- France

- /

- Capital Markets

- /

- ENXTPA:ANTIN

August 2024's Top Euronext Paris Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

As global markets react to economic uncertainties, the French stock market has not been immune, with the CAC 40 Index recently experiencing a notable decline. Amidst this volatility, investors are increasingly on the lookout for undervalued stocks that may offer potential growth opportunities. Identifying stocks estimated below their fair value can be particularly advantageous in such conditions, providing a chance to invest in companies with strong fundamentals at a discount.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SPIE (ENXTPA:SPIE) | €33.50 | €49.67 | 32.5% |

| Tikehau Capital (ENXTPA:TKO) | €22.00 | €34.00 | 35.3% |

| Vivendi (ENXTPA:VIV) | €9.244 | €18.07 | 48.8% |

| MEMSCAP (ENXTPA:MEMS) | €5.88 | €9.50 | 38.1% |

| Safran (ENXTPA:SAF) | €188.80 | €319.04 | 40.8% |

| Guillemot (ENXTPA:GUI) | €5.14 | €8.98 | 42.8% |

| EKINOPS (ENXTPA:EKI) | €3.315 | €5.52 | 39.9% |

| Pullup Entertainment Société anonyme (ENXTPA:ALPUL) | €10.78 | €18.28 | 41% |

| Vogo (ENXTPA:ALVGO) | €3.27 | €6.48 | 49.5% |

| OVH Groupe (ENXTPA:OVH) | €5.365 | €8.74 | 38.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Antin Infrastructure Partners SAS (ENXTPA:ANTIN)

Overview: Antin Infrastructure Partners SAS is a private equity firm that focuses on infrastructure investments and has a market cap of approximately €2.12 billion.

Operations: Antin Infrastructure Partners SAS generates €282.87 million from its Asset Management segment.

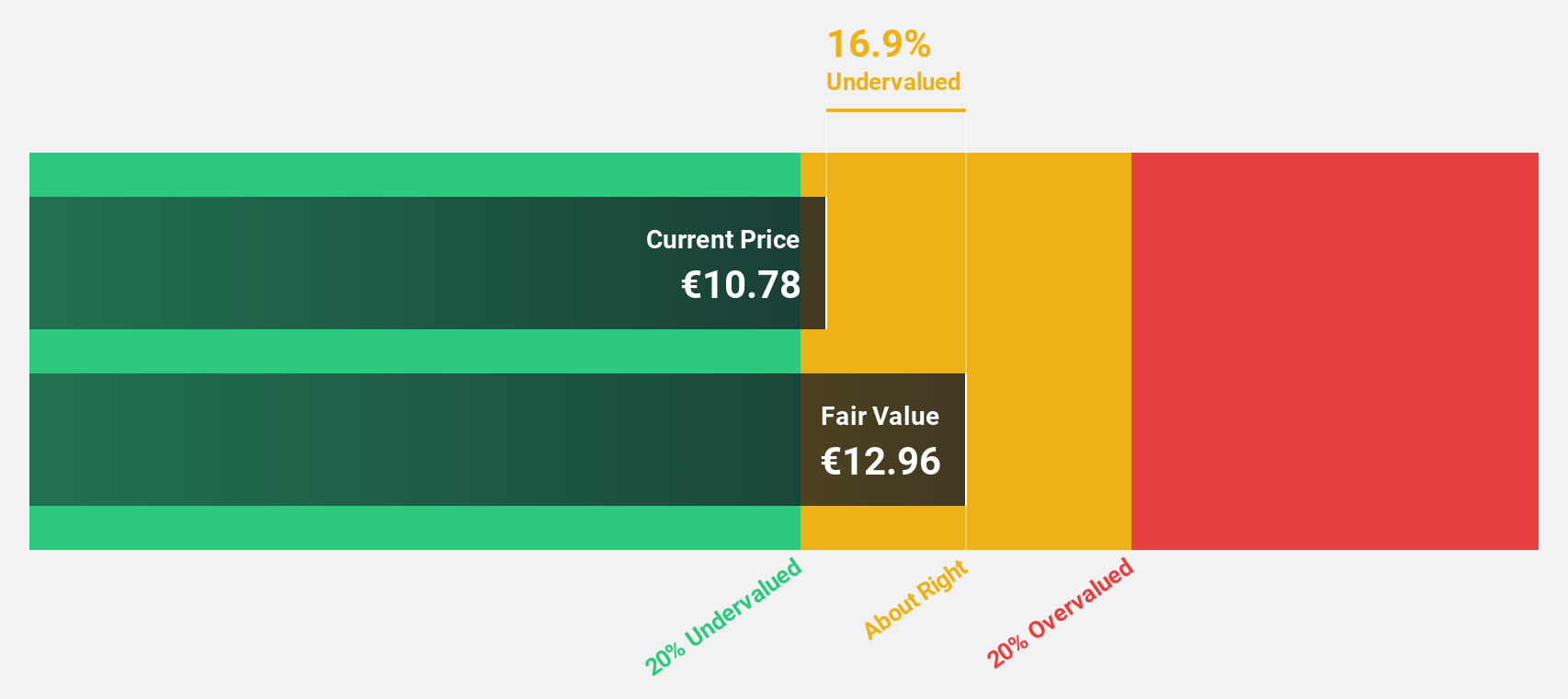

Estimated Discount To Fair Value: 31.9%

Antin Infrastructure Partners SAS is trading at €11.82, significantly below its estimated fair value of €17.36, making it highly undervalued based on discounted cash flows. Despite past shareholder dilution and a dividend yield of 5.41% not well covered by earnings or free cash flows, the company has become profitable this year and forecasts suggest annual earnings growth of 25.23%, outpacing the French market's 12.2%. Recent dividend increases further highlight its potential for value investors.

- Our comprehensive growth report raises the possibility that Antin Infrastructure Partners SAS is poised for substantial financial growth.

- Dive into the specifics of Antin Infrastructure Partners SAS here with our thorough financial health report.

Aramis Group SAS (ENXTPA:ARAMI)

Overview: Aramis Group SAS operates in the online sale of used vehicles across France, Belgium, the United Kingdom, Austria, Italy, and Spain with a market cap of €372.07 million.

Operations: The company's revenue segments include B2B (€175.70 million), Services (€109.33 million), Refurbished Cars (€1.44 billion), and Pre-Registered Cars (€375.16 million).

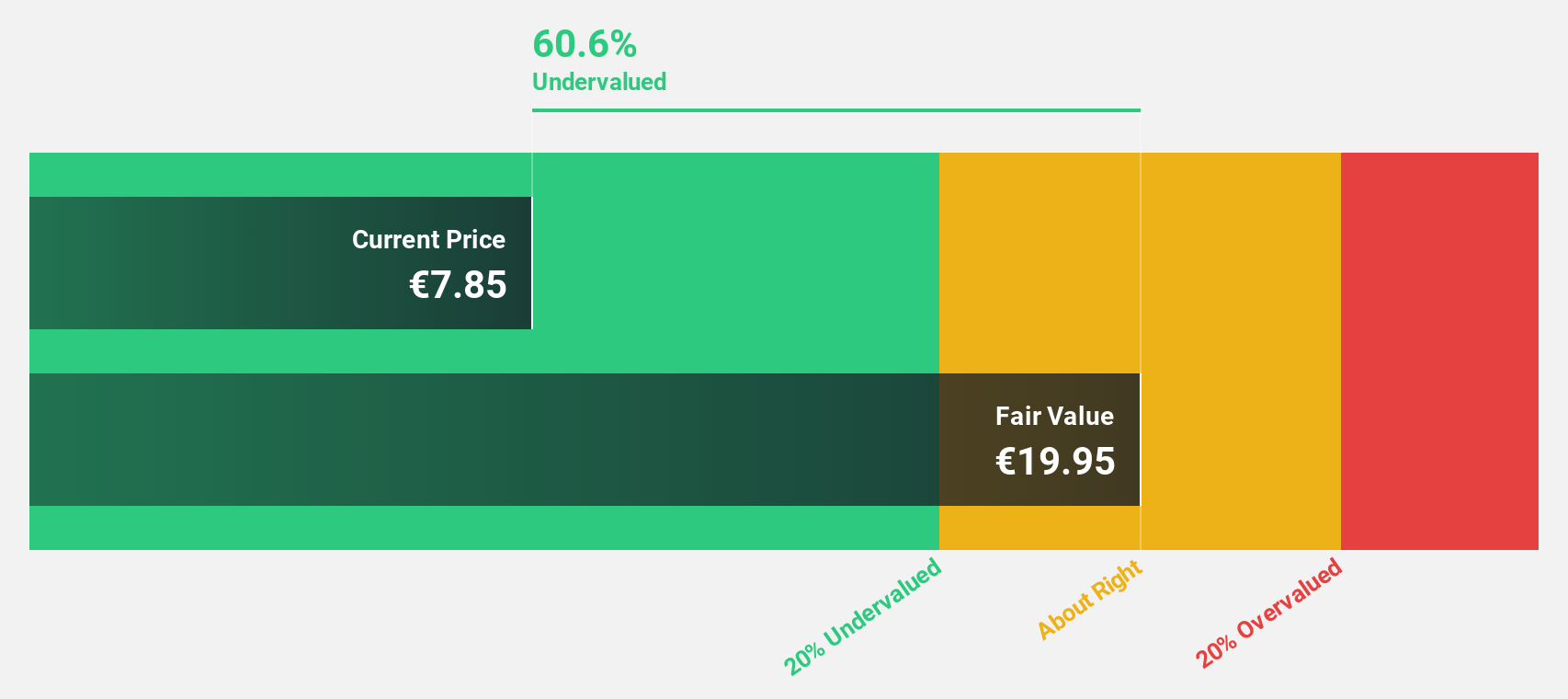

Estimated Discount To Fair Value: 22.1%

Aramis Group SAS is trading at €4.5, 22.1% below its estimated fair value of €5.78, making it highly undervalued based on discounted cash flows. With revenue forecasted to grow 10.2% annually, faster than the French market's 5.9%, and earnings expected to increase by 117.91% per year, the company shows strong potential for future profitability despite a current net loss of €13.34 million for H1 2024 compared to €12.58 million last year.

- The analysis detailed in our Aramis Group SAS growth report hints at robust future financial performance.

- Navigate through the intricacies of Aramis Group SAS with our comprehensive financial health report here.

OVH Groupe (ENXTPA:OVH)

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market cap of €1.02 billion.

Operations: The company's revenue segments include Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud & Other (€185.43 million).

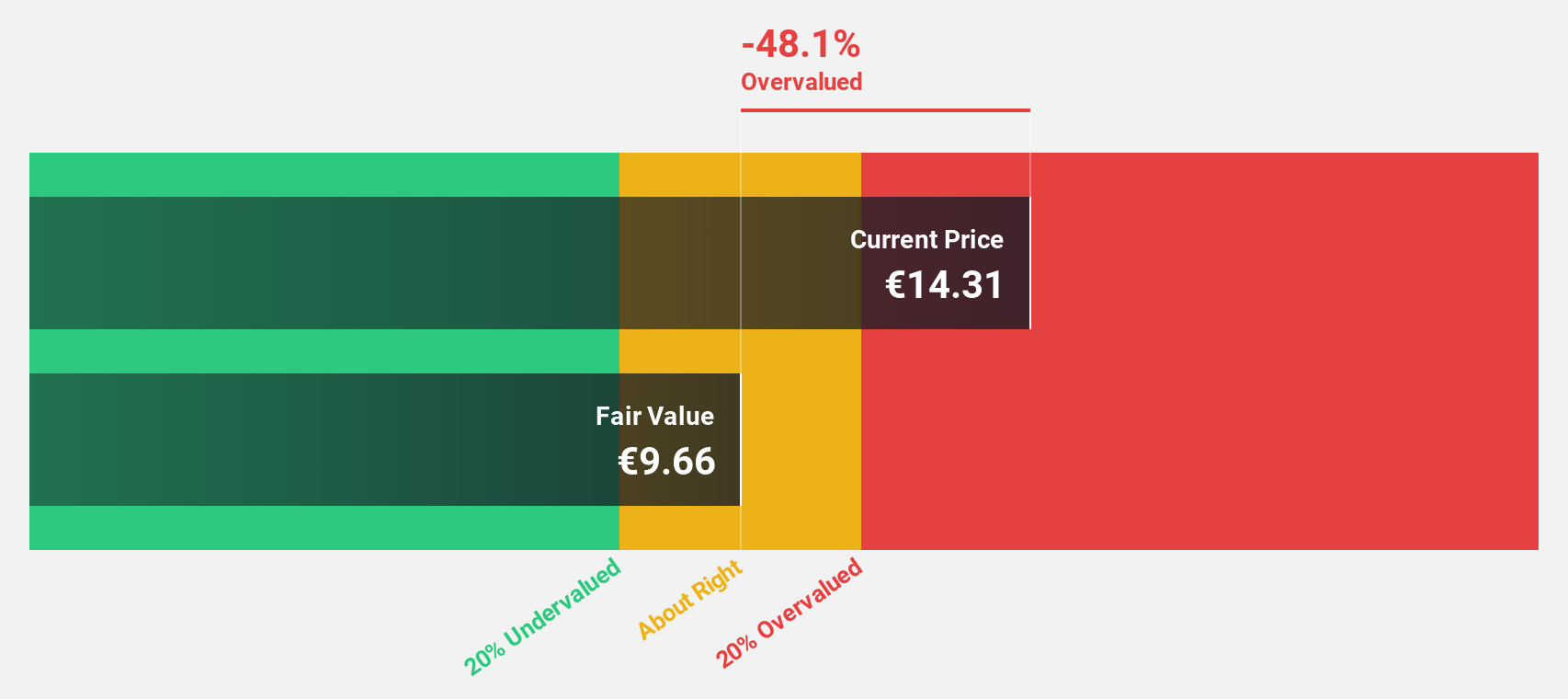

Estimated Discount To Fair Value: 38.6%

OVH Groupe (€5.37) is trading at 38.6% below its estimated fair value of €8.74, indicating it may be undervalued based on discounted cash flows. The company is expected to become profitable in the next three years, with earnings forecasted to grow significantly at 101.12% per year and revenue projected to increase by 10% annually, outpacing the French market's growth rate of 5.9%. Recent product innovations like the ADV-Gen3 Bare Metal servers highlight OVHcloud's commitment to performance and sustainability, potentially enhancing future cash flows despite a currently low return on equity forecast (1.7%).

- Upon reviewing our latest growth report, OVH Groupe's projected financial performance appears quite optimistic.

- Take a closer look at OVH Groupe's balance sheet health here in our report.

Taking Advantage

- Access the full spectrum of 17 Undervalued Euronext Paris Stocks Based On Cash Flows by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ANTIN

Antin Infrastructure Partners SAS

A private equity firm specializing in infrastructure investments.

Outstanding track record with flawless balance sheet.