- France

- /

- Gas Utilities

- /

- ENXTPA:RUI

3 Top Euronext Paris Dividend Stocks Yielding Up To 7.0%

Reviewed by Simply Wall St

As the Eurozone economy maintains its resilience, France's CAC 40 Index has advanced by 2.48%, reflecting investor optimism amid hopes for potential interest rate cuts. In this favorable market environment, dividend stocks present a compelling opportunity for investors seeking steady income streams. When evaluating dividend stocks, it's crucial to consider factors such as yield consistency, payout ratio, and the company's overall financial health. In light of current conditions, these attributes can help identify robust investment options on Euronext Paris that offer attractive yields up to 7.0%.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.53% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.03% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.86% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 6.06% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.37% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.03% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.83% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.53% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.26% | ★★★★★☆ |

| Eiffage (ENXTPA:FGR) | 4.46% | ★★★★☆☆ |

Click here to see the full list of 34 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

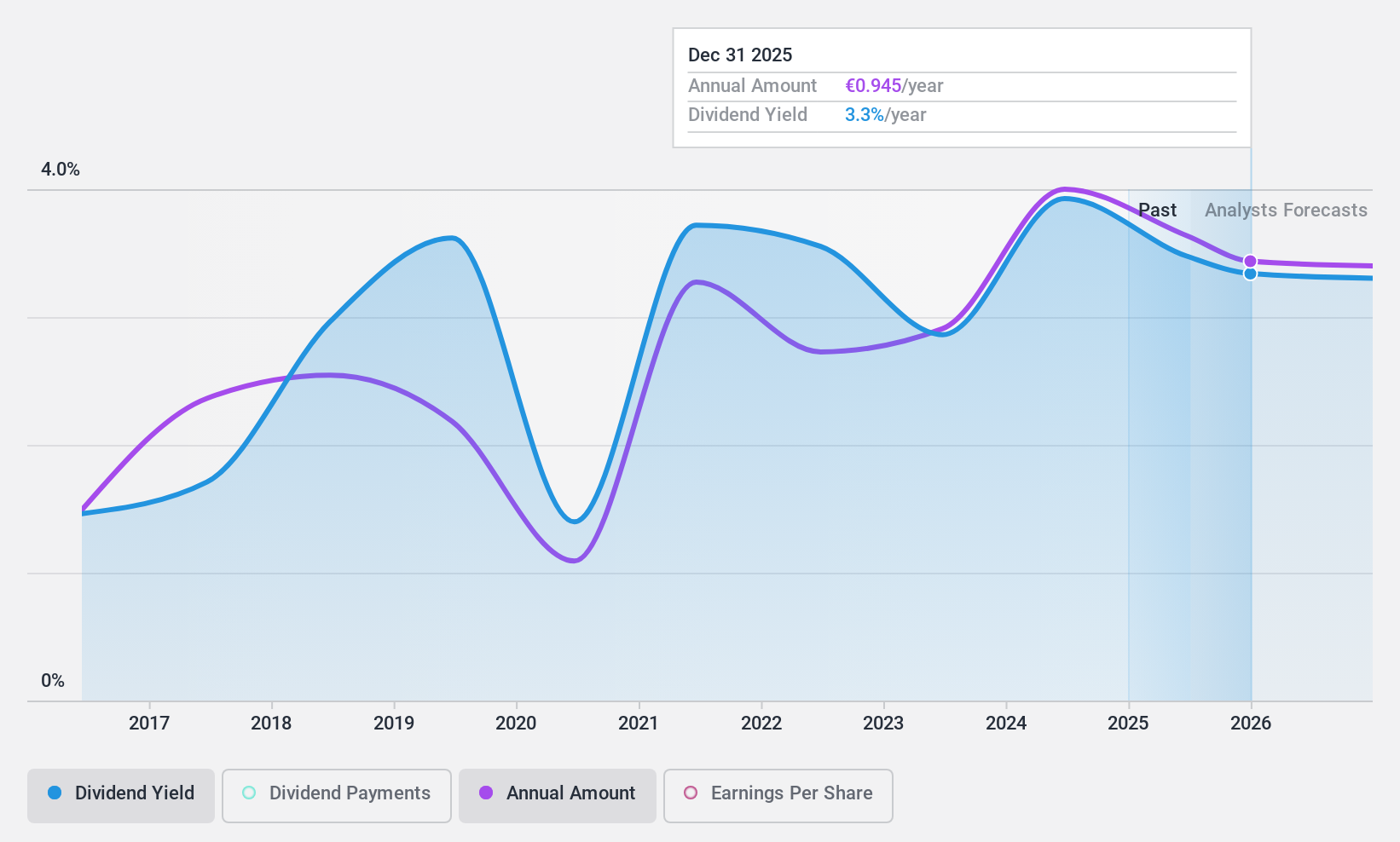

Groupe Guillin (ENXTPA:ALGIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Guillin S.A. produces and sells food packaging products in France and internationally, with a market cap of €536.11 million.

Operations: Groupe Guillin S.A. generates revenue primarily from its Packaging Sector (€837.39 million) and Material Sector (€48.24 million).

Dividend Yield: 3.8%

Groupe Guillin's dividend payments are well covered by earnings and cash flows, with a payout ratio of 27% and a cash payout ratio of 18.5%. Although the dividend yield is lower than the top tier in France at 3.79%, it trades at good value compared to peers and industry, being significantly below its estimated fair value. However, investors should note the volatility in its dividend payments over the past decade despite recent earnings growth of 47.9%.

- Navigate through the intricacies of Groupe Guillin with our comprehensive dividend report here.

- According our valuation report, there's an indication that Groupe Guillin's share price might be on the cheaper side.

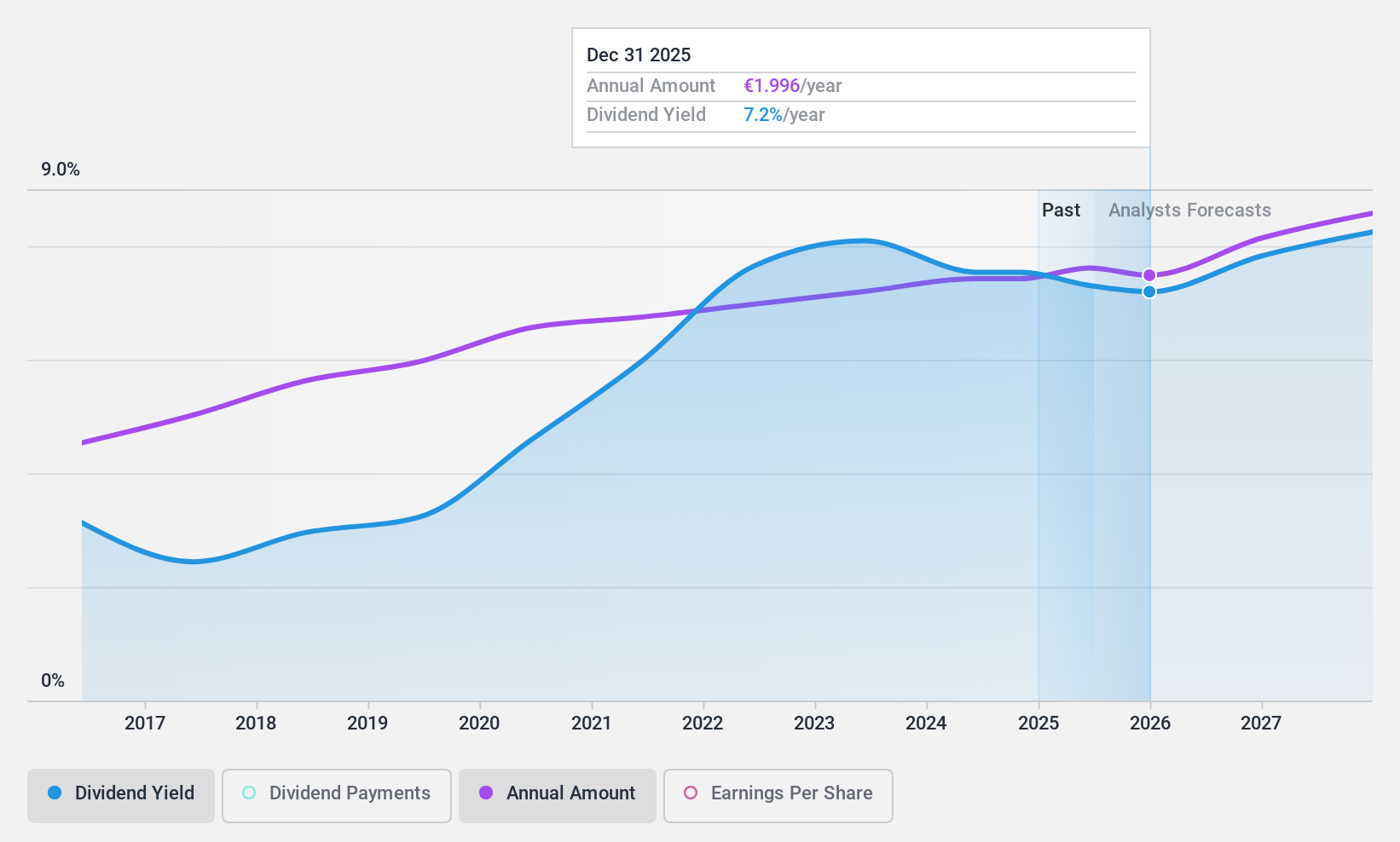

Rubis (ENXTPA:RUI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial customers across Europe, Africa, and the Caribbean, with a market cap of €2.93 billion.

Operations: Rubis generates revenue primarily from Energy Distribution (€6.58 billion) and Renewable Electricity Production (€48.64 million).

Dividend Yield: 7.0%

Rubis offers a compelling dividend profile with a payout ratio of 57.7%, ensuring dividends are covered by earnings and cash flows (73.8%). The stock's dividend yield of 7.03% is among the top 25% in France, supported by stable and growing payments over the past decade. Despite a high level of debt, Rubis trades at good value with a Price-To-Earnings ratio of 8.3x, significantly below the French market average of 14.7x.

- Click here and access our complete dividend analysis report to understand the dynamics of Rubis.

- Insights from our recent valuation report point to the potential undervaluation of Rubis shares in the market.

TF1 (ENXTPA:TFI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TF1 SA operates in broadcasting, studios and entertainment, and digital businesses across France and internationally, with a market cap of €1.68 billion.

Operations: TF1 SA generates revenue from Newen Studios (€377.40 million) and Media, including Digital (€2.06 billion).

Dividend Yield: 6.9%

TF1's dividend yield of 6.92% is in the top 25% of French dividend payers, with payments covered by earnings (62.2%) and cash flows (53.3%). However, its dividends have been unstable and not grown over the past decade. Despite trading at a significant discount to its estimated fair value, recent earnings showed a decline in net income for H1 2024 compared to last year (€96 million vs €101.3 million).

- Dive into the specifics of TF1 here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that TF1 is priced lower than what may be justified by its financials.

Taking Advantage

- Gain an insight into the universe of 34 Top Euronext Paris Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RUI

Rubis

Engages in the operation of bulk liquid storage facilities for commercial and industrial customers in Europe, Africa, and the Caribbean.

6 star dividend payer with solid track record.