- France

- /

- Real Estate

- /

- ENXTPA:EEM

European Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the European market faces mixed signals with the pan-European STOXX Europe 600 Index slightly declining, investor attention remains on interest rate decisions and inflation trends. Despite these broader market fluctuations, penny stocks continue to intrigue investors due to their potential for growth and value. These smaller or newer companies, often overlooked in favor of larger names, can offer unique opportunities when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.706 | €1.28B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €2.00 | €27.64M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 2 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.50 | SEK212.94M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.955 | €77.06M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €3.86 | €75.51M | ✅ 1 ⚠️ 5 View Analysis > |

| Faes Farma (BME:FAE) | €4.385 | €1.36B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.03 | €280.59M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 281 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Ariston Holding (BIT:ARIS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ariston Holding N.V. operates through its subsidiaries to produce and distribute hot water and space heating solutions across the Netherlands, Germany, Italy, Switzerland, and internationally, with a market cap of €1.28 billion.

Operations: Ariston Holding generates revenue primarily from its Thermal Comfort segment (€2.48 billion), followed by Burners (€89.2 million) and Components (€83.3 million).

Market Cap: €1.28B

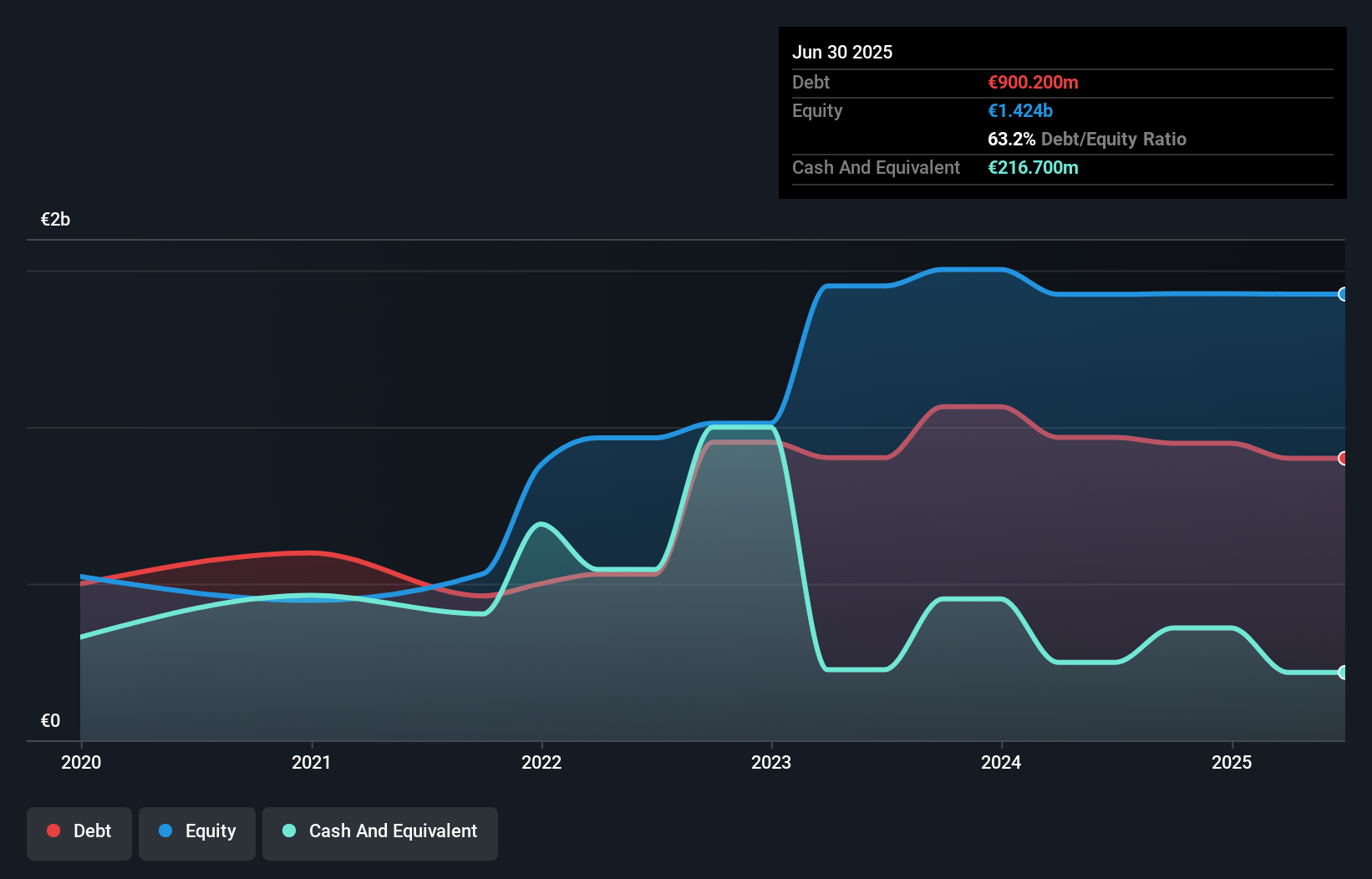

Ariston Holding exhibits strong earnings growth, with a 61.4% increase over the past year, outpacing both its historical performance and the broader building industry. The company maintains high-quality earnings and has improved profit margins from 2% to 3.5%. Despite a high net debt to equity ratio of 48%, its debt is well covered by operating cash flow at 35.5%. The stock trades at a favorable price-to-earnings ratio of 13.8x compared to the Italian market average, indicating potential value for investors. Analysts expect continued growth with consensus forecasts predicting a 17.39% annual increase in earnings.

- Get an in-depth perspective on Ariston Holding's performance by reading our balance sheet health report here.

- Evaluate Ariston Holding's prospects by accessing our earnings growth report.

Electricité et Eaux de Madagascar Société Anonyme (ENXTPA:EEM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Electricité et Eaux de Madagascar Société Anonyme operates in the real estate sector with a market capitalization of €17.79 million.

Operations: Electricité et Eaux de Madagascar Société Anonyme's revenue segments amount to €0.41 million.

Market Cap: €17.79M

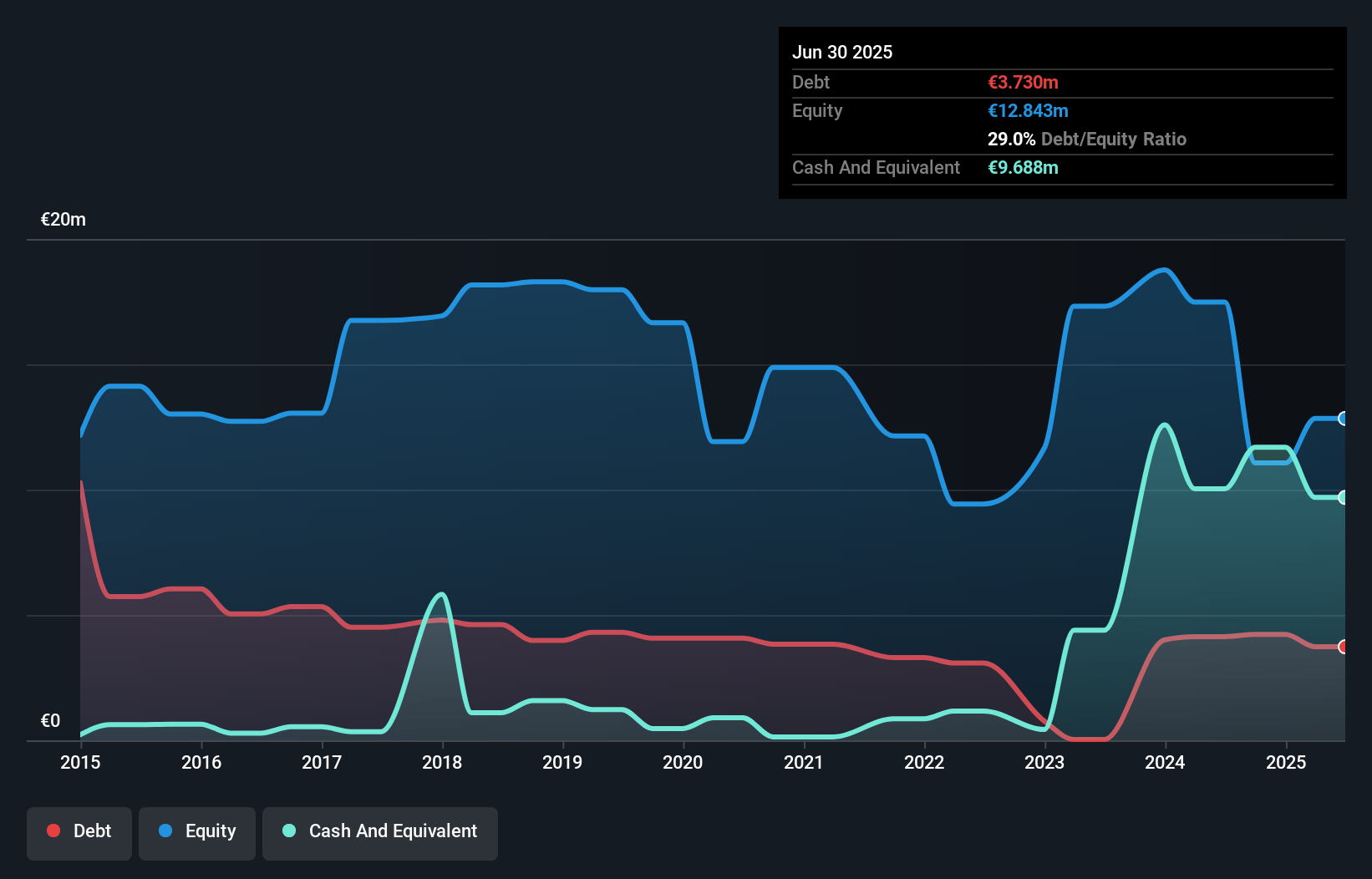

Electricité et Eaux de Madagascar Société Anonyme, operating with a market capitalization of €17.79 million, is pre-revenue with sales of €0.41 million. Despite being unprofitable, the company reported a positive net income of €1.4 million for the half year ended June 2025, showing improvement from a previous loss. It has more cash than total debt and short-term assets (€11.5M) exceed both short-term (€5M) and long-term liabilities (€1.8M). The company's share price remains highly volatile but it has not experienced significant shareholder dilution recently, offering some stability in its financial structure amidst challenges.

- Dive into the specifics of Electricité et Eaux de Madagascar Société Anonyme here with our thorough balance sheet health report.

- Gain insights into Electricité et Eaux de Madagascar Société Anonyme's past trends and performance with our report on the company's historical track record.

Investors House Oyj (HLSE:INVEST)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Investors House Oyj is a real estate investment company operating in Finland and Estonia with a market cap of €26.12 million.

Operations: The company's revenue is primarily derived from its Real Estate segment, generating €7.49 million, and its Services segment, contributing €2.61 million.

Market Cap: €26.12M

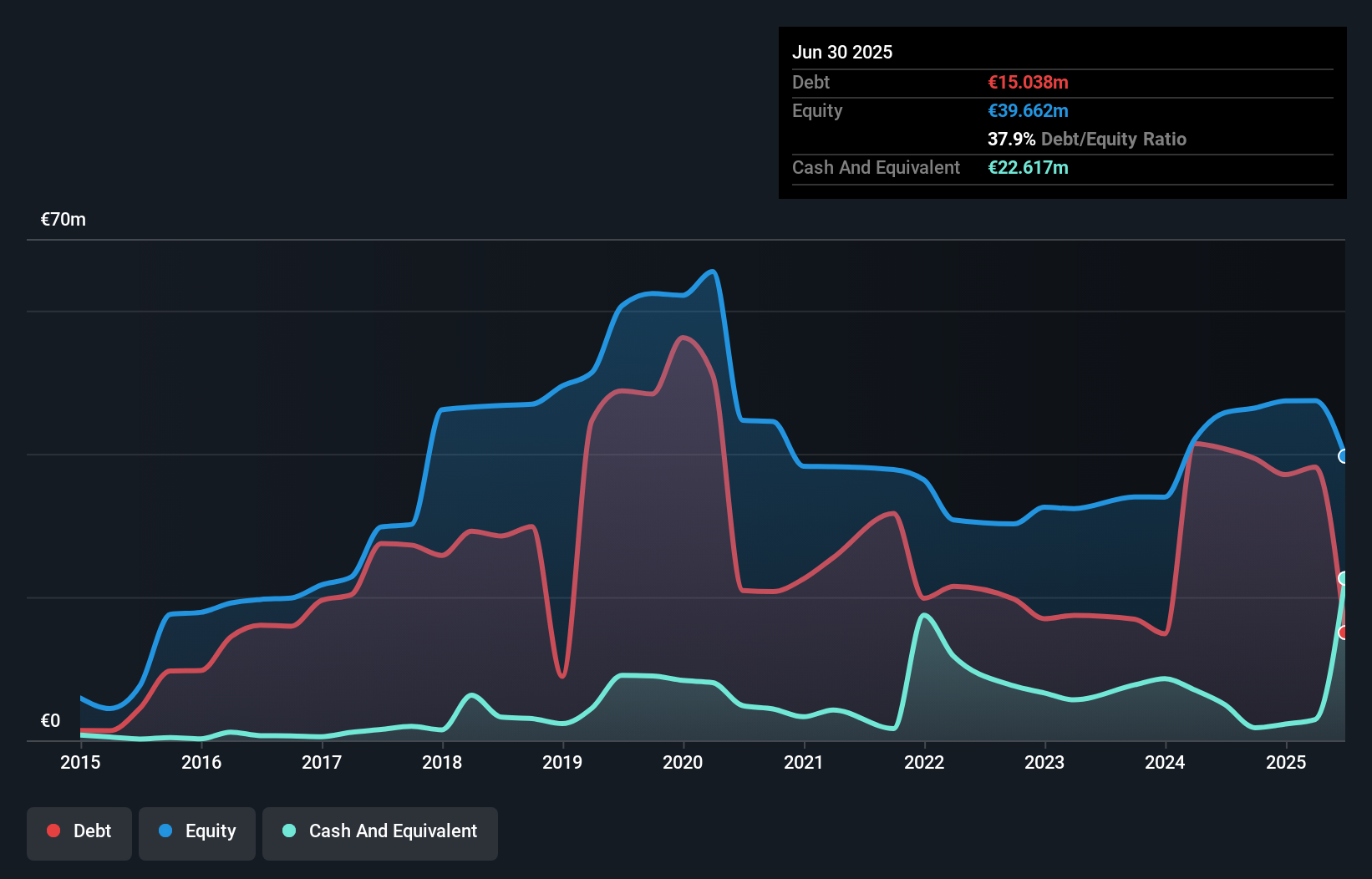

Investors House Oyj, with a market cap of €26.12 million, operates in Finland and Estonia's real estate sector, generating revenue primarily from its Real Estate (€7.49 million) and Services (€2.61 million) segments. Despite a decline in net income to €3.36 million for Q2 2025 from €5.62 million the previous year, the company maintains strong financials with short-term assets exceeding liabilities and more cash than debt. However, earnings growth has been negative recently, compounded by significant one-off gains impacting results and forecasted declines in future earnings pose challenges amidst high share price volatility.

- Click here to discover the nuances of Investors House Oyj with our detailed analytical financial health report.

- Understand Investors House Oyj's earnings outlook by examining our growth report.

Taking Advantage

- Discover the full array of 281 European Penny Stocks right here.

- Curious About Other Options? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electricité et Eaux de Madagascar Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EEM

Electricité et Eaux de Madagascar Société Anonyme

Engages in the real estate business.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives