Nexity SA (EPA:NXI) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 12%.

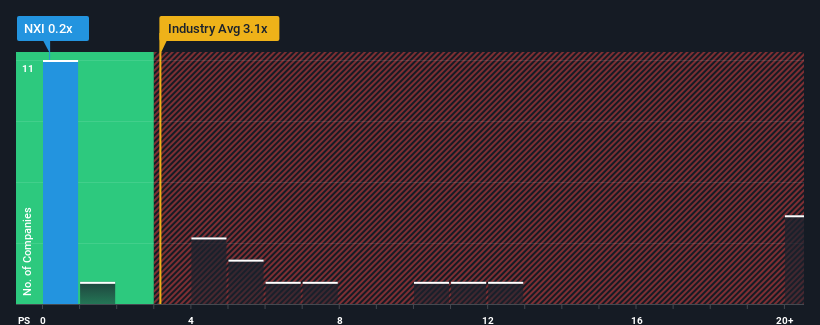

Since its price has dipped substantially, Nexity may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Real Estate industry in France have P/S ratios greater than 3.1x and even P/S higher than 8x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Nexity

How Has Nexity Performed Recently?

Nexity hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Nexity will help you uncover what's on the horizon.How Is Nexity's Revenue Growth Trending?

Nexity's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. The last three years don't look nice either as the company has shrunk revenue by 25% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company are not great, suggesting revenue should decline by 2.6% over the next year. Meanwhile, the industry is forecast to moderate by 8.1%, which indicates the company should perform better regardless.

With this in mind, we find it curious but not unexplainable that Nexity's P/S falls short of its industry peers. Even though the company may outperform the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares excessively.

What Does Nexity's P/S Mean For Investors?

Having almost fallen off a cliff, Nexity's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Nexity currently trades on a much lower than expected P/S since its revenue forecast is not as bad as the struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the more attractive outlook. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, given the low P/S, risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

You always need to take note of risks, for example - Nexity has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Nexity's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nexity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:NXI

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives