- France

- /

- Life Sciences

- /

- ENXTPA:ERF

Assessing Eurofins Scientific After New Tech Expansion and a 5% Share Price Pullback

Reviewed by Bailey Pemberton

- If you have ever wondered whether Eurofins Scientific is a good buy right now, you are not alone. Questions of value have been swirling as more investors focus on the stock's potential.

- After climbing 32.0% over the past year (and up 21.1% so far this year), the share price has pulled back by 5.0% in the last month. This shift hints at changing dynamics between growth optimism and risk.

- Recent headlines have highlighted Eurofins’ expansion into new diagnostic technologies and strategic acquisitions, underscoring their ongoing efforts to diversify revenue streams. There is growing attention on how these initiatives could shape both near-term momentum and the long-term outlook for the company.

- The company's valuation score currently stands at 4 out of 6, reflecting strengths in several key checks but also areas that may warrant a closer look. We will break down the standard valuation methods, and there is a more insightful approach to valuation featured at the end of this article.

Approach 1: Eurofins Scientific Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. This approach focuses on evaluating likely cash generation and what that means for a fair share price.

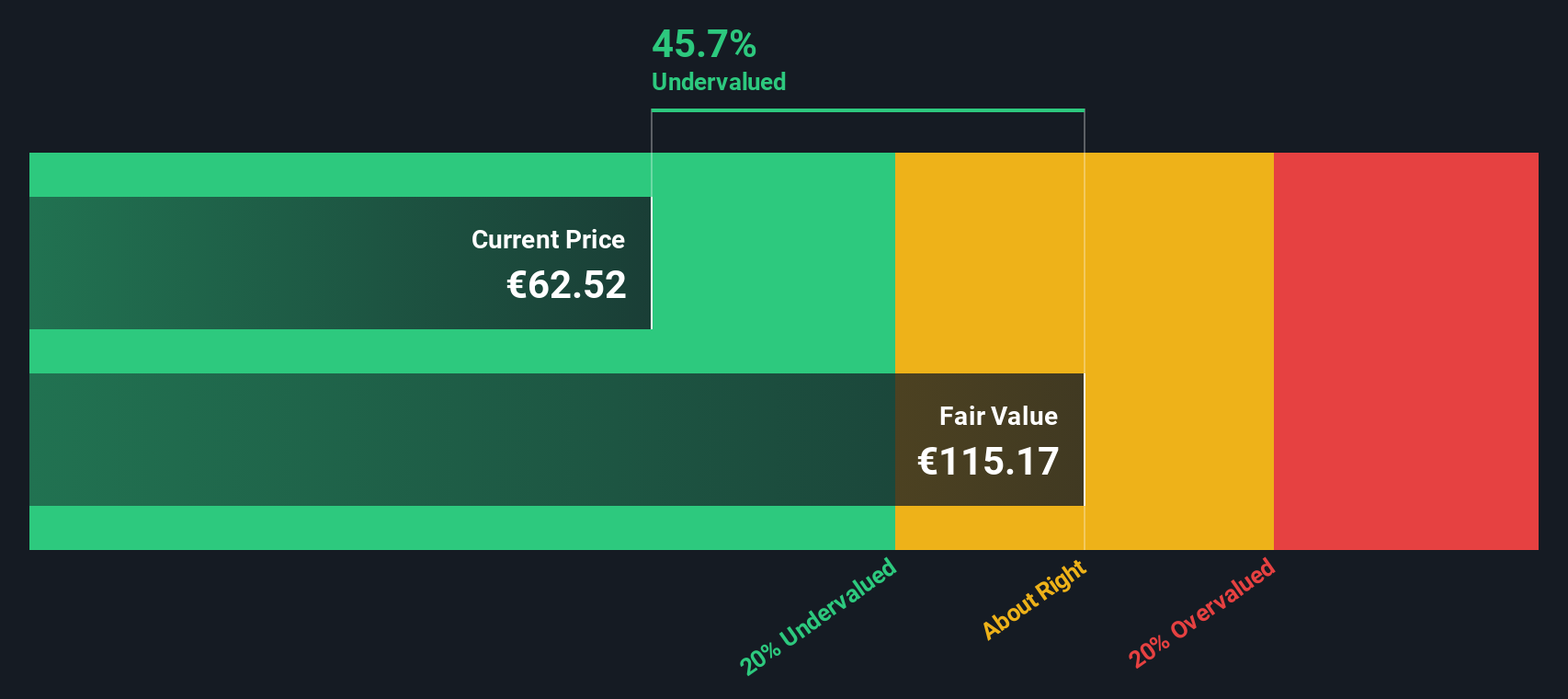

For Eurofins Scientific, the model starts with a Last Twelve Months (LTM) Free Cash Flow of €717.5 million. According to analyst expectations and calculated forecasts, free cash flow is projected to steadily increase, reaching approximately €946.5 million by 2035. It is important to note that analyst estimates only extend five years forward, while subsequent figures are extrapolated based on existing trends and assumptions.

Using this two-stage cash flow method, the estimated intrinsic value for Eurofins Scientific shares is €92.06 each. This means the stock is trading at a 35.8% discount to its fair value, suggesting it is currently undervalued based on future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eurofins Scientific is undervalued by 35.8%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: Eurofins Scientific Price vs Earnings (P/E)

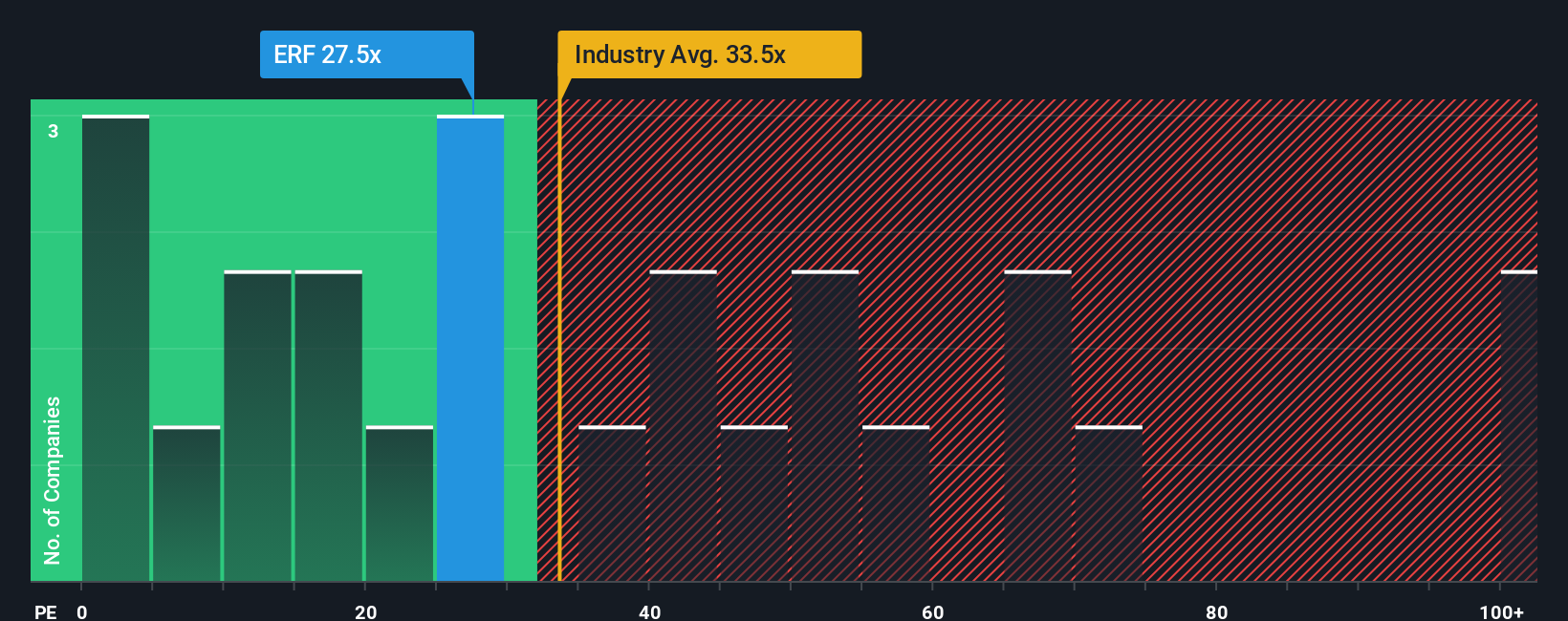

The Price-to-Earnings (P/E) ratio is a favored valuation tool for profitable companies because it directly links share price to underlying earnings, offering a straightforward gauge of how much investors are willing to pay for a euro of profit. It is especially useful when assessing mature companies like Eurofins Scientific, where consistent profitability makes earnings a reliable benchmark.

It is important to note that what counts as a “normal” or “fair” P/E ratio varies between companies and industries. Higher growth expectations typically justify a higher P/E, while greater risk can pull it lower. Comparing a stock’s P/E to its industry average or to key peers gives a quick sense of sentiment, but it does not always capture company-specific nuances.

Currently, Eurofins Scientific trades at a P/E of 27.5x. This is below both its peer group average of 32.3x and the broader Life Sciences industry average of 37.0x. However, Simply Wall St’s proprietary “Fair Ratio” puts a more precise lens on valuation. The Fair Ratio for Eurofins Scientific is 19.1x, calculated based on factors like its earnings growth outlook, profit margins, market cap, and risk profile.

Unlike traditional comparisons, the Fair Ratio goes deeper than basic averages. By considering company-specific growth potentials and risks, it offers a tailored benchmark for what Eurofins’ P/E should be in current market conditions. This makes it a more objective and nuanced guide for investors than generic market comparisons.

With Eurofins Scientific’s actual P/E of 27.5x sitting notably above its Fair Ratio of 19.1x, the indication is that the stock appears overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eurofins Scientific Narrative

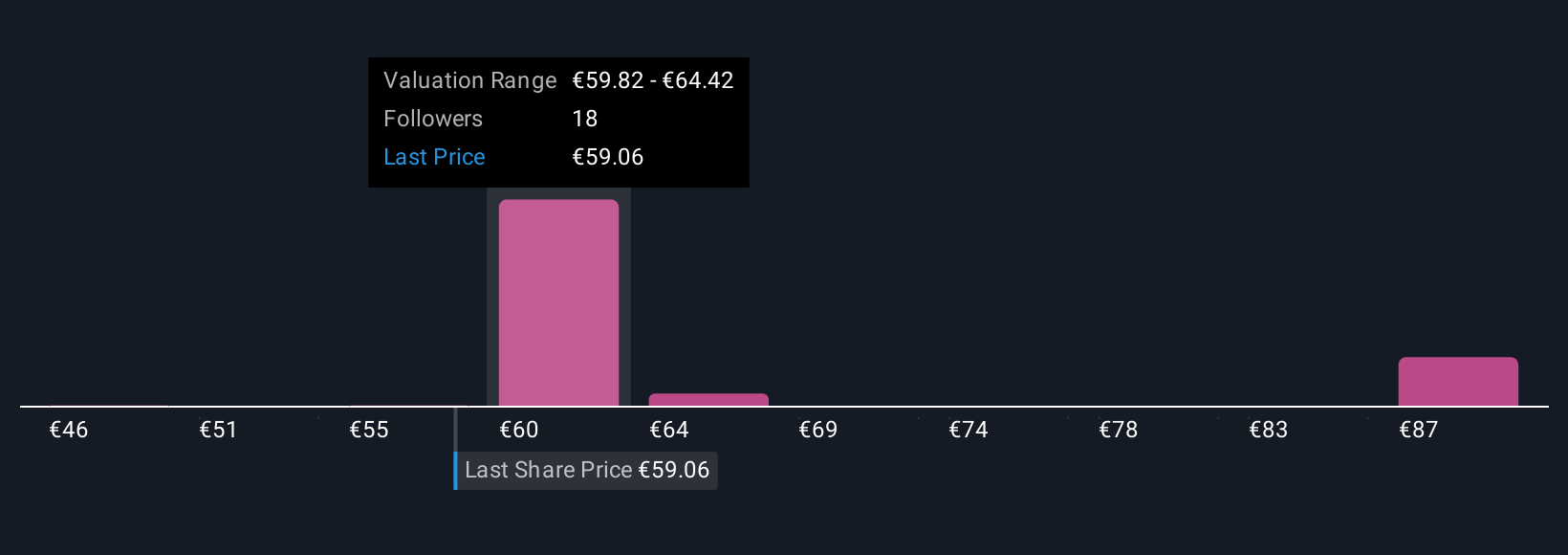

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your opportunity to tell the story you believe about a company, putting your assumptions and outlook behind the numbers. With Narratives, you connect your perspective on Eurofins Scientific’s business, such as where revenue and margins could go, to specific financial forecasts and a resulting fair value.

Available in the Simply Wall St Community, Narratives are a simple and powerful tool used by millions of investors to translate their unique views into actionable decisions. By comparing their Fair Value to the actual market price, investors can decide if now is the time to buy or sell. Unlike static models, Narratives update dynamically as key events and new information arise, so your analysis stays current as the story evolves.

For example, some investors believe Eurofins Scientific could be worth as much as €95.00 per share by anticipating strong earnings growth and profits, while more cautious views suggest a fair value closer to €46.00, based on risks like integration challenges and spending. Narratives let you make your own call based on the business story you trust most and see instantly how this shapes your decision.

Do you think there's more to the story for Eurofins Scientific? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eurofins Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ERF

Eurofins Scientific

Provides various analytical testing and laboratory services worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives