Stock Analysis

Euronext Paris Growth Stocks With Insider Ownership And Minimum 11% Revenue Increase

Reviewed by Simply Wall St

Amidst a backdrop of political uncertainty and fluctuating market sentiments across Europe, the French market has shown resilience, with particular interest in growth companies that boast high insider ownership. These firms not only demonstrate confidence from those closest to the helm but also offer intriguing prospects for revenue growth, aligning well with current market dynamics where investors are keenly focused on sustainable earnings potential.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.6% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

| Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 42.4% |

| Munic (ENXTPA:ALMUN) | 29.4% | 150% |

| WALLIX GROUP (ENXTPA:ALLIX) | 19.8% | 101.6% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 74.6% |

Let's explore several standout options from the results in the screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA specializes in industrial intelligence solutions targeting the fashion, automotive, and furniture sectors across Northern Europe, Southern Europe, the Americas, and Asia Pacific, with a market capitalization of approximately €1.03 billion.

Operations: The company generates revenue from the Americas and Asia-Pacific regions, amounting to €170.33 million and €110.28 million respectively.

Insider Ownership: 19.6%

Revenue Growth Forecast: 11.3% p.a.

Lectra, a French growth company with high insider ownership, recently reported a slight decline in net income and earnings per share for Q1 2024, with sales increasing to €129.56 million. Despite this dip, the firm is trading at 36.7% below its estimated fair value and analysts predict a significant price increase of 30.8%. Expected to outpace the French market, Lectra's revenue and earnings are forecasted to grow by 11.3% and 28.6% per year respectively, though its projected return on equity remains low at 13.3%.

- Click to explore a detailed breakdown of our findings in Lectra's earnings growth report.

- According our valuation report, there's an indication that Lectra's share price might be on the cheaper side.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable medications across multiple therapeutic areas, with a market capitalization of approximately €405.10 million.

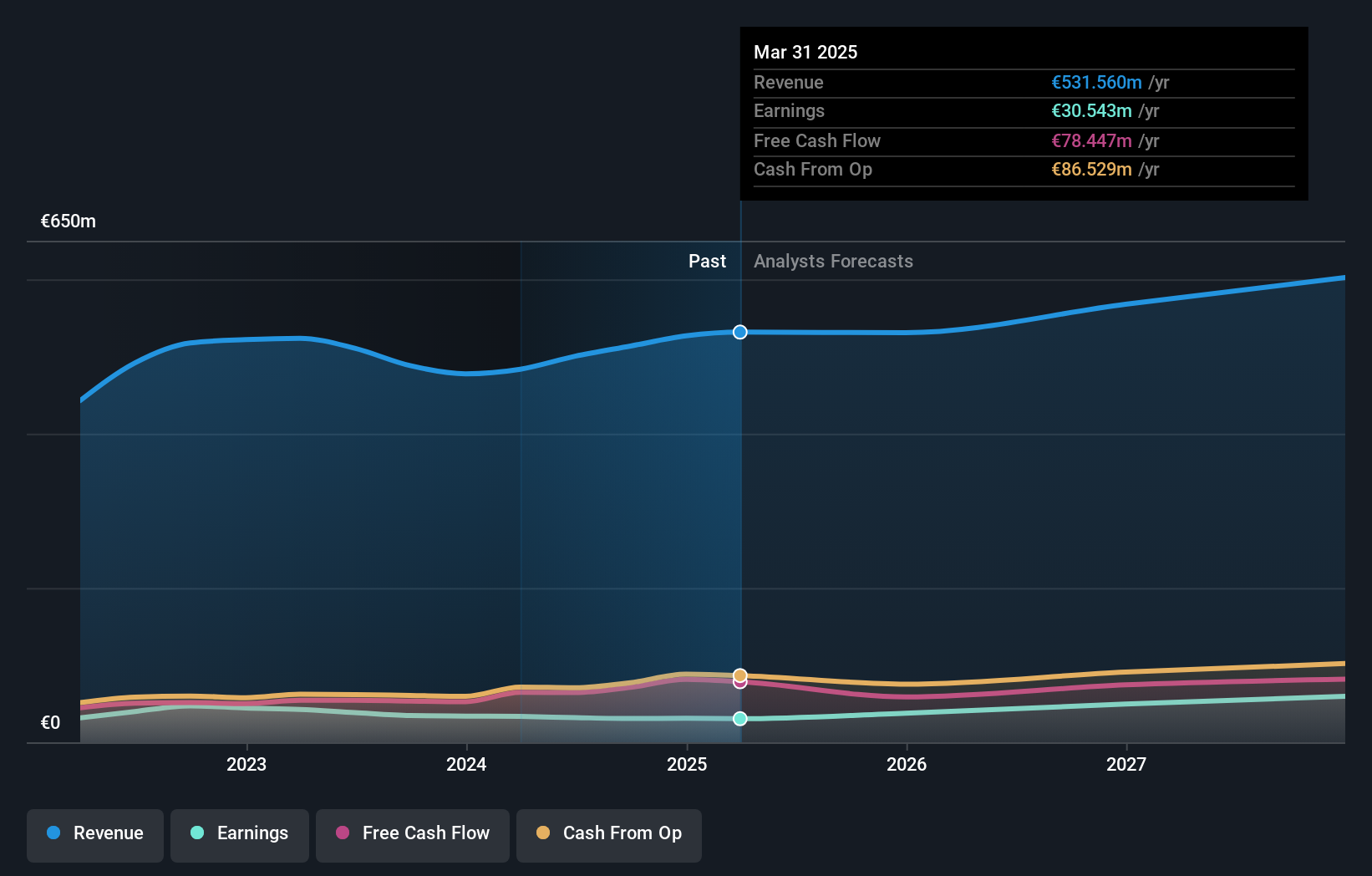

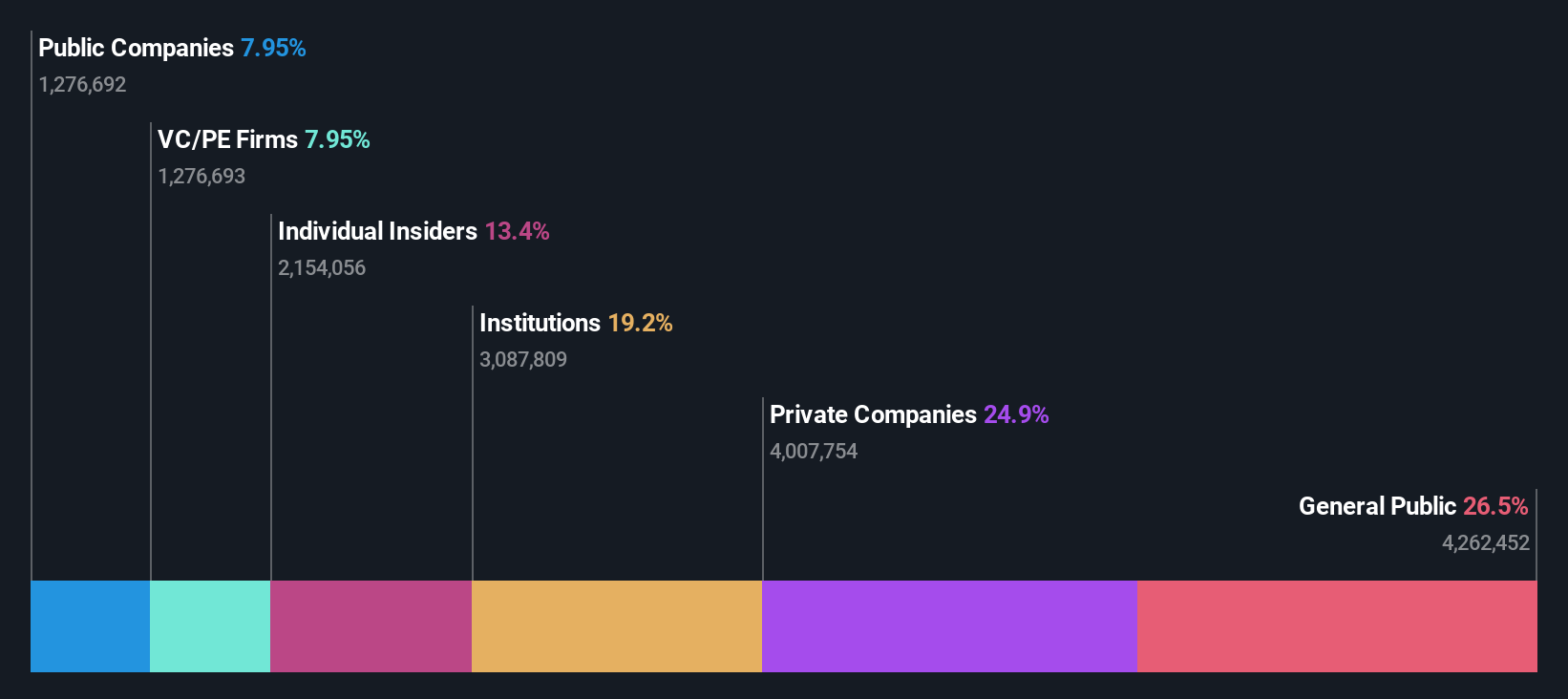

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling €11.95 million.

Insider Ownership: 16.4%

Revenue Growth Forecast: 42.9% p.a.

MedinCell, a French biotech firm with high insider ownership, faces challenges and opportunities. Despite a recent earnings report showing decreased sales and revenue, the company's net loss improved from EUR 32.01 million to EUR 25.04 million year-over-year. MedinCell is actively engaging in significant collaborations, like the one with AbbVie potentially worth up to US$1.9 billion in milestones, highlighting its innovative long-acting injectable technology platform's potential across various therapeutic areas. However, the company has less than one year of cash runway and has experienced shareholder dilution over the past year, underscoring some financial vulnerabilities amidst its growth trajectory.

- Take a closer look at MedinCell's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that MedinCell is priced lower than what may be justified by its financials.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. is a company that offers digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.14 billion.

Operations: The company generates revenue primarily through the installation and maintenance of electronic shelf labels, contributing €801.96 million.

Insider Ownership: 13.5%

Revenue Growth Forecast: 21.9% p.a.

VusionGroup S.A., a French company with high insider ownership, has shown robust growth with earnings surging by 320.8% last year and revenues up from €620.86 million to €801.96 million. Forecasts suggest earnings will grow by 25.24% annually, outpacing the French market's 11.1%. Despite this strong performance, the company's share price remains volatile, presenting potential risks for investors. Analysts predict a significant price increase of 41.6%, reflecting confidence in its future prospects despite market challenges.

- Click here to discover the nuances of VusionGroup with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, VusionGroup's share price might be too pessimistic.

Summing It All Up

- Unlock our comprehensive list of 21 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether MedinCell is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

High growth potential and fair value.