- France

- /

- Specialty Stores

- /

- ENXTPA:ALBOU

Bourrelier Group (ENXTPA:ALBOU) Five-Year Net Loss Reduction Challenges Persistent Profitability Concerns

Reviewed by Simply Wall St

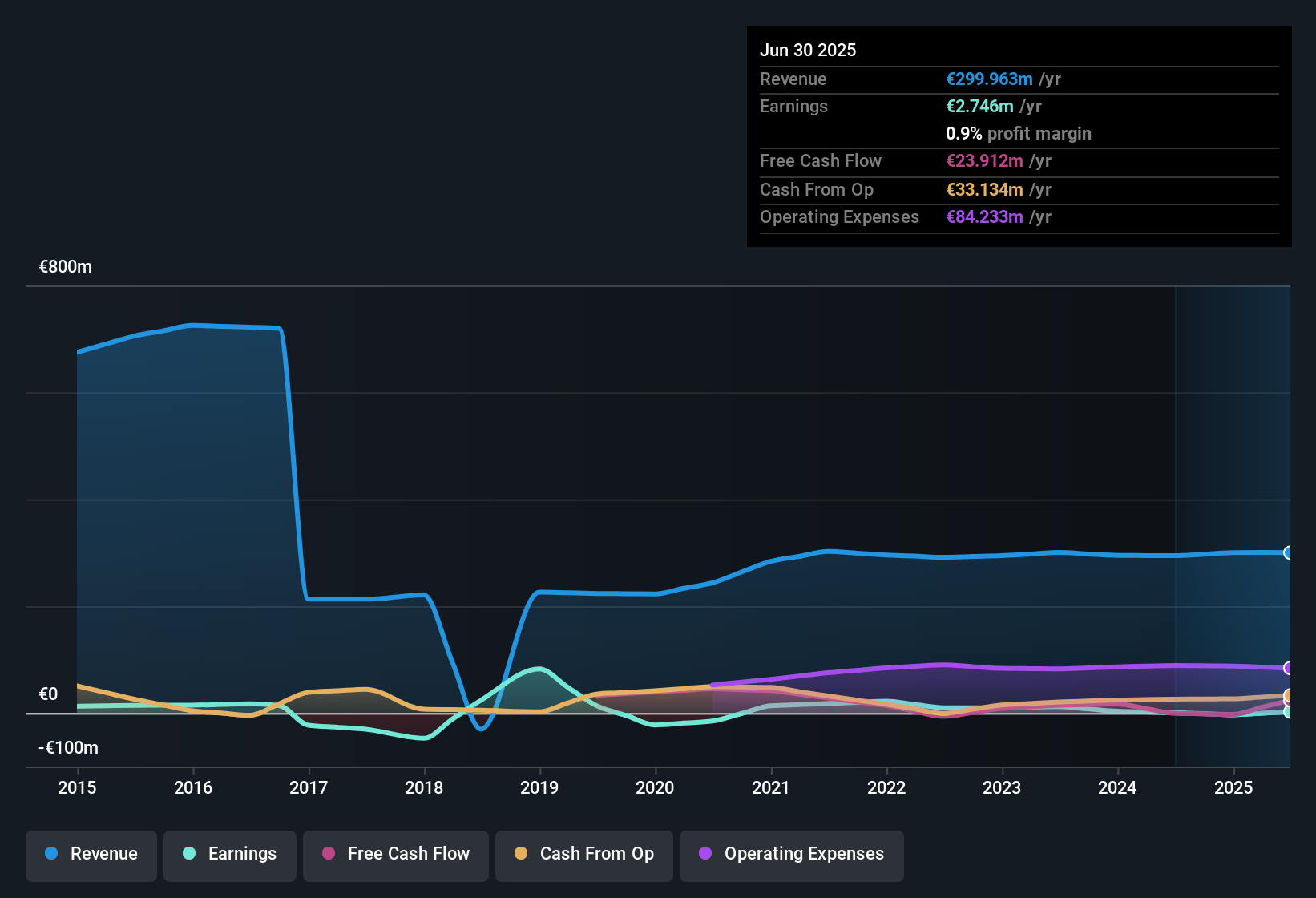

Bourrelier Group (ENXTPA:ALBOU) remains unprofitable, but the company managed to reduce its losses by 14.7% per year over the last five years. Despite the steady decline in losses, net profit margins are still negative and the quality of earnings continues to be affected by the ongoing lack of profitability. On the valuation front, shares now trade at a Price-to-Sales ratio of 0.9x. This stands above both the European Specialty Retail industry average of 0.4x and the peer group’s 0.2x. The current share price of €42.4 also trades at a premium to an estimated fair value of €36.66. Over the past three months, both dividend sustainability and share price stability have missed positive thresholds, highlighting some near-term risks for investors. In this context, investor sentiment is likely to remain cautious as operational improvement is offset by persistent unprofitability and relatively high valuation.

See our full analysis for Bourrelier Group.Now it’s time to see how these results hold up against the dominant market narratives, and where the numbers might challenge the consensus view.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Loss Reduction Outpaces Peers

- Bourrelier Group’s net losses have fallen by 14.7% per year over five consecutive years, a rate of improvement that stands out in a sector where many competitors remain stagnant or see slower progress.

- The prevailing market view highlights that while operational improvement is encouraging, ongoing net profit margins remain negative, and the quality of earnings is not yet robust enough to shift sentiment decisively.

- Investors following recent trends may note that despite the steady pace of loss reduction, Bourrelier’s inability to reach consistent profitability limits the case for a broad turnaround.

- This scenario creates tension for investors looking for both momentum and proven bottom-line results simultaneously in cyclical retail names.

Dividend and Price Stability Miss Benchmarks

- Neither the company’s dividend sustainability nor share price stability over the past three months has met its positive thresholds, raising questions about both income reliability and near-term volatility.

- The prevailing market view calls out that these additional risks reinforce caution among some investors, even as operational metrics look brighter in isolation.

- Given the absence of fresh reward signals and the disappointment on two fronts (dividends and price swings), cautious buyers may seek reassurance from future disclosures before reshaping their view.

- This supports the idea that, even with underlying business progress, short-term risks could continue to weigh on demand for the shares.

Premium Valuation vs DCF and Peers

- The share price of €42.4 sits substantially above the DCF fair value of €36.66, and the company’s 0.9x Price-to-Sales ratio exceeds the industry average (0.4x) and direct peer group (0.2x), signaling a notable premium.

- Despite the ongoing reduction in losses, the prevailing market view acknowledges that such valuation premiums are difficult to justify without a clear pivot to profitability or sector-leading growth.

- With Bourrelier’s financials not yet achieving positive net margins, the gap to fair value and premium against peers could make value investors question whether the price already factors in future improvements.

- Market watchers looking for an upside catalyst might point to premium pricing as a sign that expectations are already high and upside could be limited unless something material changes operationally.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bourrelier Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Bourrelier Group faces persistent unprofitability and trades at a valuation premium. The company also falls short on both dividend reliability and share price stability.

If valuation risks and missed benchmarks make you hesitant, consider these 832 undervalued stocks based on cash flows to uncover companies where strong fundamentals and a better price tag align right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bourrelier Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALBOU

Bourrelier Group

Operates do-it-yourself (DIY) stores in France, Belgium, and the Netherlands.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives