As global markets respond to China's robust stimulus measures, European indices have shown notable resilience, with France's CAC 40 Index climbing nearly 4%. Against this backdrop of economic optimism and market recovery, identifying growth companies with high insider ownership on Euronext Paris can offer valuable insights into potential investment opportunities.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 20.6% | 36% |

| VusionGroup (ENXTPA:VU) | 13.4% | 81.8% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 33.9% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 26.6% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 35.2% |

| STIF Société anonyme (ENXTPA:ALSTI) | 16.4% | 28.5% |

| Adocia (ENXTPA:ADOC) | 11.9% | 64% |

| Munic (ENXTPA:ALMUN) | 29.2% | 150% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

Let's review some notable picks from our screened stocks.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA operates as a global cybersecurity specialist for digital infrastructure with a market cap of €2.13 billion.

Operations: Exclusive Networks SA generates revenue from three primary regions: €480 million from APAC, €4.19 billion from EMEA, and €705 million from the Americas.

Insider Ownership: 13.1%

Earnings Growth Forecast: 33.7% p.a.

Exclusive Networks, a French cybersecurity firm, is poised for significant growth with earnings forecasted to increase 33.69% annually, outpacing the French market's 12.3%. Despite lower profit margins this year (2.7% vs. 5.5%), its revenue is expected to grow at 12.9% per year. Insider ownership is substantial with Permira and founder Olivier Breittmayer holding 66.7%. Recent news highlights a proposed acquisition by CD&R and Permira valuing the company at EUR 2.2 billion (USD 2.4 billion).

- Click here and access our complete growth analysis report to understand the dynamics of Exclusive Networks.

- Our valuation report here indicates Exclusive Networks may be overvalued.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of €1.29 billion.

Operations: OVH Groupe S.A. generates revenue from public cloud (€169.01 million), private cloud (€589.61 million), and web cloud services (€185.43 million).

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.1% p.a.

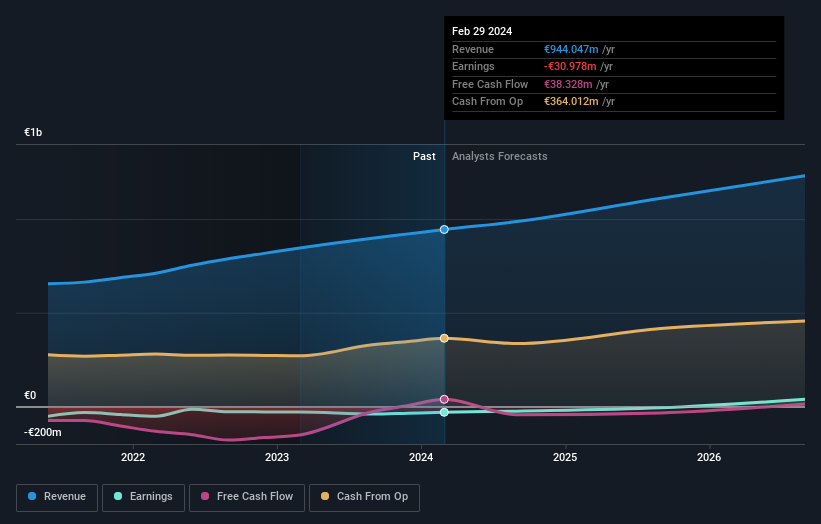

OVH Groupe, a French cloud computing firm, is forecast to grow its revenue at 9.7% annually, faster than the French market's 5.7%. The company is expected to become profitable within three years with earnings projected to grow by 101.12% per year. Despite trading at 25.1% below its estimated fair value and having a highly volatile share price recently, insider ownership remains high, indicating strong internal confidence in its growth potential.

- Unlock comprehensive insights into our analysis of OVH Groupe stock in this growth report.

- According our valuation report, there's an indication that OVH Groupe's share price might be on the cheaper side.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of approximately €2.47 billion.

Operations: VusionGroup S.A. generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €830.16 million.

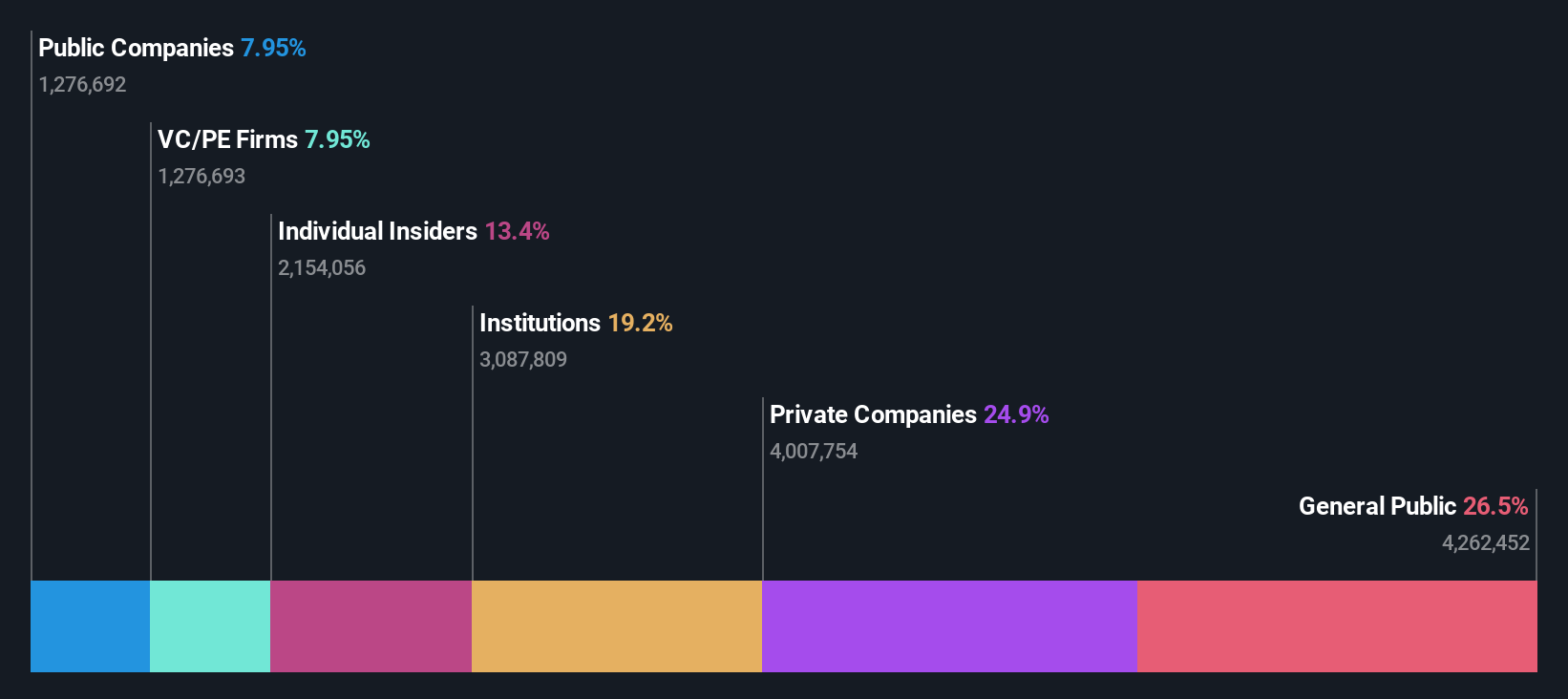

Insider Ownership: 13.4%

Earnings Growth Forecast: 81.8% p.a.

VusionGroup, known for its advanced digital shelf label technology, is forecast to grow revenue at 28.4% annually, outpacing the French market's 5.7%. Recent partnerships with Ace Hardware and Hy-Vee highlight its expanding footprint in the retail sector. Despite a net loss of €24.4 million for H1 2024, analysts expect profitability within three years and project earnings growth of 81.78% per year. Trading at 47.9% below fair value suggests potential upside as insiders maintain significant ownership stakes.

- Click to explore a detailed breakdown of our findings in VusionGroup's earnings growth report.

- The analysis detailed in our VusionGroup valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Navigate through the entire inventory of 23 Fast Growing Euronext Paris Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Exclusive Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXN

Exclusive Networks

Operates as a global cybersecurity specialist for digital infrastructure.

Flawless balance sheet with reasonable growth potential.