Why Investors Shouldn't Be Surprised By Nextedia S.A.'s (EPA:ALNXT) P/E

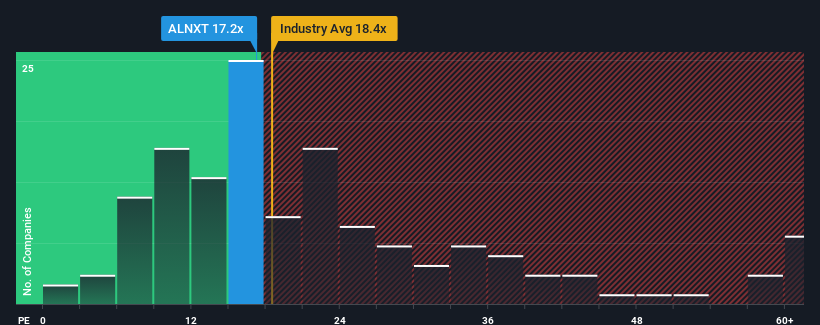

When close to half the companies in France have price-to-earnings ratios (or "P/E's") below 14x, you may consider Nextedia S.A. (EPA:ALNXT) as a stock to potentially avoid with its 17.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Nextedia hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Nextedia

How Is Nextedia's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Nextedia's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 68% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 42% per year over the next three years. That's shaping up to be materially higher than the 10% per annum growth forecast for the broader market.

In light of this, it's understandable that Nextedia's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Nextedia's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Nextedia's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 7 warning signs for Nextedia that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Nextedia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALNXT

Nextedia

Provides cybersecurity, cloud and digital workspace, and customer experience solutions in France.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success