Stock Analysis

- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

Believe And Two More Euronext Paris Growth Companies With High Insider Stakes

Reviewed by Simply Wall St

Amidst a backdrop of rising inflation and cautious monetary policy signals from the European Central Bank, France's CAC 40 Index reflected broader European market trends with a notable decline. In such an environment, growth companies with high insider ownership in France may offer unique investment appeal as these insiders often have a vested interest in the company's long-term success. High insider stakes can be indicative of confidence from those who know the company best, aligning their interests closely with other shareholders especially during uncertain economic times.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.5% | 24.4% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.6% |

| WALLIX GROUP (ENXTPA:ALLIX) | 19.8% | 101.4% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

| Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 41.7% |

| Munic (ENXTPA:ALMUN) | 29.4% | 150% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 68.8% |

Let's dive into some prime choices out of from the screener.

Believe (ENXTPA:BLV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Believe S.A. operates as a digital music service provider for independent labels and local artists across regions including France, Germany, Europe, the Americas, Asia, Oceania, and the Pacific, with a market cap of approximately €1.48 billion.

Operations: The company generates revenue primarily through two segments: Premium Solutions, which brought in €825.12 million, and Automated Solutions, contributing €55.19 million.

Insider Ownership: 10.4%

Believe S.A., a French digital music company, has shown promising signs despite recent challenges. In 2023, the firm significantly reduced its net loss and improved sales to €880.31 million from €760.81 million the previous year. Amidst takeover bids, with the highest at €1.65 billion from Warner Music Group, Believe's board supported a lower offer from an insider-led consortium at €15 per share, underscoring high insider commitment but raising questions about valuation and strategic direction. The company is expected to turn profitable within three years with revenue growth projected to outpace the French market significantly.

- Dive into the specifics of Believe here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Believe shares in the market.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable medications across multiple therapeutic areas, with a market capitalization of approximately €475.34 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling €14.13 million.

Insider Ownership: 16.4%

MedinCell, a French biotech firm, is navigating the complex terrain of drug development with mixed results in recent trials. Despite a setback in its Phase 3 trial for F14, where primary endpoints were not met, the company observed significant improvements in secondary measures such as knee range of motion and swelling reduction. These results may support alternative regulatory pathways. Additionally, MedinCell's collaboration with major industry players like AbbVie and Teva underscores its strategic positioning and potential growth trajectory through innovative long-acting injectable technologies. However, investor caution is advised due to recent shareholder dilution and highly volatile share prices.

- Click here to discover the nuances of MedinCell with our detailed analytical future growth report.

- The analysis detailed in our MedinCell valuation report hints at an inflated share price compared to its estimated value.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. is a company that offers digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.32 billion.

Operations: The company generates revenue primarily through the installation and maintenance of electronic shelf labels, totaling €801.96 million.

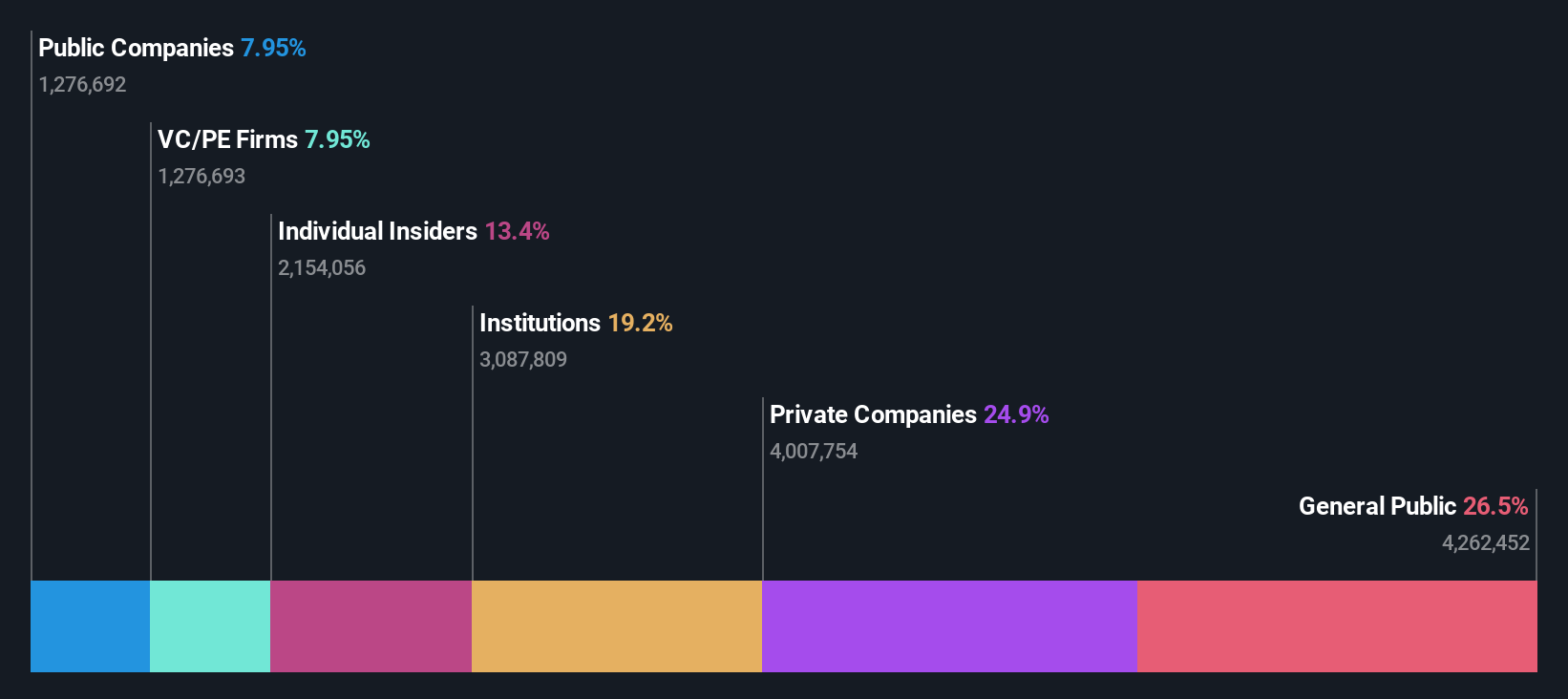

Insider Ownership: 13.5%

VusionGroup S.A. has demonstrated robust growth, with a significant increase in earnings over the past year and is expected to continue this trend. Analysts predict a 24.4% annual revenue growth, outpacing the French market significantly. Despite its highly volatile share price recently, insider ownership remains stable with no substantial buying or selling reported in the last three months. The company's strong performance was highlighted at the Berenberg European Conference and in its impressive full-year earnings report for 2023, where net income soared due to increased sales reaching €801.96 million.

- Delve into the full analysis future growth report here for a deeper understanding of VusionGroup.

- Upon reviewing our latest valuation report, VusionGroup's share price might be too optimistic.

Summing It All Up

- Take a closer look at our Fast Growing Euronext Paris Companies With High Insider Ownership list of 23 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether VusionGroup is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Provides digitalization solutions for commerce in Europe, Asia, and North America.

Exceptional growth potential with outstanding track record.