Claranova (ENXTPA:CLA) Faces Widening Losses as Earnings Turnaround Becomes Central Investor Focus

Reviewed by Simply Wall St

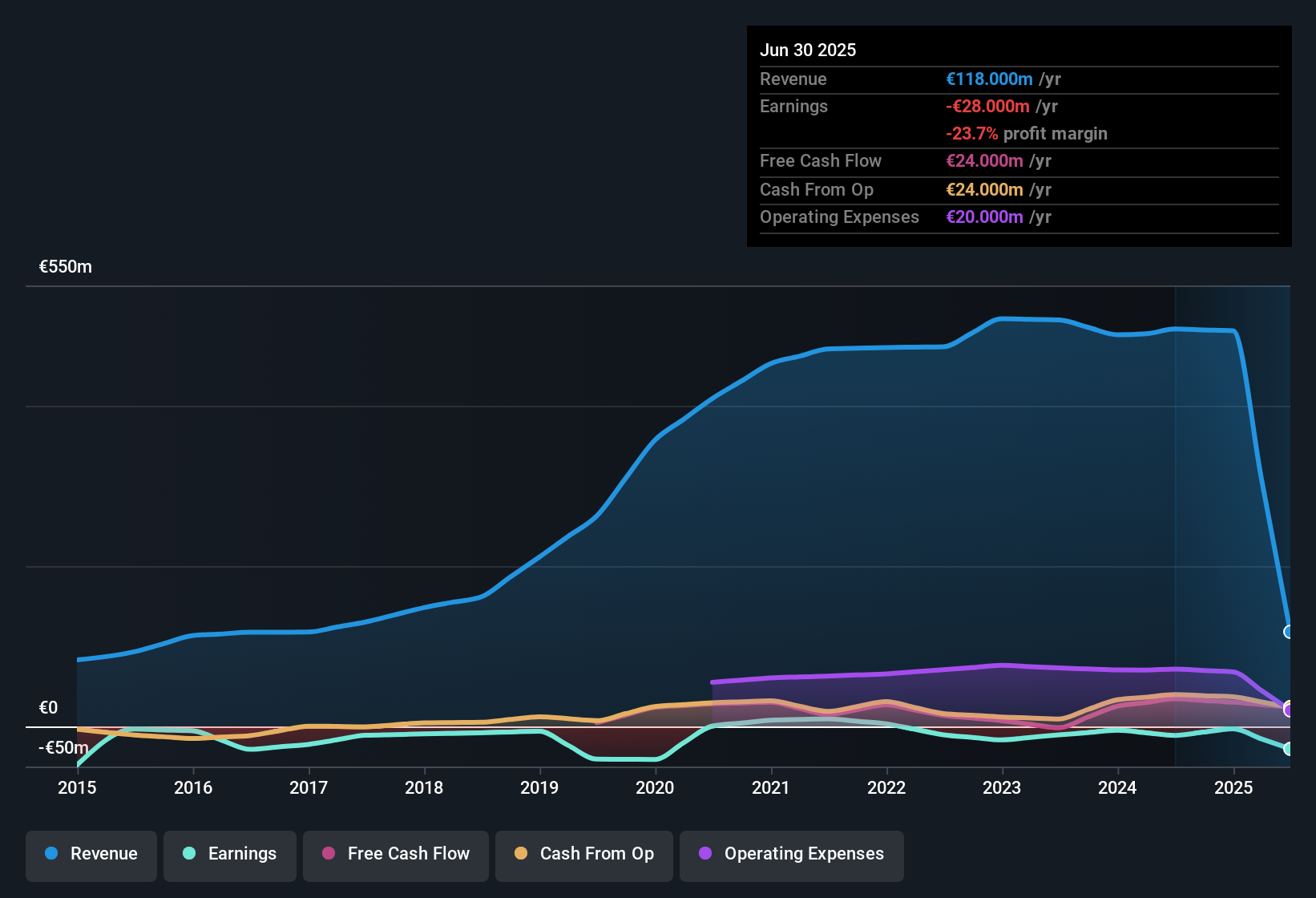

Claranova (ENXTPA:CLA) reported revenue growth that is forecast at 4.8% per year, trailing the French market average of 5.5% per year. Despite recent annual losses expanding by 50.5% over the past five years, analysts now expect earnings to surge by 109.28% annually. The company is expected to return to profitability within three years. Shares, currently trading at €1.74, are valued at a Price-To-Sales Ratio of 0.8x, significantly below industry and peer averages. The current price is also well beneath some fair value estimates, suggesting a potentially attractive setup for investors.

See our full analysis for Claranova.Next, we will see how these headline results compare with the market’s prevailing narratives and community outlook. This analysis will reveal which investor expectations are validated and which may face a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Mount Despite Growth Turnaround Forecast

- Annual losses have widened by 50.5% over the past five years, even as analysts now project a sharp reversal with earnings expected to grow by 109.28% per year and a return to profitability within three years.

- Analyst commentary focuses on the tension between this steep loss history and the optimism for rapid earnings growth,

- Recent years of increasing losses raise the bar for the projected turnaround, making analyst optimism dependent on visible margin expansion ahead.

- What is especially notable is that the expectation for 109.28% earnings growth must overcome not just typical unprofitability but a long-running trend of deepening losses, a dynamic that shapes the market’s skepticism.

Peer Valuations Point to Relative Discount

- Claranova trades at a Price-To-Sales Ratio of just 0.8x, less than half the French software industry average (1.7x) and far below the peer group average (6.5x).

- The prevailing market view weighs this valuation gap against risk,

- Some investors see the steep discount as a cushion against past losses, especially where similar unprofitable software names fetch multiples 2 to 8 times higher.

- With the current share price at €1.74, value investors are watching for an inflection. If profitability materializes as forecast, this discount could unwind quickly.

DCF Fair Value Shows Upside Risk

- Shares trade at €1.74, markedly below the modeled DCF fair value of €3.09, suggesting potential for a substantial re-rating if the turnaround takes hold.

- Investors balancing the outlook for profitability with historical volatility note,

- Recent mild share price instability may reflect market hesitation to re-rate upward before clear signs of progress on earnings.

- Nevertheless, the gap to DCF fair value is wide enough that conviction in profitability forecasts could spark renewed interest from bargain hunters.

Want the full balanced picture on Claranova? Get insights from every angle in the consensus narrative. 📊 Read the full Claranova Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Claranova's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite promising forecasts, Claranova’s record of widening losses and uncertain turnaround prospects put its financial health under the spotlight.

If you want more consistent financial strength on your watchlist, use our solid balance sheet and fundamentals stocks screener (1985 results) to filter for companies with robust balance sheets and resilience through volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CLA

Claranova

A technology company, engages in personalized e-commerce, software publishing, and internet of things (IoT) management in France, the United States, the United Kingdom, Germany, France, other European countries, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives