If You Had Bought Innate Pharma's (EPA:IPH) Shares Five Years Ago You Would Be Down 67%

Over the last month the Innate Pharma S.A. (EPA:IPH) has been much stronger than before, rebounding by 47%. But that is little comfort to those holding over the last half decade, sitting on a big loss. Indeed, the share price is down 67% in the period. So is the recent increase sufficient to restore confidence in the stock? Not yet. We'd err towards caution given the long term under-performance.

Check out our latest analysis for Innate Pharma

Innate Pharma isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Innate Pharma saw its revenue increase by 25% per year. That's well above most other pre-profit companies. Unfortunately for shareholders the share price has dropped 11% per year - disappointing considering the growth. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. If you think the company can keep up its revenue growth, you'd have to consider the possibility that there's an opportunity here.

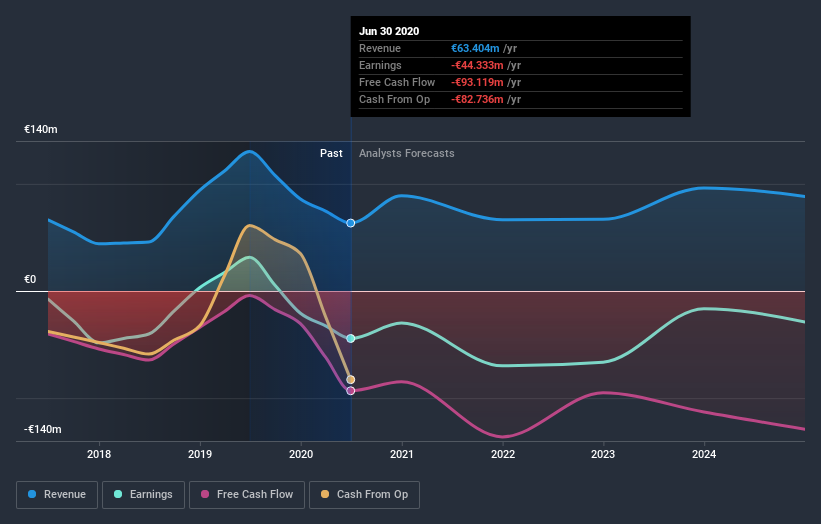

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Innate Pharma stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 0.2% in the last year, Innate Pharma shareholders lost 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Innate Pharma , and understanding them should be part of your investment process.

Of course Innate Pharma may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you’re looking to trade Innate Pharma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:IPH

Innate Pharma

A biotechnology company, develops immunotherapies for cancer patients in France and internationally.

Adequate balance sheet and slightly overvalued.