Why Investors Shouldn't Be Surprised By Streamwide S.A.'s (EPA:ALSTW) P/E

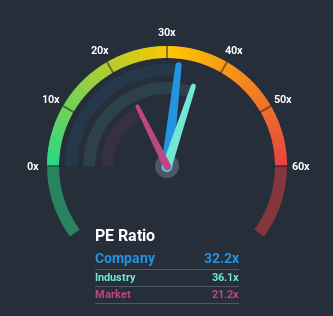

Streamwide S.A.'s (EPA:ALSTW) price-to-earnings (or "P/E") ratio of 32.2x might make it look like a strong sell right now compared to the market in France, where around half of the companies have P/E ratios below 21x and even P/E's below 12x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Streamwide has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Streamwide

Is There Enough Growth For Streamwide?

In order to justify its P/E ratio, Streamwide would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 130%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 33% per year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 20% each year, which is noticeably less attractive.

In light of this, it's understandable that Streamwide's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Streamwide's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Streamwide's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Streamwide that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

If you’re looking to trade Streamwide, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ALSTW

Streamwide

Designs, develops, markets, and maintains a set of service software for mobiles and telecommunication operators worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives