Stock Analysis

Three High Insider Ownership Growth Companies On Euronext Paris With Up To 101% Earnings Growth

Reviewed by Simply Wall St

Amidst a backdrop of political uncertainty and fluctuating market conditions across Europe, France's market has particularly felt the impact, with significant movements in bond yields and equity indices. In such an environment, exploring growth companies with high insider ownership on Euronext Paris could offer investors a unique blend of potential resilience and growth, given that high insider ownership often aligns company leadership closely with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.6% |

| Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 42.4% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 34.2% |

| Munic (ENXTPA:ALMUN) | 29.4% | 150% |

| WALLIX GROUP (ENXTPA:ALLIX) | 19.8% | 101.6% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 74.6% |

Underneath we present a selection of stocks filtered out by our screen.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA, with a market cap of €1.05 billion, offers industrial intelligence solutions across the fashion, automotive, and furniture sectors in regions including Northern Europe, Southern Europe, the Americas, and Asia Pacific.

Operations: The revenue for the company across its operational regions includes €170.33 million from the Americas and €110.28 million from the Asia Pacific.

Insider Ownership: 19.6%

Earnings Growth Forecast: 28.6% p.a.

Lectra, a French growth company with high insider ownership, shows promising financial trends despite some challenges. Its revenue is expected to grow at 11.3% annually, outpacing the broader French market's 5.8%. Additionally, earnings are projected to surge by 28.6% per year over the next three years. However, its Return on Equity is anticipated to be modest at 13.3%. Recently, Lectra reported a slight dip in net income and EPS in Q1 2024 compared to the previous year but maintained stable sales growth. Trading at 35.7% below its estimated fair value suggests potential undervaluation relative to peers.

- Click to explore a detailed breakdown of our findings in Lectra's earnings growth report.

- Our expertly prepared valuation report Lectra implies its share price may be lower than expected.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable medications across multiple therapeutic areas, with a market capitalization of approximately €393.48 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling €11.95 million.

Insider Ownership: 16.4%

Earnings Growth Forecast: 74.6% p.a.

MedinCell S.A., a French growth company with high insider ownership, is navigating through financial challenges with promising prospects. Despite a decline in annual revenue to €11.95 million and a net loss of €25.04 million, the company's revenue growth rate stands at 42.9% per year, significantly outpacing the French market average of 5.8%. Analysts expect MedinCell to become profitable within three years and project an earnings growth rate of 74.59% annually, reflecting potential recovery and value despite current volatility and shareholder dilution concerns from the past year.

- Delve into the full analysis future growth report here for a deeper understanding of MedinCell.

- Our valuation report unveils the possibility MedinCell's shares may be trading at a discount.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

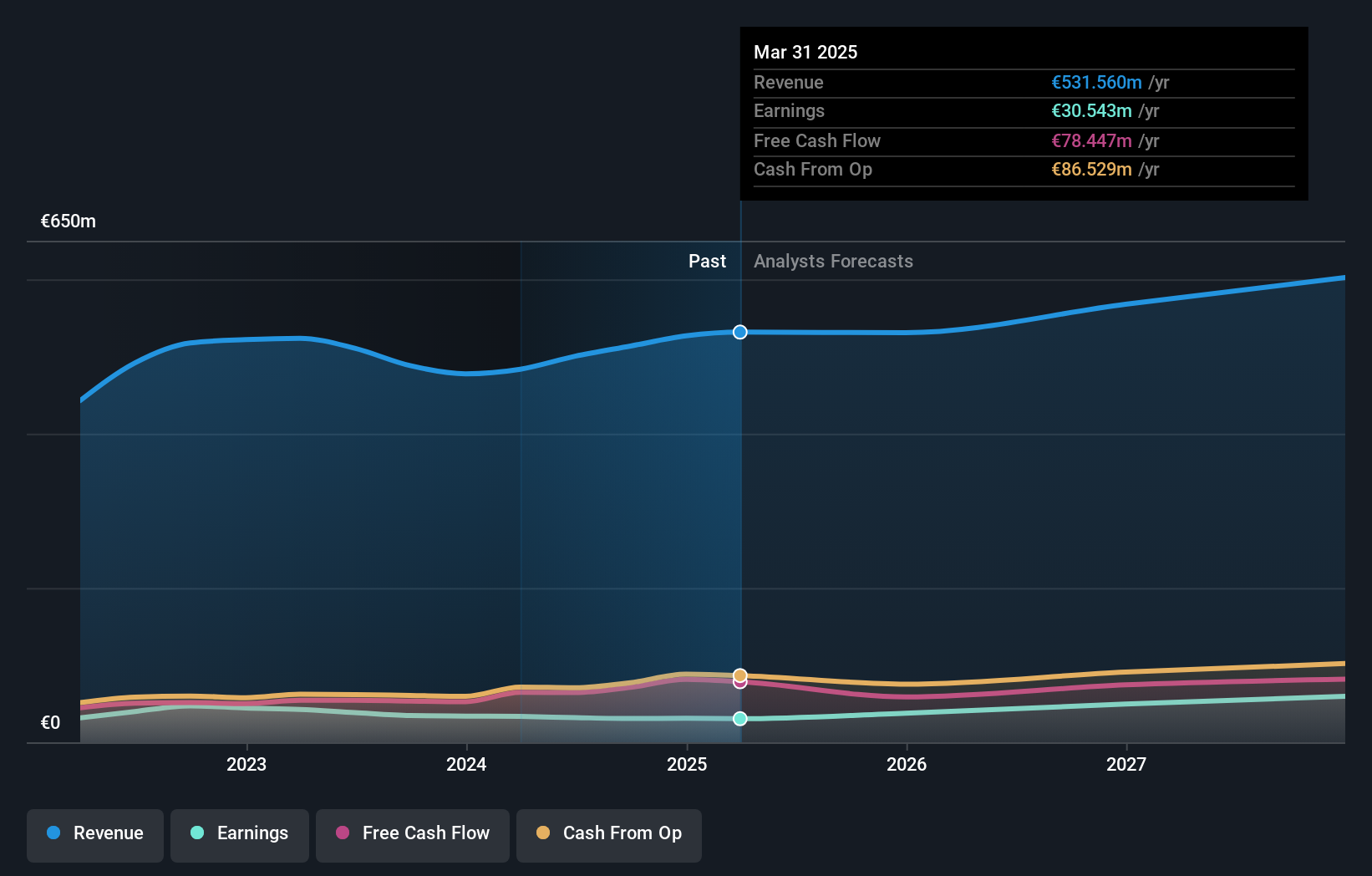

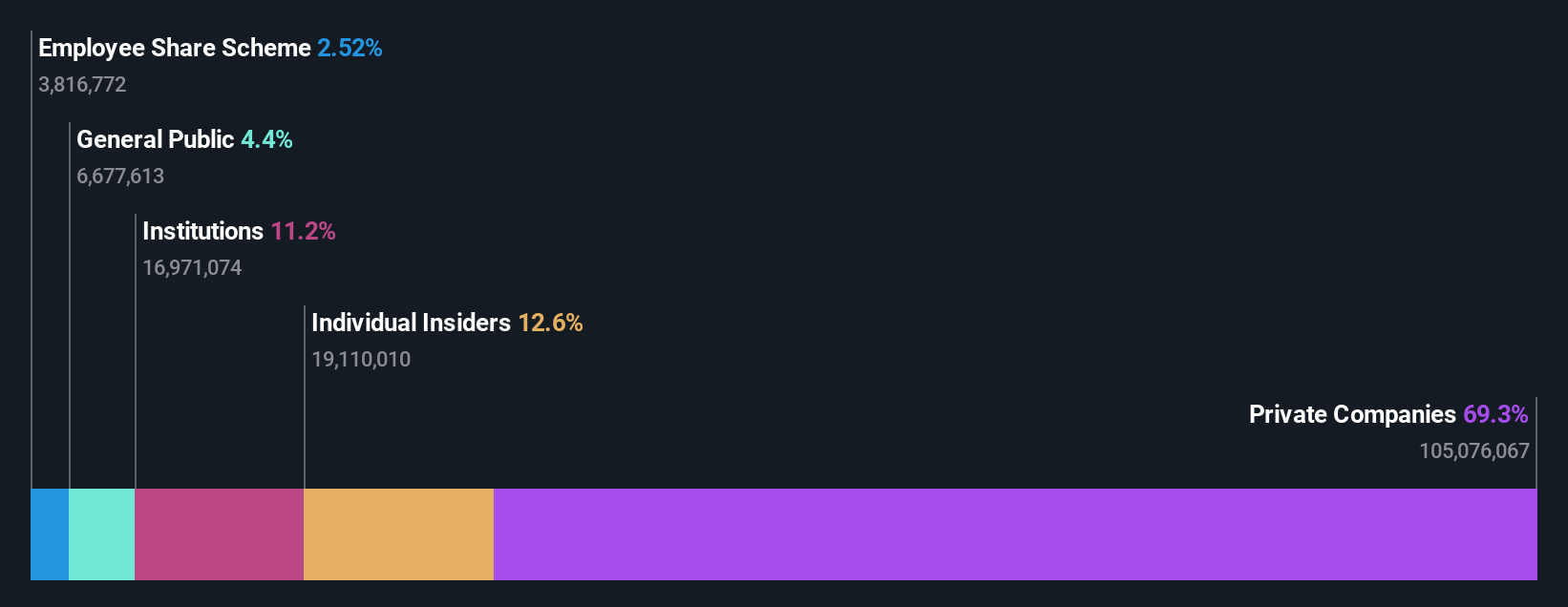

Overview: OVH Groupe S.A. offers a range of cloud services, shared hosting, and dedicated server solutions globally, with a market capitalization of approximately €0.99 billion.

Operations: The company generates revenue primarily through three segments: Public Cloud (€140.71 million), Private Cloud (€514.59 million), and Web cloud (€179.45 million).

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.5% p.a.

OVH Groupe, amidst a volatile share price, is on a trajectory toward profitability within three years with its revenue growth (10.9% per year) outpacing the French market's 5.8%. Although its return on equity is expected to remain low at 3.7%, earnings are projected to surge by 101.5% annually. Recent strategic hires like Celine Choussy and Benjamin Revcolevschi underscore the company’s commitment to innovation and international expansion, aligning with OVH's strategic development goals despite current financial challenges evidenced by a reduced net loss from €26.59 million to €17.24 million in the latest half-year report.

- Get an in-depth perspective on OVH Groupe's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, OVH Groupe's share price might be too optimistic.

Turning Ideas Into Actions

- Gain an insight into the universe of 22 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether MedinCell is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

High growth potential and fair value.