Investors Who Bought Witbe (EPA:ALWIT) Shares A Year Ago Are Now Up 268%

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Witbe S.A. (EPA:ALWIT) share price has soared 268% in the last year. Most would be very happy with that, especially in just one year! On top of that, the share price is up 69% in about a quarter. The longer term returns have not been as good, with the stock price only 29% higher than it was three years ago.

Check out our latest analysis for Witbe

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Witbe went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We think that the revenue growth of 24% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

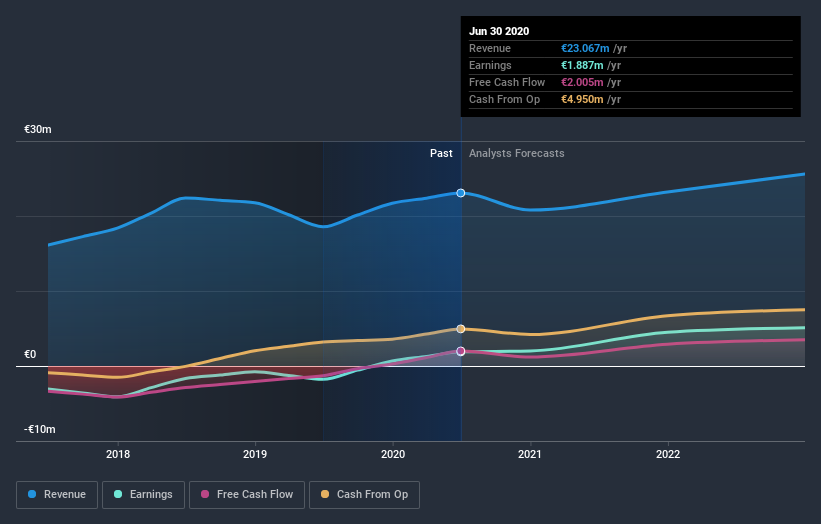

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Witbe has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Witbe stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Pleasingly, Witbe's total shareholder return last year was 268%. That's better than the annualized TSR of 9% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Witbe on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Witbe has 4 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Witbe, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Witbe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ALWIT

Witbe

Provides digital services in France, Europe, the Middle East, Africa, Asia, the United States, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives