Take Care Before Jumping Onto Solutions 30 SE (EPA:S30) Even Though It's 26% Cheaper

The Solutions 30 SE (EPA:S30) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

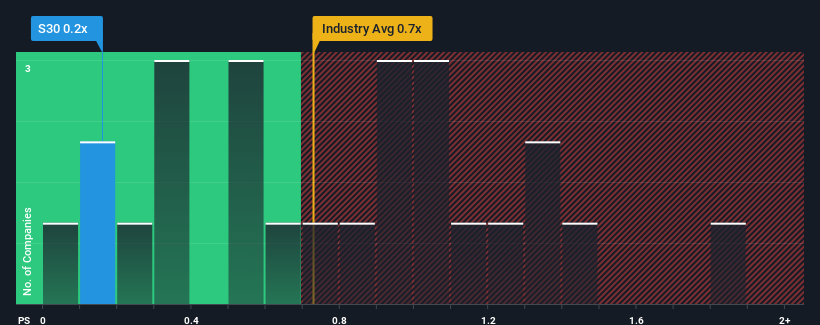

Since its price has dipped substantially, it would be understandable if you think Solutions 30 is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in France's IT industry have P/S ratios above 0.7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Solutions 30

What Does Solutions 30's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Solutions 30 has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Solutions 30's future stacks up against the industry? In that case, our free report is a great place to start.How Is Solutions 30's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Solutions 30's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. As a result, it also grew revenue by 28% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 8.6% per year as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 5.6% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Solutions 30's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Solutions 30's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Solutions 30's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Solutions 30 that you need to be mindful of.

If you're unsure about the strength of Solutions 30's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:S30

Solutions 30

Provides support solutions for new digital technologies in Benelux, France, Spain, Italy, Germany, Portugal, Poland, and the United Kingdom.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives