3 Euronext Paris Growth Stocks With High Insider Ownership Expecting 25% Earnings Growth

Reviewed by Simply Wall St

As European markets navigate mixed earnings reports and economic uncertainties, the French CAC 40 Index has recently experienced slight declines. Despite these challenges, growth companies with high insider ownership continue to attract attention for their potential resilience and long-term prospects. In this article, we will explore three Euronext Paris growth stocks that boast significant insider ownership and are anticipating a 25% earnings growth. High insider ownership often signals confidence in the company's future, making these stocks noteworthy in today's fluctuating market environment.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

| VusionGroup (ENXTPA:VU) | 13.5% | 25.7% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 35.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| STIF Société anonyme (ENXTPA:ALSTI) | 10.7% | 28.5% |

| Munic (ENXTPA:ALMUN) | 29.4% | 149.2% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 69.6% |

We're going to check out a few of the best picks from our screener tool.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company in France that develops long-acting injectables across various therapeutic areas, with a market cap of €468.46 million.

Operations: MedinCell generates €11.95 million in revenue from its pharmaceuticals segment.

Insider Ownership: 16.4%

Earnings Growth Forecast: 69.6% p.a.

MedinCell, a French growth company with high insider ownership, is forecast to achieve substantial revenue growth of 44.7% annually and become profitable within three years. Despite recent setbacks in product trials, such as the F14 Phase 3 trial for knee pain not meeting its primary endpoint, MedinCell's innovative technologies like BEPO® and SteadyTeq™ show promise. Trading at 8.4% below its estimated fair value, the company remains a compelling investment prospect amidst ongoing developments.

- Click here to discover the nuances of MedinCell with our detailed analytical future growth report.

- Our expertly prepared valuation report MedinCell implies its share price may be too high.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

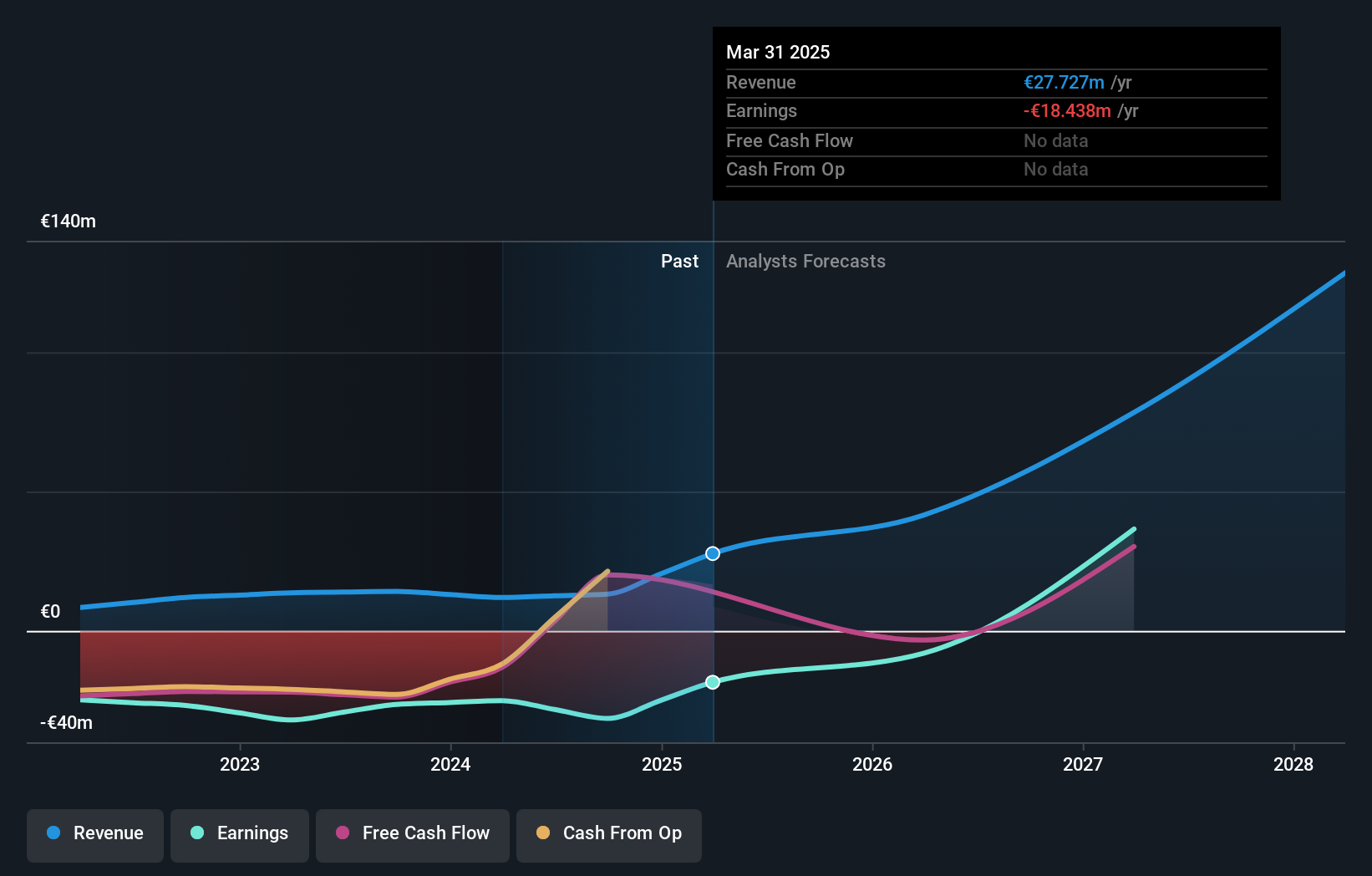

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of approximately €1.11 billion.

Operations: The company's revenue segments include Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud & Other (€185.43 million).

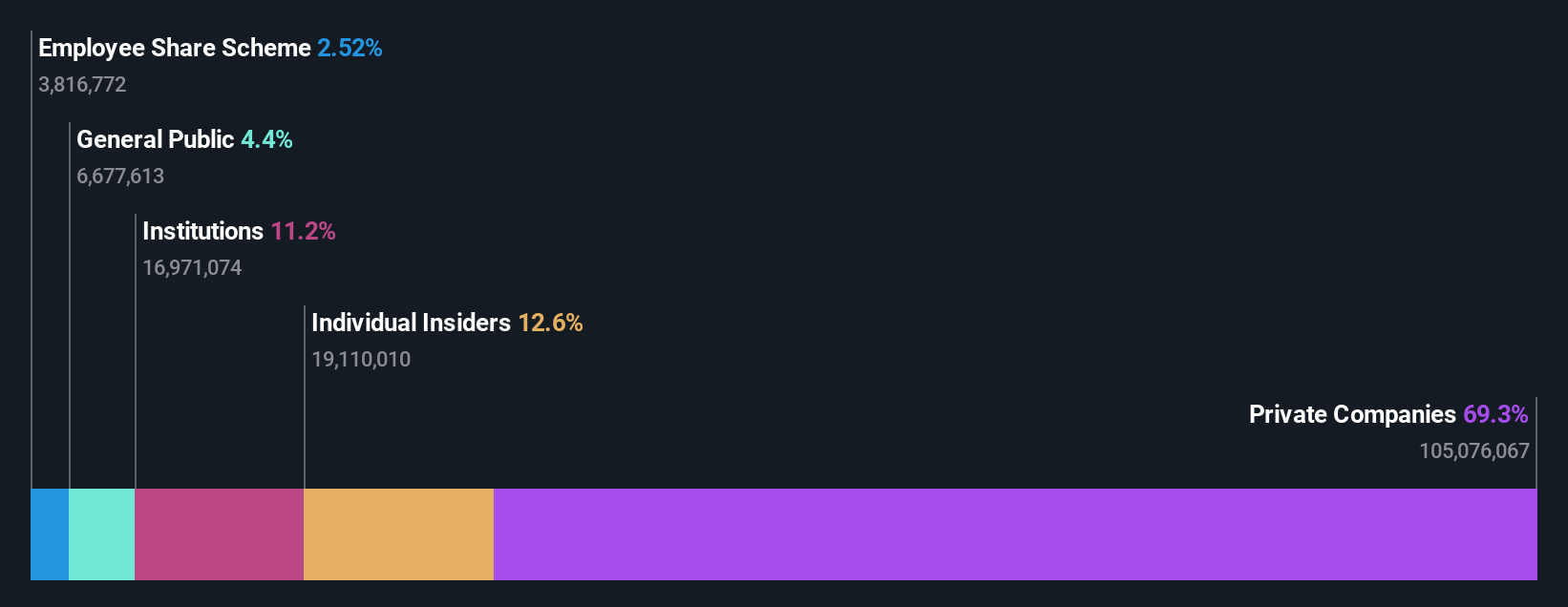

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.1% p.a.

OVH Groupe is forecast to grow revenue at 10% annually and become profitable within three years, outperforming the French market's growth rate. Recent innovations include the launch of ADV-Gen3 Bare Metal servers powered by AMD EPYC 4004 processors, enhancing performance and sustainability. Despite a volatile share price, OVH trades at a significant discount to its estimated fair value. The company also recently appointed Celine Choussy as chief marketing officer to bolster its brand and communication efforts.

- Click here and access our complete growth analysis report to understand the dynamics of OVH Groupe.

- The valuation report we've compiled suggests that OVH Groupe's current price could be quite moderate.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of €2.06 billion.

Operations: The company generates €801.96 million in revenue from installing and maintaining electronic shelf labels.

Insider Ownership: 13.5%

Earnings Growth Forecast: 25.7% p.a.

VusionGroup's earnings are forecast to grow at 25.7% annually, significantly outpacing the French market's 11.9%. Recent earnings surged by 320.8%, and revenue is expected to grow faster than the market at 21.3% per year. Despite high volatility in its share price, analysts agree on a potential 49.3% rise in stock value. The recent implementation of digital solutions for Hy-Vee highlights VusionGroup's innovative approach and growth potential in retail technology solutions.

- Delve into the full analysis future growth report here for a deeper understanding of VusionGroup.

- The valuation report we've compiled suggests that VusionGroup's current price could be inflated.

Summing It All Up

- Get an in-depth perspective on all 25 Fast Growing Euronext Paris Companies With High Insider Ownership by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

Good value with reasonable growth potential.