- France

- /

- Communications

- /

- ENXTPA:ATEME

ATEME SA (EPA:ATEME) Analysts Are Pretty Bullish On The Stock After Recent Results

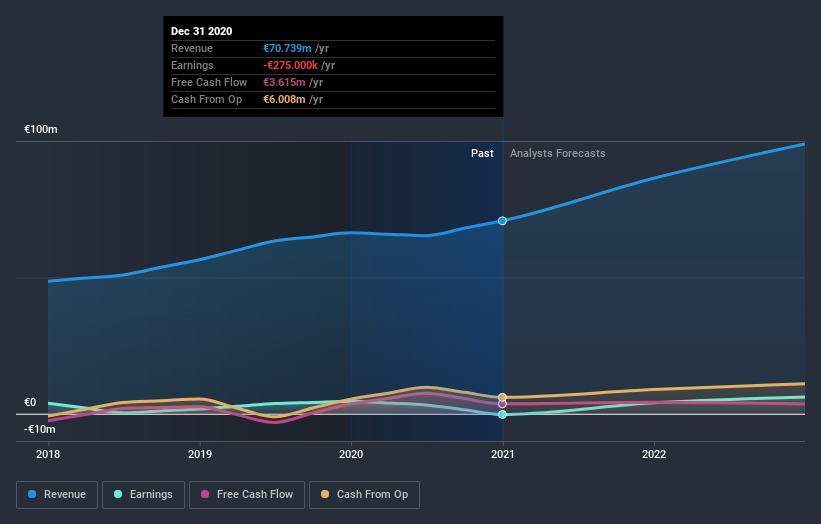

It's been a mediocre week for ATEME SA (EPA:ATEME) shareholders, with the stock dropping 13% to €15.00 in the week since its latest yearly results. It was an okay result overall, with revenues coming in at €71m, roughly what the analysts had been expecting. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for ATEME

Taking into account the latest results, the consensus forecast from ATEME's two analysts is for revenues of €86.4m in 2021, which would reflect a huge 22% improvement in sales compared to the last 12 months. Earnings are expected to improve, with ATEME forecast to report a statutory profit of €0.36 per share. Yet prior to the latest earnings, the analysts had been anticipated revenues of €86.9m and earnings per share (EPS) of €0.46 in 2021. The analysts seem to have become more bearish following the latest results. While there were no changes to revenue forecasts, there was a pretty serious reduction to EPS estimates.

Despite cutting their earnings forecasts,the analysts have lifted their price target 31% to €21.60, suggesting that these impacts are not expected to weigh on the stock's value in the long term.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting ATEME's growth to accelerate, with the forecast 22% annualised growth to the end of 2021 ranking favourably alongside historical growth of 17% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 18% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that ATEME is expected to grow much faster than its industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for ATEME. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for ATEME going out as far as 2022, and you can see them free on our platform here.

You still need to take note of risks, for example - ATEME has 2 warning signs (and 1 which is significant) we think you should know about.

If you decide to trade ATEME, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ATEME

ATEME

Engages in the production and sales of electronic and computer devices and instruments in Europe, the Middle East, Africa, the United States, Canada, Latin America, and the Asia Pacific.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success