The Market Lifts Union Technologies Informatique Group S.A. (EPA:FPG) Shares 28% But It Can Do More

Those holding Union Technologies Informatique Group S.A. (EPA:FPG) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

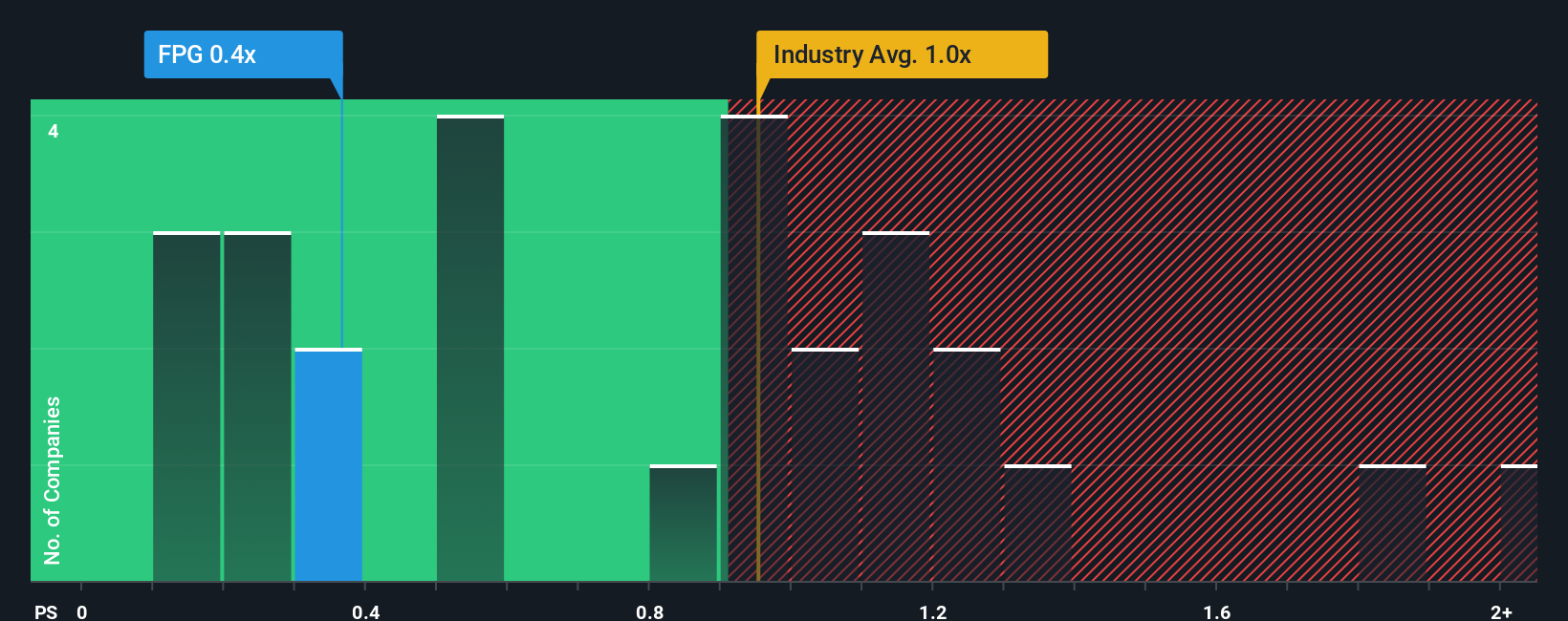

In spite of the firm bounce in price, it's still not a stretch to say that Union Technologies Informatique Group's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the IT industry in France, where the median P/S ratio is around 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Union Technologies Informatique Group

What Does Union Technologies Informatique Group's Recent Performance Look Like?

For example, consider that Union Technologies Informatique Group's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Union Technologies Informatique Group will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Union Technologies Informatique Group?

Union Technologies Informatique Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.7%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 16% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 1.7% shows it's noticeably more attractive.

In light of this, it's curious that Union Technologies Informatique Group's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Union Technologies Informatique Group's P/S Mean For Investors?

Its shares have lifted substantially and now Union Technologies Informatique Group's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Union Technologies Informatique Group revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Union Technologies Informatique Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FPG

Union Technologies Informatique Group

An IT service company, provides consulting and engineering services to banking, finance, insurance, retirement, industry, and service sectors in France and internationally.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives