- France

- /

- Tech Hardware

- /

- ENXTPA:ARTO

Exploring Société Industrielle et Financière de l'Artois Société anonyme And 2 Other Hidden French Small Cap Gems

Reviewed by Simply Wall St

The French market has been buoyed by a rally in the STOXX Europe 600 Index, which hit a record high amid slowing inflation, strengthening the case for potential interest rate cuts by the European Central Bank. Against this backdrop of economic optimism and cautious monetary policy, small-cap stocks in France present intriguing opportunities for investors seeking growth. In this article, we explore three hidden gems within the French small-cap sector, starting with Société Industrielle et Financière de l'Artois Société anonyme. A good stock in today's market is characterized by strong fundamentals and resilience to economic shifts—qualities that these lesser-known companies possess.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.00% | 16.26% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Société Industrielle et Financière de l'Artois Société anonyme (ENXTPA:ARTO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Société Industrielle et Financière de l'Artois Société anonyme designs, manufactures, markets, and sells terminals, bollards, access control, and automatic identification systems with a market cap of €1.49 billion.

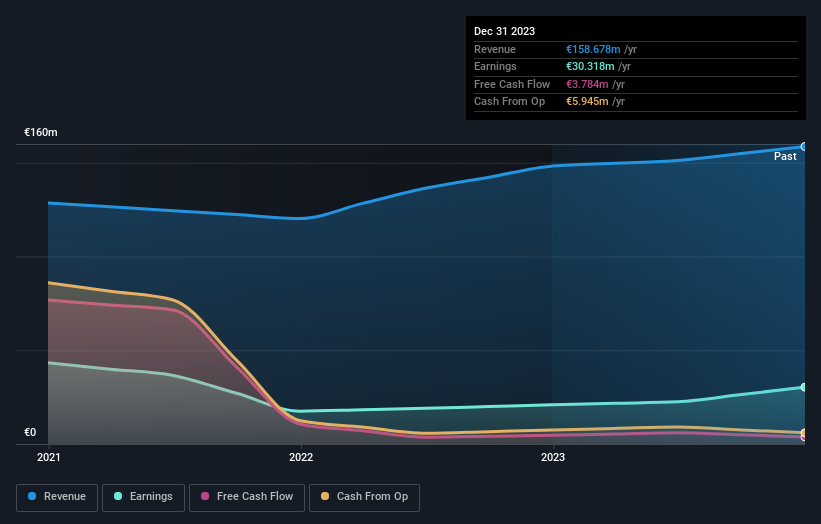

Operations: The company generates revenue primarily from the industry segment, amounting to €158.68 million. The business focuses on designing, manufacturing, marketing, and selling terminals, bollards, access control systems, and automatic identification systems.

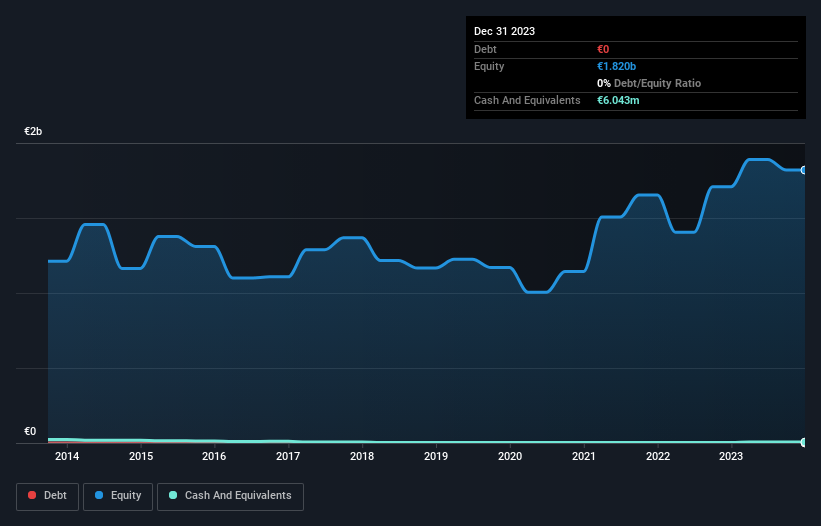

Société Industrielle et Financière de l'Artois, a smaller player in the French market, has shown consistent performance over the past five years. The company's debt to equity ratio decreased from 4.4 to 2.9, indicating better financial health. Earnings have grown annually by 8.3%, reflecting steady progress. Despite not outperforming the Tech industry's earnings growth of 45.1% last year, ARTO remains profitable with high-quality earnings and positive free cash flow (US$6 million).

Financière Moncey Société anonyme (ENXTPA:FMONC)

Simply Wall St Value Rating: ★★★★★★

Overview: Financière Moncey Société anonyme is a holding company that manages a portfolio of investments in France, with a market cap of €1.55 billion.

Operations: Financière Moncey Société anonyme generates revenue primarily through its portfolio of investments in France. The company has a market capitalization of €1.55 billion.

Financière Moncey Société anonyme, a small financial entity in France, saw its earnings grow by 41.7% over the past year, significantly outperforming the Diversified Financial industry’s -3.9%. The company is debt-free now compared to five years ago when it had a debt to equity ratio of 0.02%. Despite making less than US$1m in revenue (€0), its high-quality earnings and positive free cash flow underscore robust financial health.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme, is an investment company that offers interdealer broking, online trading, and private banking services across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific; it has a market cap of €628.86 million.

Operations: VIEL & Cie generates revenue primarily from professional intermediation (€1006.77 million) and stock exchange online services (€65.12 million). The company also has minor contributions from holdings (€0.21 million) and incurs a slight loss in property and other activities (-€0.14 million).

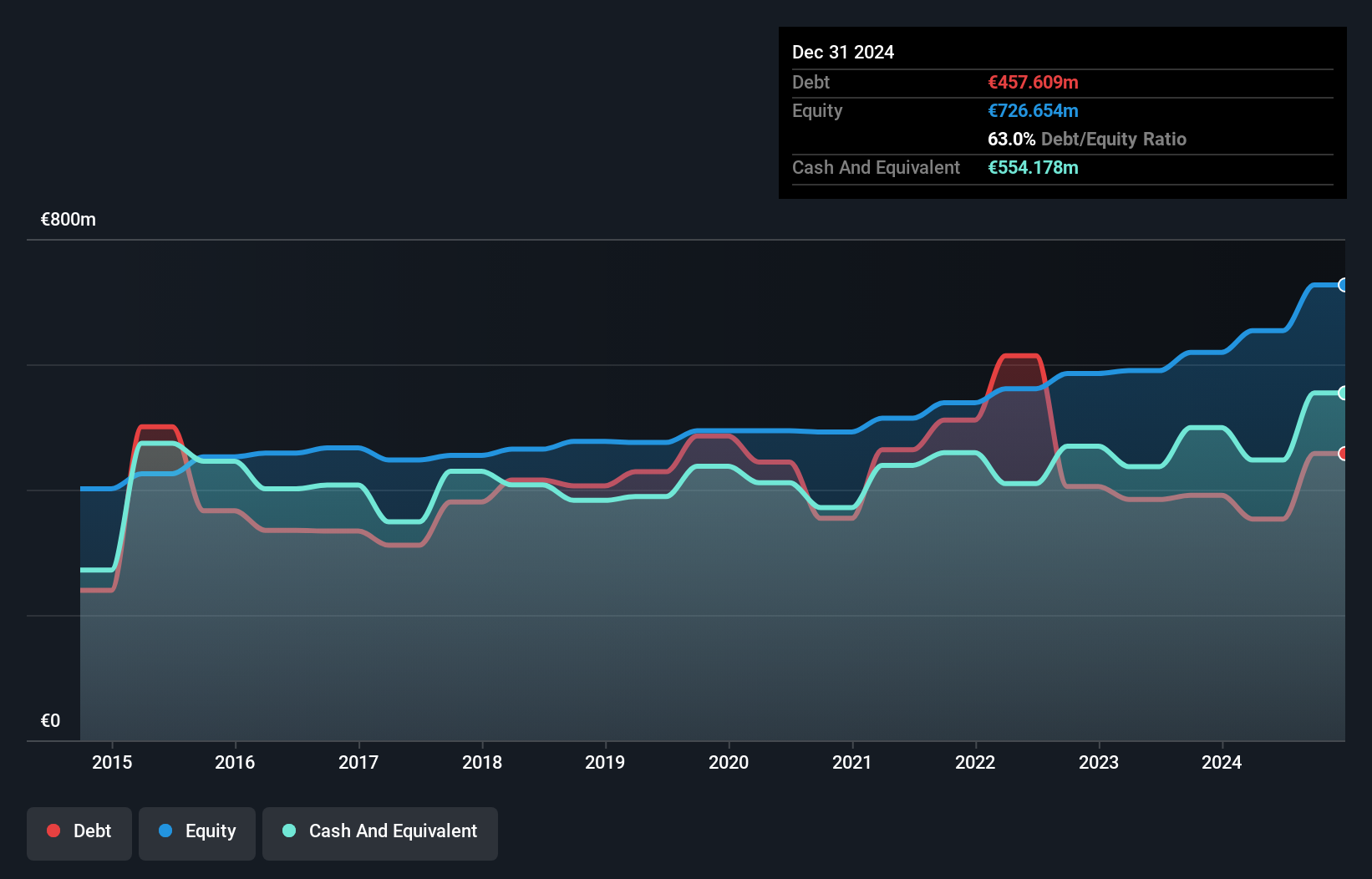

VIEL & Cie société anonyme has demonstrated notable financial improvements, trading at 37.5% below our fair value estimate. Over the past five years, its debt to equity ratio decreased from 85.1% to 63.2%, indicating better financial health. Impressively, earnings grew by 33.4% last year, outpacing the Capital Markets industry growth of 29.3%. With more cash than total debt and high-quality earnings, VIL seems poised for continued stability and potential growth in the market.

- Take a closer look at VIEL & Cie société anonyme's potential here in our health report.

Learn about VIEL & Cie société anonyme's historical performance.

Where To Now?

- Discover the full array of 35 Euronext Paris Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ARTO

Société Industrielle et Financière de l'Artois Société anonyme

Designs, manufactures, markets, and sells terminals, bollards, access control, and automatic identification systems.

Proven track record with adequate balance sheet.