- France

- /

- Semiconductors

- /

- ENXTPA:ALTRO

The Market Lifts Tronic's Microsystems SA (EPA:ALTRO) Shares 39% But It Can Do More

Tronic's Microsystems SA (EPA:ALTRO) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

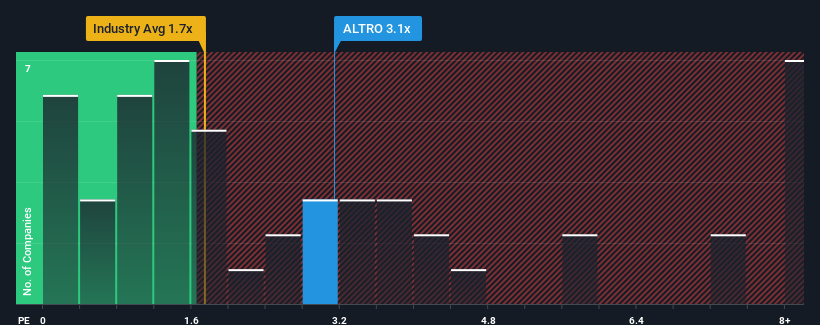

Although its price has surged higher, you could still be forgiven for feeling indifferent about Tronic's Microsystems' P/S ratio of 3.1x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in France is also close to 3.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Tronic's Microsystems

How Has Tronic's Microsystems Performed Recently?

Revenue has risen firmly for Tronic's Microsystems recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Tronic's Microsystems, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Tronic's Microsystems?

The only time you'd be comfortable seeing a P/S like Tronic's Microsystems' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. The latest three year period has also seen an excellent 107% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 2.6%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Tronic's Microsystems is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Tronic's Microsystems' P/S Mean For Investors?

Its shares have lifted substantially and now Tronic's Microsystems' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision Tronic's Microsystems' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 5 warning signs for Tronic's Microsystems (3 are a bit concerning!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tronic's Microsystems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALTRO

Tronic's Microsystems

Manufactures and sells inertial micro-electro-mechanical-system (MEMS) sensor solutions for motion sensing, positioning, and navigation and condition monitoring of assets in France and internationally.

Slight risk with questionable track record.

Market Insights

Community Narratives