- France

- /

- Communications

- /

- ENXTPA:ATEME

A Piece Of The Puzzle Missing From ATEME SA's (EPA:ATEME) 34% Share Price Climb

ATEME SA (EPA:ATEME) shares have had a really impressive month, gaining 34% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

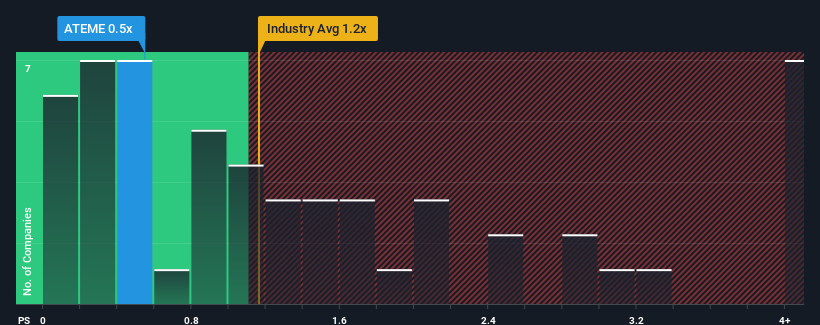

Although its price has surged higher, you could still be forgiven for feeling indifferent about ATEME's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Communications industry in France is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for ATEME

What Does ATEME's Recent Performance Look Like?

There hasn't been much to differentiate ATEME's and the industry's retreating revenue lately. It seems that few are expecting the company's revenue performance to deviate much from most other companies, which has held the P/S back. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on ATEME will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For ATEME?

There's an inherent assumption that a company should be matching the industry for P/S ratios like ATEME's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.3% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 27% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 12%, which is noticeably less attractive.

With this information, we find it interesting that ATEME is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now ATEME's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at ATEME's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you settle on your opinion, we've discovered 3 warning signs for ATEME (1 is concerning!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ATEME

ATEME

Engages in the production and sales of electronic and computer devices and instruments in Europe, the Middle East, Africa, the United States, Canada, Latin America, and the Asia Pacific.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026