Here's Why Vivendi SE's (EPA:VIV) CEO Might See A Pay Rise Soon

Shareholders will be pleased by the robust performance of Vivendi SE (EPA:VIV) recently and this will be kept in mind in the upcoming AGM on 22 June 2021. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

Check out our latest analysis for Vivendi

How Does Total Compensation For Arnaud de Puyfontaine Compare With Other Companies In The Industry?

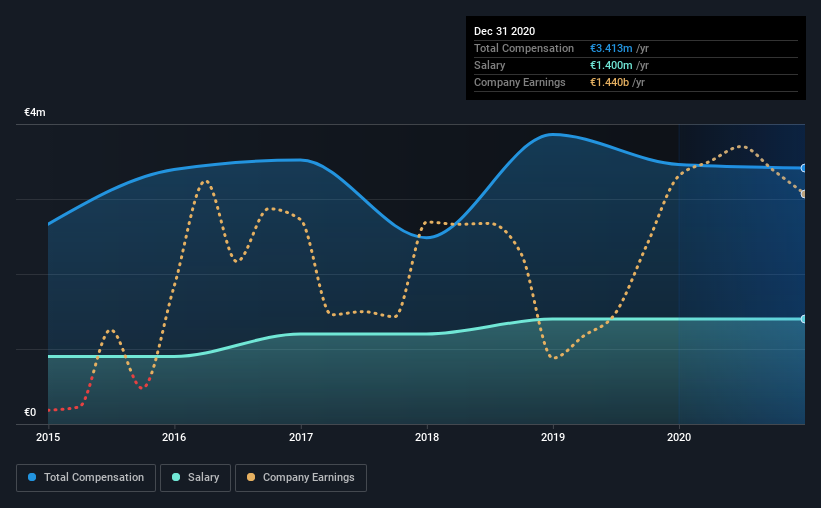

At the time of writing, our data shows that Vivendi SE has a market capitalization of €32b, and reported total annual CEO compensation of €3.4m for the year to December 2020. That is, the compensation was roughly the same as last year. We think total compensation is more important but our data shows that the CEO salary is lower, at €1.4m.

In comparison with other companies in the industry with market capitalizations over €6.6b , the reported median total CEO compensation was €5.6m. In other words, Vivendi pays its CEO lower than the industry median. Furthermore, Arnaud de Puyfontaine directly owns €9.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €1.4m | €1.4m | 41% |

| Other | €2.0m | €2.1m | 59% |

| Total Compensation | €3.4m | €3.5m | 100% |

On an industry level, roughly 41% of total compensation represents salary and 59% is other remuneration. Vivendi is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Vivendi SE's Growth

Over the past three years, Vivendi SE has seen its earnings per share (EPS) grow by 9.2% per year. Its revenue is up 1.2% over the last year.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but we're happy with the modest EPS growth. So there are some positives here, but not enough to earn high praise. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Vivendi SE Been A Good Investment?

Boasting a total shareholder return of 43% over three years, Vivendi SE has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Vivendi that investors should think about before committing capital to this stock.

Switching gears from Vivendi, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Vivendi, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:VIV

Vivendi

Operates as an entertainment, media, and communication company in France, the rest of Europe, the Americas, Asia/Oceania, and Africa.

Excellent balance sheet with reasonable growth potential.