Atos (ENXTPA:ATO): Examining Valuation After Recent Share Price Drop and Ongoing Restructuring

Reviewed by Simply Wall St

See our latest analysis for Atos.

Atos’s share price has been on a rollercoaster this year, with a sharp 90-day rally still visible despite a 13% slip in the past month. Momentum appears to be fading after a strong comeback, and when you take the longer view, the 1-year total shareholder return is down 3%. This reminds investors that recent surges have not erased the earlier setbacks that sent the 3-year total return tumbling by 94%.

If you’re in the mood to broaden your search, now’s a perfect time to discover fast growing stocks with high insider ownership

With shares slipping and recent gains offsetting only some of the longer-term losses, investors face a tough call. Is Atos now trading below its true worth, or are all future expectations already built into the price?

Most Popular Narrative: 10% Overvalued

Atos’s widely followed narrative assigns a fair value of €43 per share, which is 10% below the current closing price of €47.48. These numbers set a challenging benchmark, given the company’s ongoing restructuring and competitive pressures.

Persistent high debt levels and a negative equity position limit strategic flexibility and raise the risk of higher future interest costs, credit downgrades, or forced asset sales. This constraint is likely to depress net earnings and could restrict investment needed to pursue growth in emerging segments.

Wondering how debt, margins, and a big industry shift collide in shaping this valuation? There is a sharp forecast at the heart of this narrative that you won’t want to miss. Uncover the surprising quantitative logic driving the current price target, one that rewrites expectations for Atos’s future profitability.

Result: Fair Value of €43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Atos stabilizes revenues and accelerates restructuring, improved margins and renewed customer confidence could quickly challenge the prevailing narrative of overvaluation.

Find out about the key risks to this Atos narrative.

Another View: Deep Discount on Earnings Compared to Industry

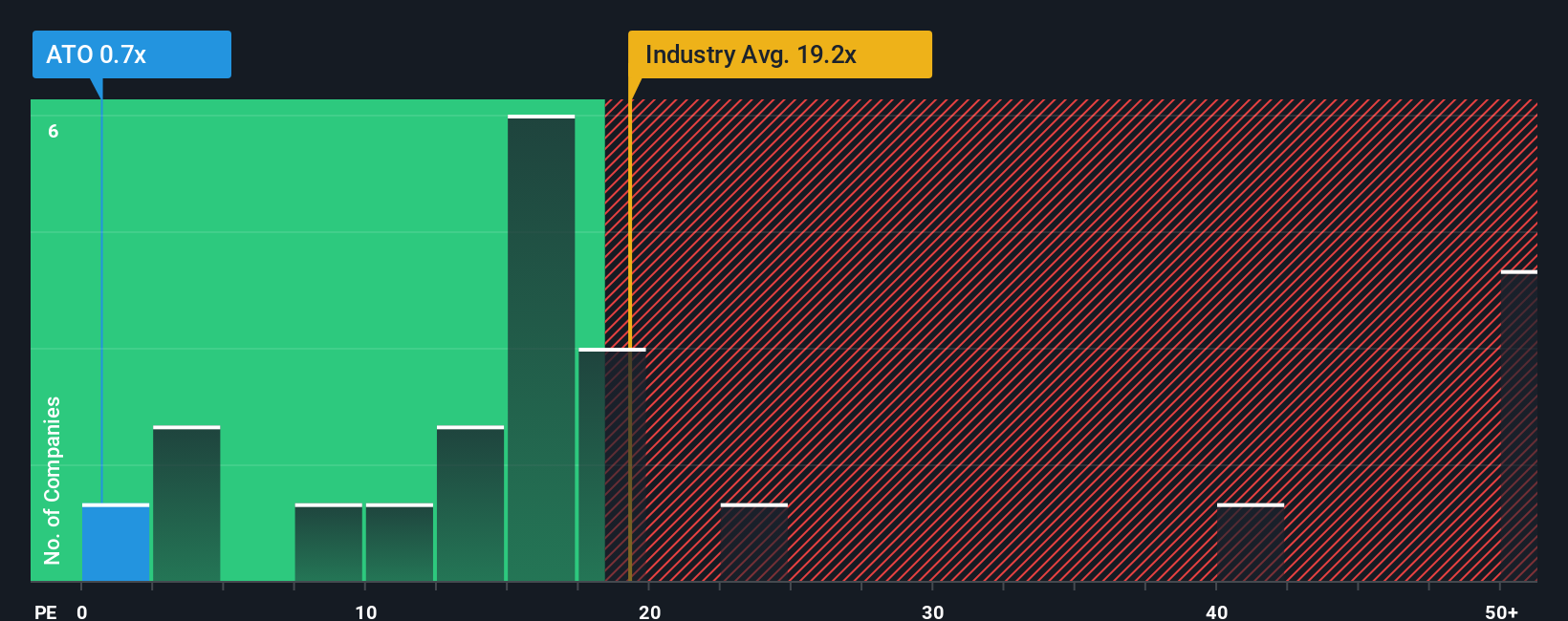

While many see Atos as overvalued based on recent price targets, there is a striking gap when you look at its earnings-based valuation. Atos trades at just 0.6 times earnings, far below the European IT industry average of 18.9, with a fair ratio of 7.2 often cited as a more realistic market benchmark. Such a steep discount raises the possibility of hidden value, but also questions about what risks might be keeping investors away. Could the market be too negative, or are there deeper issues at play?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atos Narrative

If you see the story differently or want to dig into the numbers yourself, you can build your own perspective in just a few minutes, and Do it your way.

A great starting point for your Atos research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by when there is a world of standout stocks just waiting to be found. Get ahead of the crowd with these handpicked paths on Simply Wall Street:

- Accelerate your returns by targeting these 836 undervalued stocks based on cash flows that are trading below their true potential and ready for savvy investors to spot the difference.

- Cash in on consistent growth by tapping into these 20 dividend stocks with yields > 3% offering robust yields above 3% for income you can rely on.

- Get ahead of tomorrow’s trends with these 25 AI penny stocks and capitalize on the latest breakthroughs in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Community Narratives