Ipsen (ENXTPA:IPN): Exploring Valuation Following Recent Share Price Strength

Reviewed by Simply Wall St

See our latest analysis for Ipsen.

Beyond this recent uptick, Ipsen’s momentum has been building over the past year, with a 17.1% share price return in the last three months and a 13.8% total shareholder return over twelve months. The stock’s performance suggests investors are warming to its growth prospects, particularly as recent gains outpace the broader pharmaceuticals sector.

If Ipsen’s run has sparked your curiosity, consider expanding your search and discover See the full list for free.

The big question for investors now is whether Ipsen’s rise reflects its underlying potential or if optimism has pushed prices to the limit, leaving little room for upside. Is there still a real buying opportunity here, or is the market already factoring in future growth?

Most Popular Narrative: 5.3% Undervalued

Based on the most widely followed narrative, Ipsen's estimated fair value is €130.79, modestly above its last close of €123.80, suggesting some headroom remains. This perspective leans on recent operational momentum and a strong medium-term outlook. Let's look at one key business driver highlighted in this view.

Strong initial launches and accelerating adoption of new specialty drugs like Iqirvo and Bylvay in rare liver diseases, especially as major reimbursement and regulatory approvals expand access in the US and Europe, with upcoming launches in additional large European countries, directly support revenue growth and geographic diversification.

Want to discover what’s powering Ipsen’s valuation beyond market hype? The narrative hinges on blockbuster product launches, higher margins, and something that could transform its profit outlook. Find out what these bold assumptions reveal about Ipsen’s future returns.

Result: Fair Value of €130.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased generic competition for Somatuline and setbacks in key drug launches could quickly erode Ipsen’s revenue momentum and shift market sentiment.

Find out about the key risks to this Ipsen narrative.

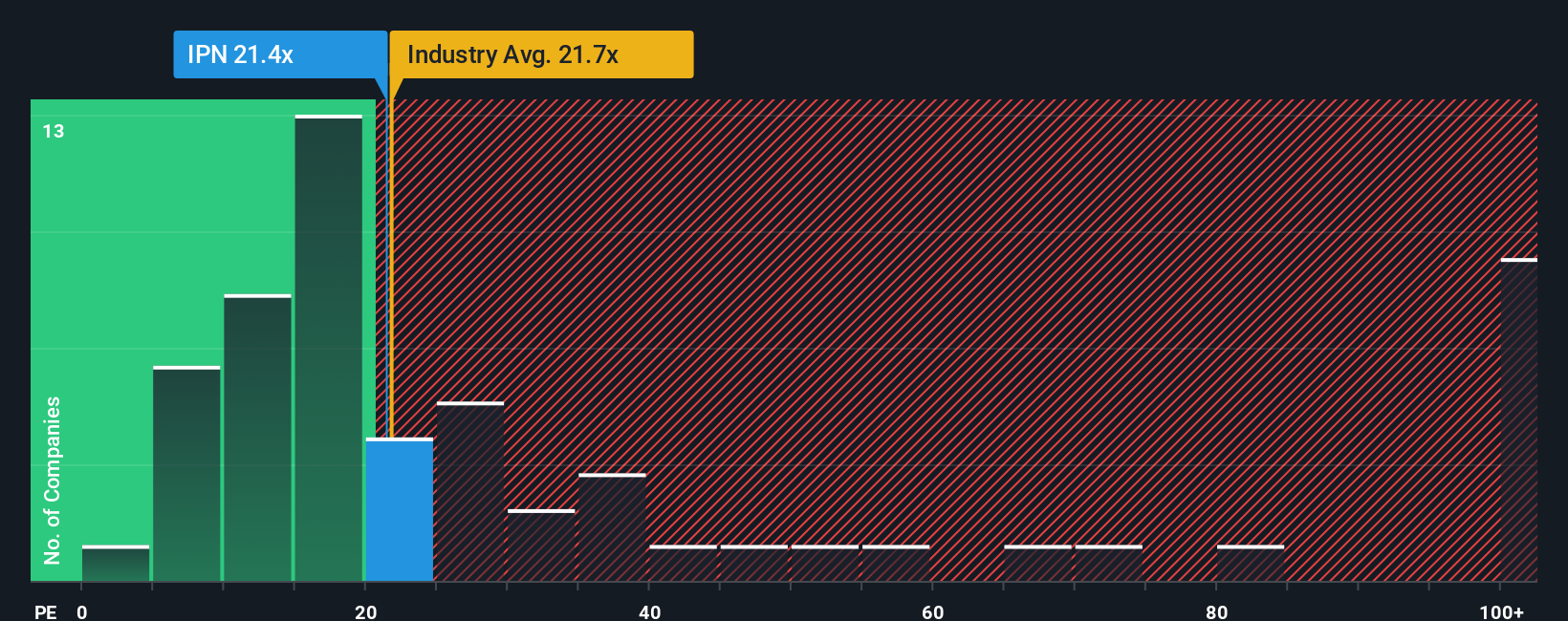

Another View: Multiples Tell a Different Story

Looking at Ipsen's valuation through the lens of the current price-to-earnings ratio gives a less optimistic signal. Ipsen trades at 22.7x earnings, which is higher than both the European pharmaceuticals average of 22.2x and the peer group average of 19.1x. This makes the stock look expensive by these measures. The fair ratio for Ipsen is estimated at 16.5x, showing a wide gap that suggests more risk is priced in than opportunity. Could this premium be justified by future growth, or will the market eventually correct?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ipsen Narrative

Keep in mind, if this perspective does not align with yours or you want to dive deeper into the numbers yourself, you can craft your own Ipsen story, usually in under three minutes. Do it your way

A great starting point for your Ipsen research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Pick your next opportunity by targeting sectors on the move. The right moves today could set your portfolio apart tomorrow, so don't wait to get started.

- Capitalize on high-potential companies with strong fundamentals by checking out these 874 undervalued stocks based on cash flows that may be poised for a breakout.

- Tap into the future with AI innovation by exploring these 25 AI penny stocks driving game-changing breakthroughs in automation and data.

- Boost your passive income potential through these 16 dividend stocks with yields > 3% offering yields above 3% for reliable and consistent cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IPN

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives