Market Might Still Lack Some Conviction On Solutions 30 SE (EPA:S30) Even After 28% Share Price Boost

Despite an already strong run, Solutions 30 SE (EPA:S30) shares have been powering on, with a gain of 28% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

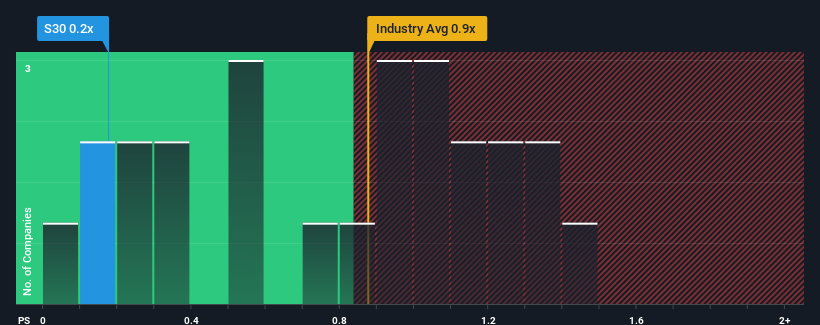

In spite of the firm bounce in price, considering around half the companies operating in France's IT industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Solutions 30 as an solid investment opportunity with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Solutions 30

How Solutions 30 Has Been Performing

Solutions 30 could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Solutions 30 will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Solutions 30?

The only time you'd be truly comfortable seeing a P/S as low as Solutions 30's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 5.8% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 10% per annum as estimated by the three analysts watching the company. With the industry only predicted to deliver 3.4% each year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Solutions 30's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Despite Solutions 30's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Solutions 30's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 1 warning sign for Solutions 30 you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:S30

Solutions 30

Provides support solutions for new digital technologies in Benelux, France, Spain, Italy, Germany, Portugal, Poland, and the United Kingdom.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives