Stock Analysis

Insider-Owned Growth Companies On Euronext Paris In July 2024

Reviewed by Simply Wall St

Amidst a backdrop of trade tensions and shifting market dynamics in Europe, where France's CAC 40 Index recently saw a decline, investors are increasingly attentive to the stability and potential growth offered by insider-owned companies. Such entities often exemplify strong commitment and confidence from those who know the business intimately, making them particularly compelling in uncertain times.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.5% | 24.3% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.8% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.2% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 31.8% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

| Munic (ENXTPA:ALMUN) | 29.4% | 149.2% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 69.6% |

Let's uncover some gems from our specialized screener.

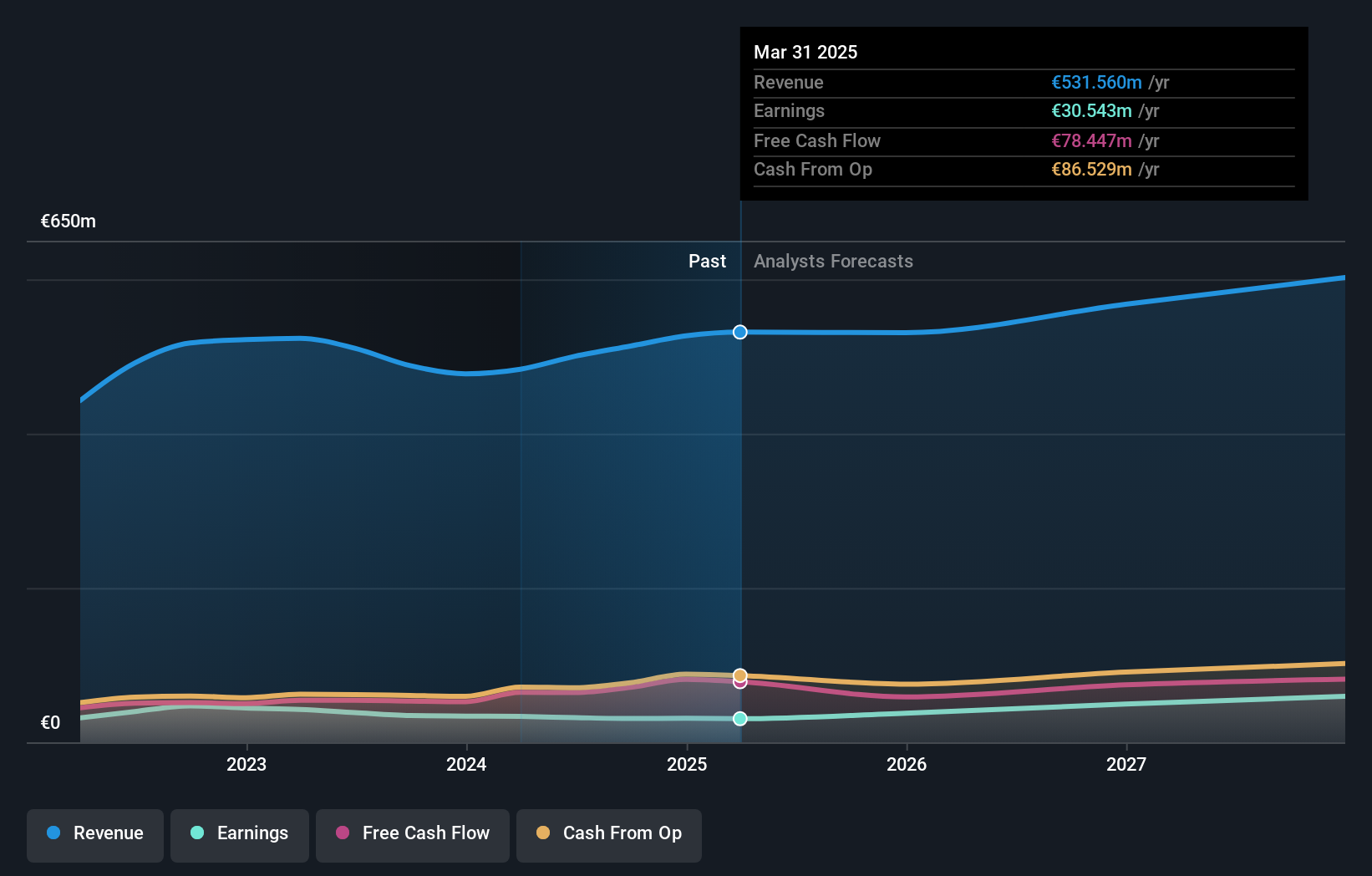

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA, with a market cap of €1.07 billion, offers industrial intelligence solutions across the fashion, automotive, and furniture sectors in regions including Northern Europe, Southern Europe, the Americas, and Asia Pacific.

Operations: The company generates revenue from the Americas and Asia Pacific, with €170.33 million and €110.28 million respectively.

Insider Ownership: 19.6%

Lectra, a French company, showcases promising growth with its earnings expected to increase significantly at 28.6% annually, outpacing the French market's 10.9%. Despite slower revenue growth predictions of 10.8% compared to a higher market average, it remains competitive by exceeding the national rate of 5.6%. Analysts project a potential stock price increase of 23%, and it currently trades at 36.7% below estimated fair value, highlighting its appeal despite modest insider trading activity and a forecasted low return on equity of 13.4% in three years.

- Get an in-depth perspective on Lectra's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Lectra is trading behind its estimated value.

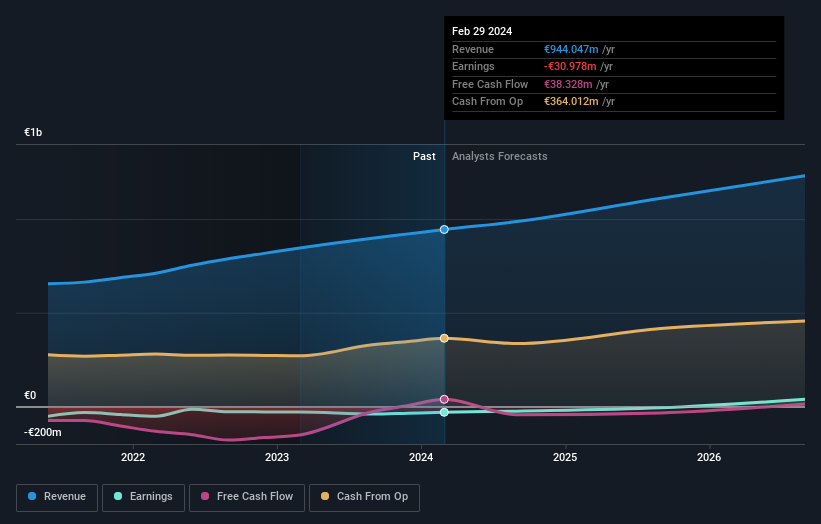

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable treatments across multiple therapeutic areas, with a market capitalization of approximately €463.23 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling €11.95 million.

Insider Ownership: 16.4%

MedinCell, a French biotech, reported a decrease in annual revenue to €11.95 million and narrowed its net loss to €25.04 million. Despite a recent Phase 3 setback with F14 not meeting its primary endpoint, significant improvements in secondary outcomes suggest potential for alternative approval paths. The company's revenue is expected to grow at 43.8% annually, outstripping the French market's 5.6%. Insider ownership remains stable with no significant buying or selling reported recently, reflecting steady confidence from within despite challenges.

- Click here and access our complete growth analysis report to understand the dynamics of MedinCell.

- Upon reviewing our latest valuation report, MedinCell's share price might be too optimistic.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions, with a market capitalization of approximately €1.05 billion.

Operations: The company generates revenue through three primary segments: public cloud (€169.01 million), private cloud (€589.61 million), and web cloud services (€185.43 million).

Insider Ownership: 10.5%

OVH Groupe, a French growth company with high insider ownership, has demonstrated a volatile share price recently. Despite this, its revenue is expected to grow at 10% annually, outpacing the French market's average of 5.6%. The company is also on track to become profitable within three years, with anticipated earnings growth significantly exceeding market expectations. Recent product launches, like the new ADV-Gen3 Bare Metal servers featuring advanced AMD processors, underscore OVH's commitment to innovation and market expansion.

- Unlock comprehensive insights into our analysis of OVH Groupe stock in this growth report.

- The analysis detailed in our OVH Groupe valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Take a closer look at our Fast Growing Euronext Paris Companies With High Insider Ownership list of 21 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

High growth potential with worrying balance sheet.