- France

- /

- Communications

- /

- ENXTPA:ATEME

Announcing: ATEME (EPA:ATEME) Stock Soared An Exciting 377% In The Last Five Years

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. For example, the ATEME SA (EPA:ATEME) share price is up a whopping 377% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. We note the stock price is up 2.5% in the last seven days.

Check out our latest analysis for ATEME

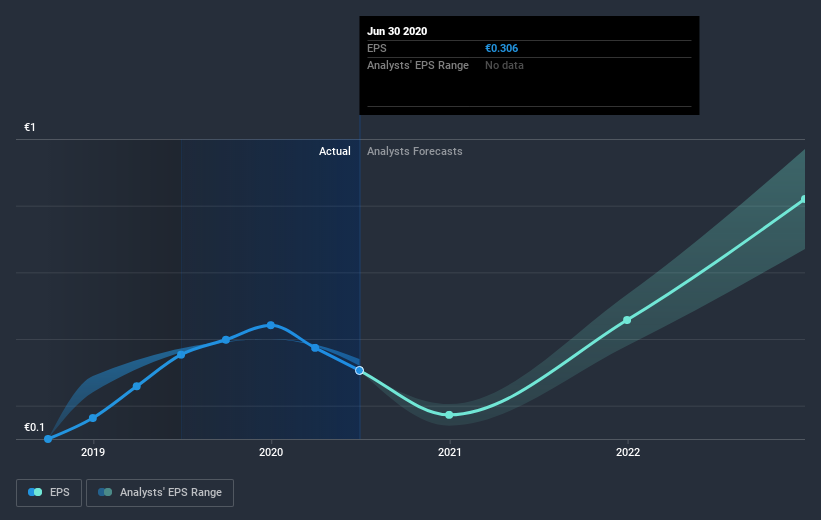

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, ATEME became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into ATEME's key metrics by checking this interactive graph of ATEME's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that ATEME shareholders have received a total shareholder return of 84% over one year. That's better than the annualised return of 37% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand ATEME better, we need to consider many other factors. Even so, be aware that ATEME is showing 2 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you’re looking to trade ATEME, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ATEME

ATEME

Engages in the production and sales of electronic and computer devices and instruments in Europe, the Middle East, Africa, the United States, Canada, Latin America, and the Asia Pacific.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives