These 4 Measures Indicate That Verimatrix Société anonyme (EPA:VMX) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Verimatrix Société anonyme (EPA:VMX) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Verimatrix Société anonyme

How Much Debt Does Verimatrix Société anonyme Carry?

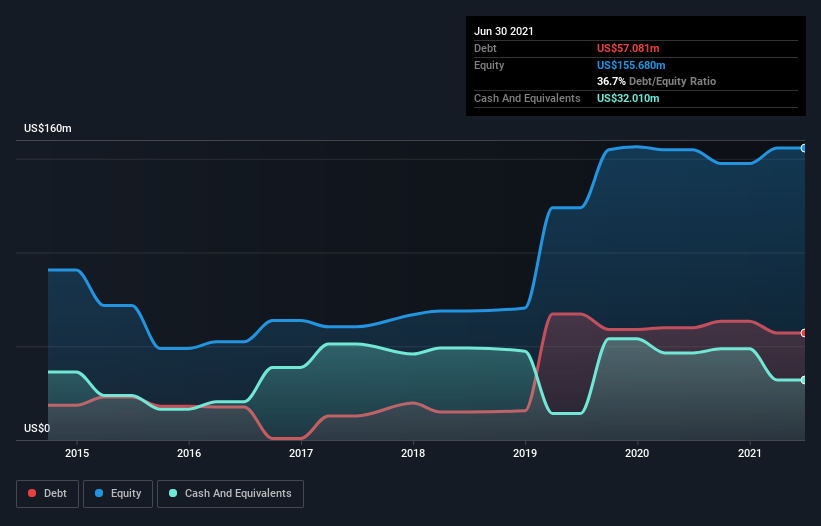

The image below, which you can click on for greater detail, shows that Verimatrix Société anonyme had debt of US$43.3m at the end of June 2021, a reduction from US$59.9m over a year. However, it also had US$32.0m in cash, and so its net debt is US$11.3m.

How Strong Is Verimatrix Société anonyme's Balance Sheet?

We can see from the most recent balance sheet that Verimatrix Société anonyme had liabilities of US$50.0m falling due within a year, and liabilities of US$39.5m due beyond that. Offsetting these obligations, it had cash of US$32.0m as well as receivables valued at US$56.4m due within 12 months. So these liquid assets roughly match the total liabilities.

Having regard to Verimatrix Société anonyme's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$163.8m company is short on cash, but still worth keeping an eye on the balance sheet.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Verimatrix Société anonyme's low debt to EBITDA ratio of 0.43 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 3.2 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. It is well worth noting that Verimatrix Société anonyme's EBIT shot up like bamboo after rain, gaining 70% in the last twelve months. That'll make it easier to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Verimatrix Société anonyme's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last two years, Verimatrix Société anonyme created free cash flow amounting to 7.7% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

The good news is that Verimatrix Société anonyme's demonstrated ability to grow its EBIT delights us like a fluffy puppy does a toddler. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. All these things considered, it appears that Verimatrix Société anonyme can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Verimatrix Société anonyme (of which 1 is potentially serious!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Verimatrix Société anonyme or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:VMX

Verimatrix

Provides security solutions that protect digital content, applications, and devices in France and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives