How Investors Are Reacting To Sopra Steria Group (ENXTPA:SOP) Powering EU’s New Schengen Biometric System

Reviewed by Simply Wall St

- On August 25, 2025, IDEMIA Public Security and Sopra Steria announced the successful go-live of eu-LISA’s new shared Biometric Matching System (sBMS), a major EU project to enhance biometric identification for Schengen border and migration management.

- This deployment underscores Sopra Steria’s ability to deliver mission-critical digital solutions at continental scale, further strengthening its credentials in European security and public sector IT.

- We'll examine how Sopra Steria’s integral role in this high-profile EU security project could reinforce its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sopra Steria Group Investment Narrative Recap

To be a long-term shareholder in Sopra Steria, you need conviction that their deep involvement in European digital transformation will directly translate into durable public sector growth and higher-margin critical infrastructure wins. The recent go-live of eu-LISA’s biometric matching system affirms Sopra Steria’s technical execution, but is unlikely to materially move the needle in the near term for organic growth or offset structural margin headwinds, which remain the biggest risk highlighted by recent results.

The launch of Sopra Crypto Solutions in April 2025 stands out given regulatory tailwinds across European financial services, yet its relevance to security and border management appears limited compared to the sBMS deployment. Investors may be more interested in how recurring, high-impact EU security projects like sBMS reflect the firm’s ability to win and deliver at scale, reinforcing the most important catalyst for earnings resilience.

Yet, despite these high-profile contract wins, rising costs and contraction in key European markets pose ongoing risks that investors should not ignore...

Read the full narrative on Sopra Steria Group (it's free!)

Sopra Steria Group's narrative projects €6.1 billion revenue and €373.6 million earnings by 2028. This requires 2.7% yearly revenue growth and a €91.6 million earnings increase from €282.0 million.

Uncover how Sopra Steria Group's forecasts yield a €222.00 fair value, a 44% upside to its current price.

Exploring Other Perspectives

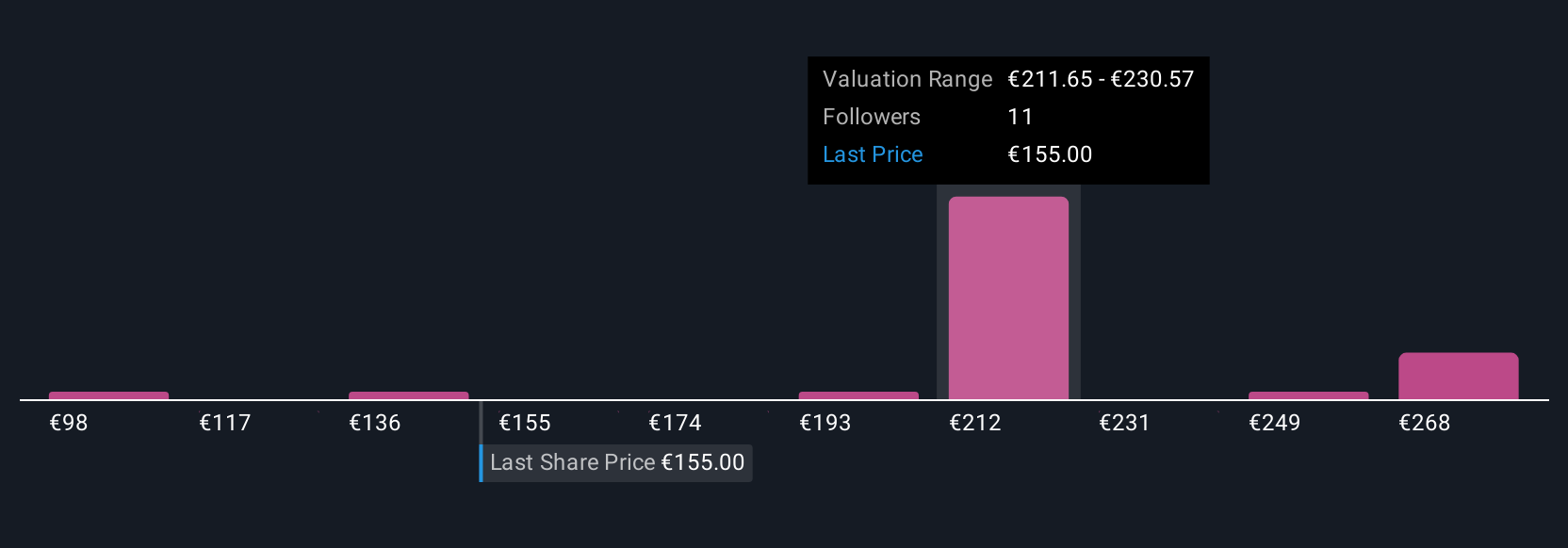

Seven individual fair value estimates from the Simply Wall St Community span €98.14 to €293.75 per share. While confidence in Sopra Steria’s critical EU contracts is a recurring catalyst, many participants remain cautious about margin compression and sluggish organic growth impacting future returns.

Explore 7 other fair value estimates on Sopra Steria Group - why the stock might be worth as much as 91% more than the current price!

Build Your Own Sopra Steria Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sopra Steria Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sopra Steria Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sopra Steria Group's overall financial health at a glance.

No Opportunity In Sopra Steria Group?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SOP

Sopra Steria Group

Provides consulting, digital, and software development services in France and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives