Stock Analysis

In recent weeks, the French market has shown resilience with the CAC 40 Index climbing by nearly 3.89%, buoyed by hopes for interest rate cuts amid slowing business activity in the eurozone. As global economic conditions continue to evolve, high-growth tech stocks in France, such as OVH Groupe and others, are attracting attention for their potential to capitalize on technological advancements and favorable market sentiment.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 17.24% | 33.91% | ★★★★★☆ |

| Archos | 25.98% | 77.41% | ★★★★★☆ |

| Valneva | 28.00% | 25.49% | ★★★★★☆ |

| VusionGroup | 28.35% | 81.78% | ★★★★★★ |

| Munic | 26.73% | 149.96% | ★★★★★☆ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| Valbiotis | 33.52% | 39.79% | ★★★★★☆ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.28 billion.

Operations: OVH Groupe generates revenue through its public cloud (€169.01 million), private cloud (€589.61 million), and web cloud services (€185.43 million). The company's offerings span a range of cloud-based solutions, catering to diverse client needs across the globe.

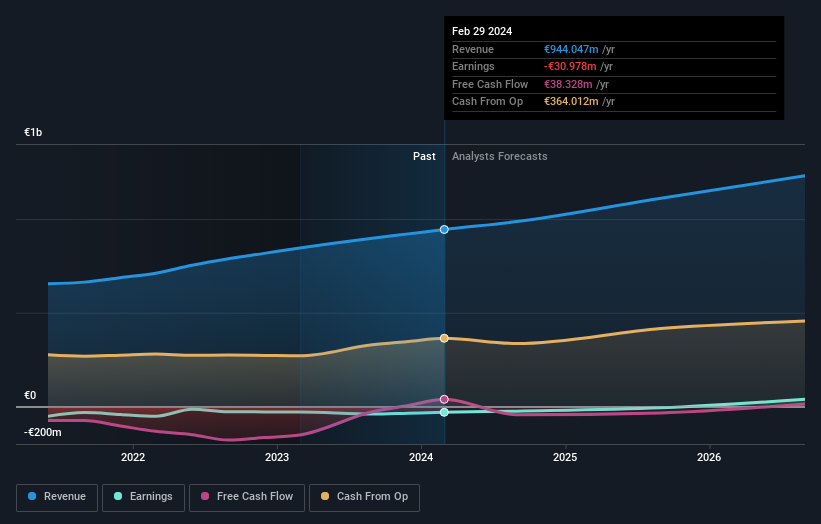

OVH Groupe, amidst a volatile market, is on a trajectory to profitability with expected earnings growth of 101.1% annually. This French tech firm's R&D spending is robust, aligning with its revenue growth projections of 9.7% per year—outpacing the French market average of 5.7%. Despite current unprofitability and a low forecasted Return on Equity at 1.7%, OVH's commitment to innovation through increased R&D expenses could bolster its competitive edge in the evolving IT landscape. With positive free cash flow and significant revenue acceleration, OVH's future in high-growth tech sectors appears promising yet challenging due to its financial volatility and slower industry growth rates.

- Dive into the specifics of OVH Groupe here with our thorough health report.

Gain insights into OVH Groupe's past trends and performance with our Past report.

Planisware SAS (ENXTPA:PLNW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Planisware SAS is a business-to-business software-as-a-service provider with operations across Europe, the Americas, the Asia-Pacific, and internationally, and has a market cap of €1.93 billion.

Operations: Planisware generates revenue primarily from its Software & Programming segment, which amounts to €156.44 million. As a business-to-business SaaS provider, it operates across multiple regions including Europe, the Americas, and the Asia-Pacific.

Planisware SAS, a French software company, is outpacing its sector with a robust earnings growth of 32.6% over the past year, significantly higher than the industry average of 11.2%. This performance is underpinned by an aggressive R&D strategy which reflects in their financial commitments; R&D expenses are notably aligned with revenue increases projected at 16.1% annually—well above the broader French market's growth rate of 5.7%. Looking ahead, Planisware is expected to sustain this momentum with earnings forecasted to grow at 15.2% per year, supported by a strong projected Return on Equity of 26.3% in three years' time, indicating potential for continued market leadership and innovation-driven expansion.

- Click to explore a detailed breakdown of our findings in Planisware SAS' health report.

Understand Planisware SAS' track record by examining our Past report.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE is a global entertainment, media, and communication company with operations across multiple continents and has a market capitalization of approximately €10.47 billion.

Operations: Vivendi SE generates revenue primarily through its Canal+ Group and Havas Group segments, contributing €6.20 billion and €2.92 billion respectively. The company also earns from other segments such as Gameloft, Prisma Media, and Vivendi Village.

Vivendi SE, amidst a dynamic earnings period, reported a significant sales jump to €9.05 billion from €4.7 billion year-over-year, reflecting robust growth despite a slight dip in net income from €174 million to €159 million. This performance is bolstered by an aggressive R&D expenditure strategy, crucial for sustaining its innovative edge in the media sector. The company's commitment to innovation is evident as it repurchased shares worth €184 million, enhancing shareholder value and demonstrating confidence in its strategic direction. Moreover, exploring a potential listing of Groupe Canal Plus indicates Vivendi's strategic shifts to maximize asset values and focus on core business strengths moving forward.

- Navigate through the intricacies of Vivendi with our comprehensive health report here.

Evaluate Vivendi's historical performance by accessing our past performance report.

Summing It All Up

- Gain an insight into the universe of 41 Euronext Paris High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.