Blockchain Group (ENXTPA:ALCPB) Five-Year Annual Losses Worsen 37.9% as Valuation Premium Draws Scrutiny

Reviewed by Simply Wall St

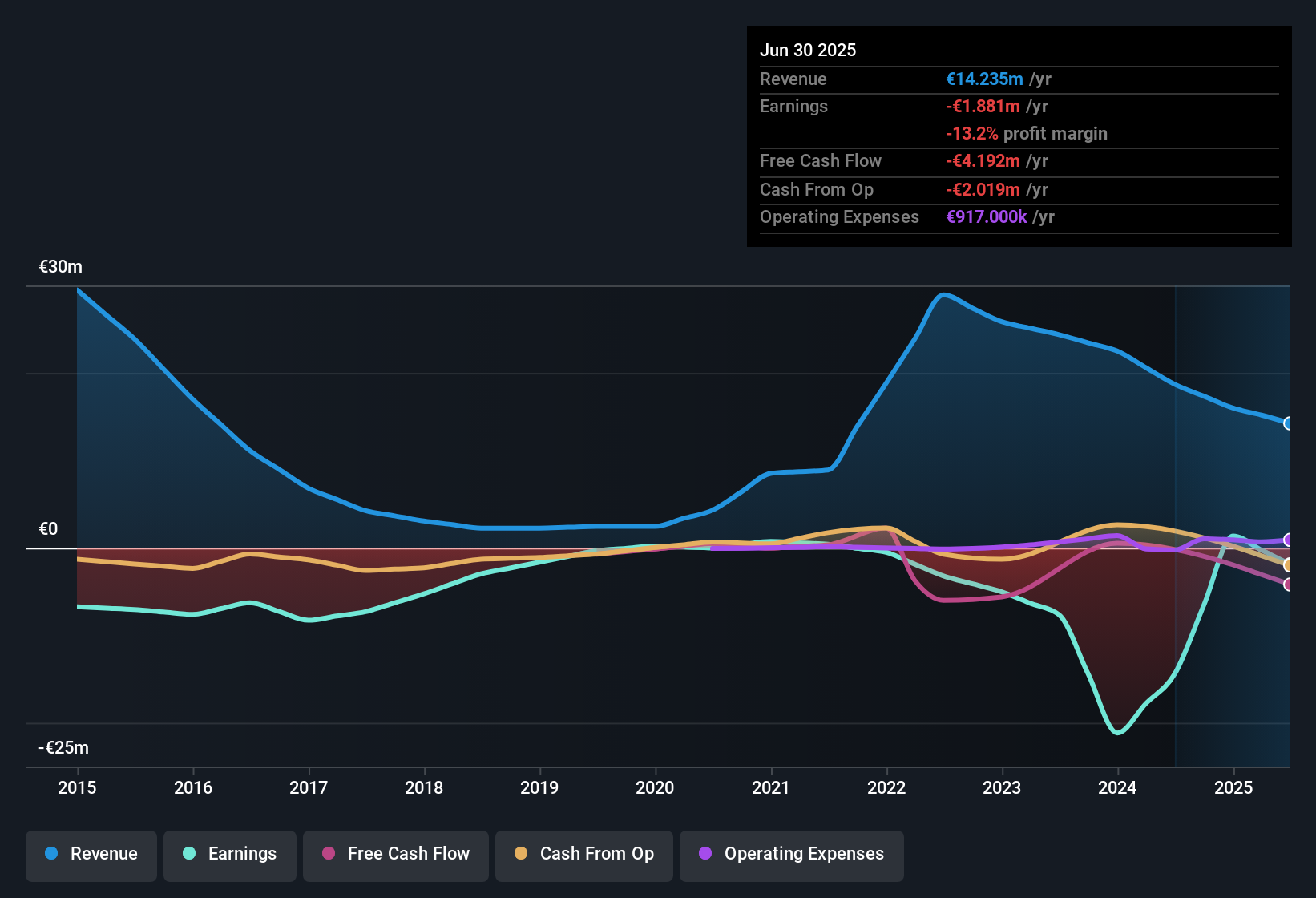

Blockchain Group (ENXTPA:ALCPB) remains unprofitable, posting losses that have deepened at an average annual rate of 37.9% over the past five years. The company’s net profit margin has shown no improvement year over year, and ALCPB stands out as expensive among both its peer group and the French software sector, with a Price-To-Sales Ratio of 15.2x compared to the industry’s 1.6x average. With no signs of profit acceleration and several key risks on the table, margin and profit trends will be in sharp focus for investors this earnings season.

See our full analysis for Blockchain Group.Next, we will see how these results stack up against the prevailing market narratives. Some views may be reinforced, while others may be challenged as we compare the numbers to the community perspective.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Escalate Despite Sector Excitement

- Blockchain Group’s net losses have been worsening at an average annual rate of 37.9% over the last five years, underlining that its negative earnings trend is not a one-off event but rather a persistent challenge.

- The prevailing market view highlights that, while news coverage often positions ALCPB as an active innovator in the blockchain space and recent momentum may have driven renewed attention, mounting losses put extra pressure on the company to translate innovation into tangible financial improvement.

- Bulls often cite the company’s strategic positioning and sector potential, but the widening losses create tension for anyone betting on a turnaround based solely on blockchain enthusiasm.

- Despite optimism around blockchain trends, there is a noticeable gap between market excitement and the actual pace of profit recovery within ALCPB’s core results.

Share Price Volatility and Dilution Add to Caution

- The share price has been unstable over the last three months, and dilution within the past year means shareholders have absorbed both swings in value and declines in their ownership stake.

- Market commentary draws attention to the risk that speculative trading and sector hype make volatility and dilution more acute for blockchain-focused stocks like ALCPB.

- While analysts observe that new investors may be drawn in by industry media coverage, the company’s inability to deliver consistent revenue or earnings growth makes those drawn-out swings riskier than in more stable software companies.

- Ongoing volatility reduces the company’s ability to simply “ride sector tailwinds” without addressing the underlying fundamentals investors expect to see improve.

Valuation Premium Widens Versus Sector

- ALCPB trades at a Price-To-Sales Ratio of 15.2x, which is nearly 10 times the French software sector average of 1.6x and over double its peer group’s 5.5x. This signals that its valuation premium has stretched much further than most sector peers.

- Rather than a simple reflection of growth expectations, the company’s elevated multiples, as noted in wider market analysis, serve as a warning that investors appear to be paying up for potential rather than proven performance.

- The gap between valuation and underlying margins means there is little room for disappointment if financial trends do not rapidly reverse, despite the promise driving the sector’s narrative.

- With no improvement in net profit margin year over year and industry averages diverging further, the stage is set for closer scrutiny from value-oriented investors in the near term.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Blockchain Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Blockchain Group’s widening losses, unstable share price, and stretched valuation indicate persistent struggles with profitability, stability, and realistic market expectations.

If you prefer companies with more sustainable growth and financial discipline, use stable growth stocks screener (2087 results) to spot those consistently outperforming with steady revenues and earnings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blockchain Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALCPB

Blockchain Group

Develops and markets blockchain technologies in France and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives