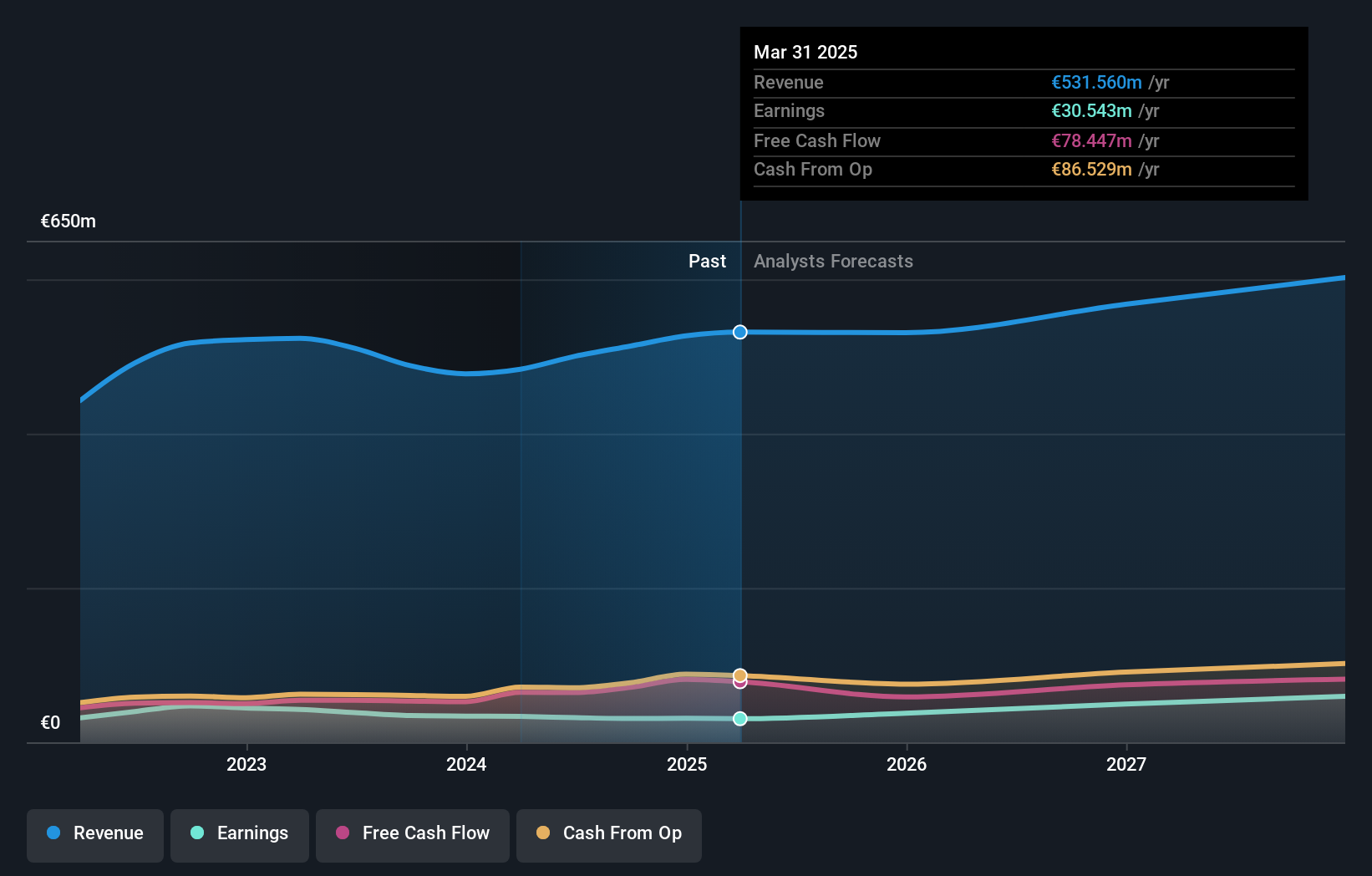

Lectra, a prominent player in the tech industry, reported half-year sales of €262.29 million, up from €239.55 million last year. Despite this growth, net income fell to €12.51 million from €14.47 million, reflecting a 7.3% decline in earnings per share to €0.33 from €0.38 previously. The company's R&D expenses are notable; investing significantly in innovation is crucial for maintaining its competitive edge in the software and AI sectors.

- Click here to discover the nuances of Lectra with our detailed analytical health report.

Evaluate Lectra's historical performance by accessing our past performance report.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE is an entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa and has a market cap of approximately €10.23 billion.

Operations: Vivendi SE generates revenue primarily through its Canal+ Group (€6.20 billion) and Havas Group (€2.92 billion) segments, with additional contributions from Gameloft (€304 million), Prisma Media (€303 million), New Initiatives (€176 million), and Vivendi Village (€151 million).

Vivendi's revenue surged to €9.05 billion for the first half of 2024, a significant leap from €4.70 billion in the same period last year, reflecting dynamic growth in its media and entertainment segments. However, net income dipped slightly to €159 million from €174 million, impacting earnings per share which fell to €0.16 from €0.20 previously. The company has also invested heavily in innovation with R&D expenses contributing significantly towards maintaining its competitive edge in the tech sector. Additionally, Vivendi repurchased 18.42 million shares worth €184 million as part of its strategic buyback program this year.

- Click to explore a detailed breakdown of our findings in Vivendi's health report.

Examine Vivendi's past performance report to understand how it has performed in the past.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of approximately €2.25 billion.

Operations: VusionGroup S.A. generates revenue primarily from installing and maintaining electronic shelf labels, totaling €801.96 million. The company focuses on digitalization solutions for commerce across Europe, Asia, and North America.

VusionGroup's partnership with Ace Hardware to deploy advanced digital shelf labels (DSL) highlights its commitment to innovation and client-centric solutions. The company's revenue is forecasted to grow at 21.3% annually, outpacing the French market's 5.8%. With earnings expected to increase by 25.7% per year, VusionGroup demonstrates robust financial health. Notably, R&D expenses have been pivotal in driving these advancements, contributing significantly towards maintaining a competitive edge in the tech sector.

- Take a closer look at VusionGroup's potential here in our health report.

Gain insights into VusionGroup's past trends and performance with our Past report.

Seize The Opportunity

- Gain an insight into the universe of 44 Euronext Paris High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, and furniture markets in Northern Europe, Southern Europe, the Americas, and the Asia Pacific.

Good value with reasonable growth potential.