- France

- /

- Industrial REITs

- /

- ENXTPA:ARG

Could Argan’s New Green Logistics Hub Reveal Its Strategy for Sustainable Growth? (ENXTPA:ARG)

Reviewed by Sasha Jovanovic

- Argan has announced the completion of a 9,000 sq.m logistics facility in Vendin-le-Vieil, France, designed to support fulfillment and urban distribution activities for a leading international transport and logistics group under a firm 12-year lease.

- This state-of-the-art platform features extensive cross-dock space and an on-site solar power plant, highlighting Argan’s focus on both operational efficiency and sustainable development.

- We’ll explore how the long-term lease agreement and green energy features shape Argan’s investment narrative going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Argan's Investment Narrative?

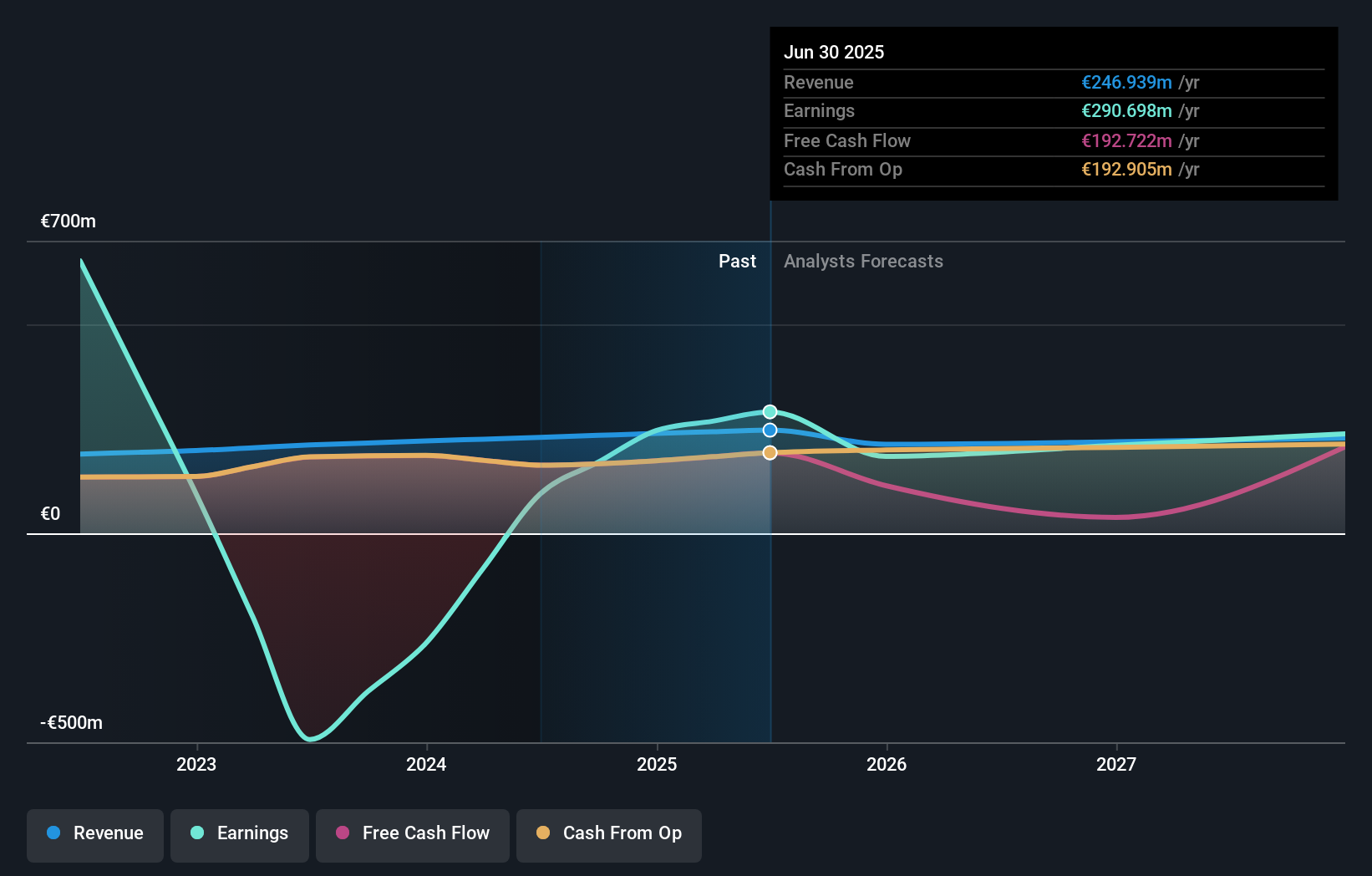

To see Argan as a business worth holding, I find you need confidence in its ability to secure and maintain long-term leases with reputable tenants, deliver ongoing sustainability upgrades, and protect rental income in a flat-to-declining revenue environment. The completion of the Vendin-le-Vieil facility, with a firm 12-year lease for a well-established logistics client, certainly adds visibility and stability to near-term cash flows, a point that could offset some short-term worries about sluggish growth expectations. Yet, while this news underscores Argan’s strengths in tenant retention and green asset development, it doesn’t fundamentally alter the broader catalysts or risks at play. The company’s revenue and earnings are both forecast to decline, and its debt coverage remains a concern, so the new project alone likely won’t shift the bigger picture for now. But with another high-quality lease added, income streams continue to look robust. On the flipside, questions remain about whether long-term earnings decline can be reversed.

Argan's shares have been on the rise but are still potentially undervalued by 20%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Argan - why the stock might be worth just €80.33!

Build Your Own Argan Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Argan research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Argan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Argan's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ARG

Argan

ARGAN is the only French real estate company specializing in the DEVELOPMENT & RENTAL OF PREMIUM WAREHOUSES listed on EURONEXT and is the leading player of its market in France.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives