- France

- /

- Entertainment

- /

- ENXTPA:VIV

Vivendi (ENXTPA:VIV) Valuation Update Following New Financial Results and Gameloft-Driven Growth

Reviewed by Simply Wall St

Vivendi (ENXTPA:VIV) released its latest unaudited financial results, highlighting a small dip in third quarter revenue, but a 5% rise for the first nine months, thanks largely to Gameloft’s improved numbers.

See our latest analysis for Vivendi.

Vivendi’s solid revenue growth from Gameloft has helped brighten its broader narrative, and investors seem to have noticed. Despite some recent softness, with a 4.57% drop in the past week, the stock’s total shareholder return of 43.61% over the past year points to strong, building momentum for long-term holders.

If Vivendi’s momentum has you curious, now could be the perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

With shares still below analyst targets despite recent gains, the question now is whether Vivendi remains underrated in the market or if the current price already reflects all the company’s potential. Is there more room for upside?

Most Popular Narrative: 14.8% Undervalued

Vivendi’s current share price still sits beneath the most widely followed narrative fair value, suggesting there is latent optimism about future growth and margin expansion that has yet to be priced in by the market.

The exceptional performance of newly listed entities like Havas and Louis Hachette and their potential synergies are likely to enhance revenue streams and net margins in the future. Vivendi's cost management strategy, demonstrated by cost reductions and streamlined operations at Gameloft, is expected to improve net margins and bolster earnings as the company continues to focus on efficiency.

Want to know what is fueling this optimistic valuation? The narrative hints at a bold transformation, forecast profit leaps, and a sharp pivot in Vivendi’s business model. The real story is in the ambitious financial projections that drive this target. Ready to uncover how they add up?

Result: Fair Value of €3.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the picture is not without risk, as ongoing net losses and uncertain returns from key investments could quickly shift Vivendi’s outlook.

Find out about the key risks to this Vivendi narrative.

Another View: Multiples Paint a Different Picture

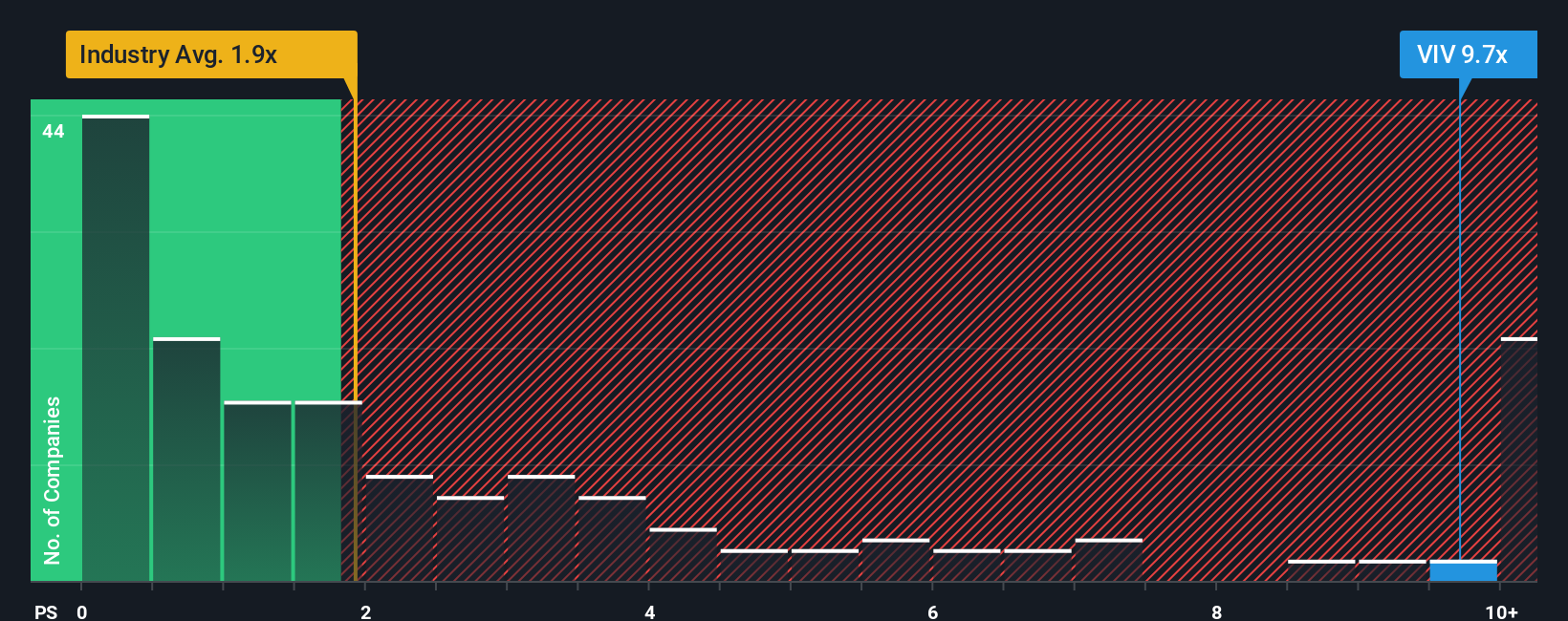

Looking through the lens of price-to-sales, Vivendi trades at 9.7 times sales, which is much higher than both the industry average of 1.9x and its fair ratio of 1.1x. This premium suggests that investors are pricing in lots of optimism, but it also raises questions about valuation risk if growth falls short. Is the market overestimating Vivendi’s future, or is there more to the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vivendi Narrative

If you want to dig into the numbers yourself or craft a perspective that fits your analysis, it only takes a few minutes to build your own view. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Vivendi.

Looking for more investment ideas?

Smart investors always keep fresh opportunities on their radar. Stay ahead of the curve and don’t miss out on unique ways to boost your portfolio’s performance.

- Capture the upside of tomorrow’s artificial intelligence by scanning these 26 AI penny stocks, transforming industries and unlocking new value.

- Collect the benefits of reliable income streams with these 24 dividend stocks with yields > 3%, delivering attractive yields above 3 percent and standout stability.

- Seize undervalued opportunities others may have missed by using these 831 undervalued stocks based on cash flows and gain an edge in your investment strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIV

Vivendi

Operates in the content, media, and entertainment industries in France, rest of Europe, the Americas, Asia/Oceania, and Africa.

Moderate growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives