Did You Participate In Any Of Verimatrix Société anonyme's (EPA:VMX) Incredible 333% Return?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is Verimatrix Société anonyme (EPA:VMX) which saw its share price drive 289% higher over five years. On top of that, the share price is up 11% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 12% in 90 days).

See our latest analysis for Verimatrix Société anonyme

Given that Verimatrix Société anonyme only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Verimatrix Société anonyme saw its revenue grow at 14% per year. That's a pretty good long term growth rate. We'd argue this growth has been reflected in the share price which has climbed at a rate of 31% per year over in that time. Given that the business has made good progress on the top line, it would be worth taking a look at the growth trend. When a growth trend accelerates, be it in revenue or earnings, it can indicate an inflection point for the business, which is can often be an opportunity for investors.

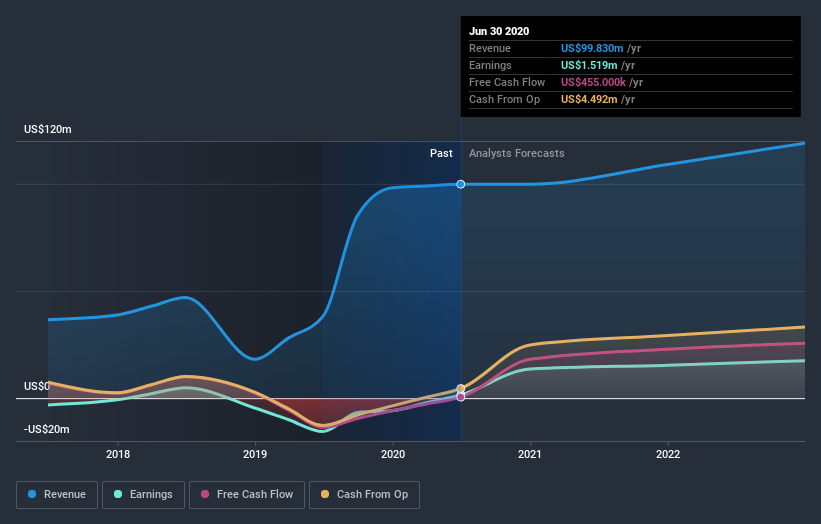

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Verimatrix Société anonyme has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Verimatrix Société anonyme in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Verimatrix Société anonyme's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Verimatrix Société anonyme hasn't been paying dividends, but its TSR of 333% exceeds its share price return of 289%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Verimatrix Société anonyme shareholders have received a total shareholder return of 63% over the last year. That gain is better than the annual TSR over five years, which is 34%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Verimatrix Société anonyme may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Verimatrix Société anonyme, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:VMX

Verimatrix

Provides security solutions that protect digital content, applications, and devices in France and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives