- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:ALWEC

Is We.Connect SA (EPA:ALWEC) A Smart Pick For Income Investors?

Is We.Connect SA (EPA:ALWEC) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

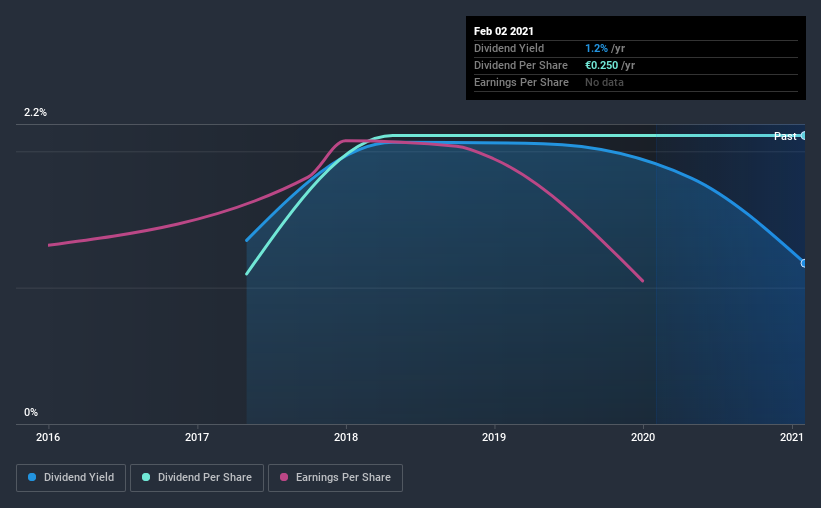

Investors might not know much about We.Connect's dividend prospects, even though it has been paying dividends for the last four years and offers a 1.2% yield. A low yield is generally a turn-off, but if the prospects for earnings growth were strong, investors might be pleasantly surprised by the long-term results. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, We.Connect paid out 29% of its profit as dividends. This is a middling range that strikes a nice balance between paying dividends to shareholders, and retaining enough earnings to invest in future growth. Plus, there is room to increase the payout ratio over time.

While the above analysis focuses on dividends relative to a company's earnings, we do note We.Connect's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of We.Connect's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. We.Connect has been paying a dividend for the past four years. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. During the past four-year period, the first annual payment was €0.1 in 2017, compared to €0.3 last year. Dividends per share have grown at approximately 18% per year over this time.

We.Connect has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. We.Connect's earnings per share have fallen -46% over the past year. This is a pretty serious concern, and it would be worth investigating whether something fundamental in the business has changed - or broken. We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

Conclusion

To summarise, shareholders should always check that We.Connect's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're glad to see We.Connect has a low payout ratio, as this suggests earnings are being reinvested in the business. Earnings per share have been falling, and the company has a relatively short dividend history - shorter than we like, anyway. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than We.Connect out there.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 5 warning signs for We.Connect that investors should take into consideration.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you’re looking to trade We.Connect, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if We.Connect might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALWEC

We.Connect

Designs, manufactures, assembles, and distributes hardware and computers, and peripheral and electronic equipment in France.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success