As the European markets experience a positive shift with the pan-European STOXX Europe 600 Index rising by 0.90% amid easing inflation and supportive monetary policy from the European Central Bank, investors are increasingly focusing on dividend stocks as a potential source of steady income. In this environment, selecting dividend stocks that demonstrate strong fundamentals and resilience can be particularly appealing for those looking to capitalize on stable returns amidst evolving economic conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.45% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.95% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.89% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.31% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.93% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.66% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.29% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.14% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.81% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.43% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Industria de Diseño Textil (BME:ITX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Industria de Diseño Textil, S.A., known for its retail and online distribution of clothing, footwear, accessories, and household products across Spain, Europe, the Americas, Asia, and globally, has a market cap of €153.28 billion.

Operations: Industria de Diseño Textil, S.A.'s revenue segments include Bershka at €2.94 billion and Zara / Zara Home at €27.96 billion.

Dividend Yield: 3.4%

Industria de Diseño Textil, S.A. offers a mixed dividend profile. The company reported strong earnings growth with Q1 2025 sales of €8.27 billion and net income of €1.31 billion, supporting its dividend payments with a payout ratio of 60%. However, the dividend yield is lower than top-tier Spanish payers at 3.41%, and past volatility raises concerns about reliability despite recent increases over the past decade and coverage by cash flows at a 79.1% cash payout ratio.

- Unlock comprehensive insights into our analysis of Industria de Diseño Textil stock in this dividend report.

- The analysis detailed in our Industria de Diseño Textil valuation report hints at an inflated share price compared to its estimated value.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market cap of €600.98 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative generates revenue through its Proximity Bank segment, which accounts for €251.71 million, and the Management for Own Account and Miscellaneous segment, contributing €60.97 million.

Dividend Yield: 3.3%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative's dividend profile is characterized by stability and reliability, with dividends growing steadily over the past decade. Trading at 35% below estimated fair value, it offers a dividend yield of 3.34%, lower than France's top payers. The low payout ratio of 25% suggests dividends are well covered by earnings, despite insufficient data to assess future sustainability or coverage beyond three years. Recent earnings show net interest income growth but a decline in net income to €80.55 million from €111.84 million the previous year.

- Delve into the full analysis dividend report here for a deeper understanding of Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative.

- The analysis detailed in our Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative valuation report hints at an deflated share price compared to its estimated value.

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. operates globally, offering marketing, communications, and digital business transformation services across various regions including North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East with a market cap of approximately €24.40 billion.

Operations: Publicis Groupe's revenue from Advertising and Communication Services is €16.03 billion.

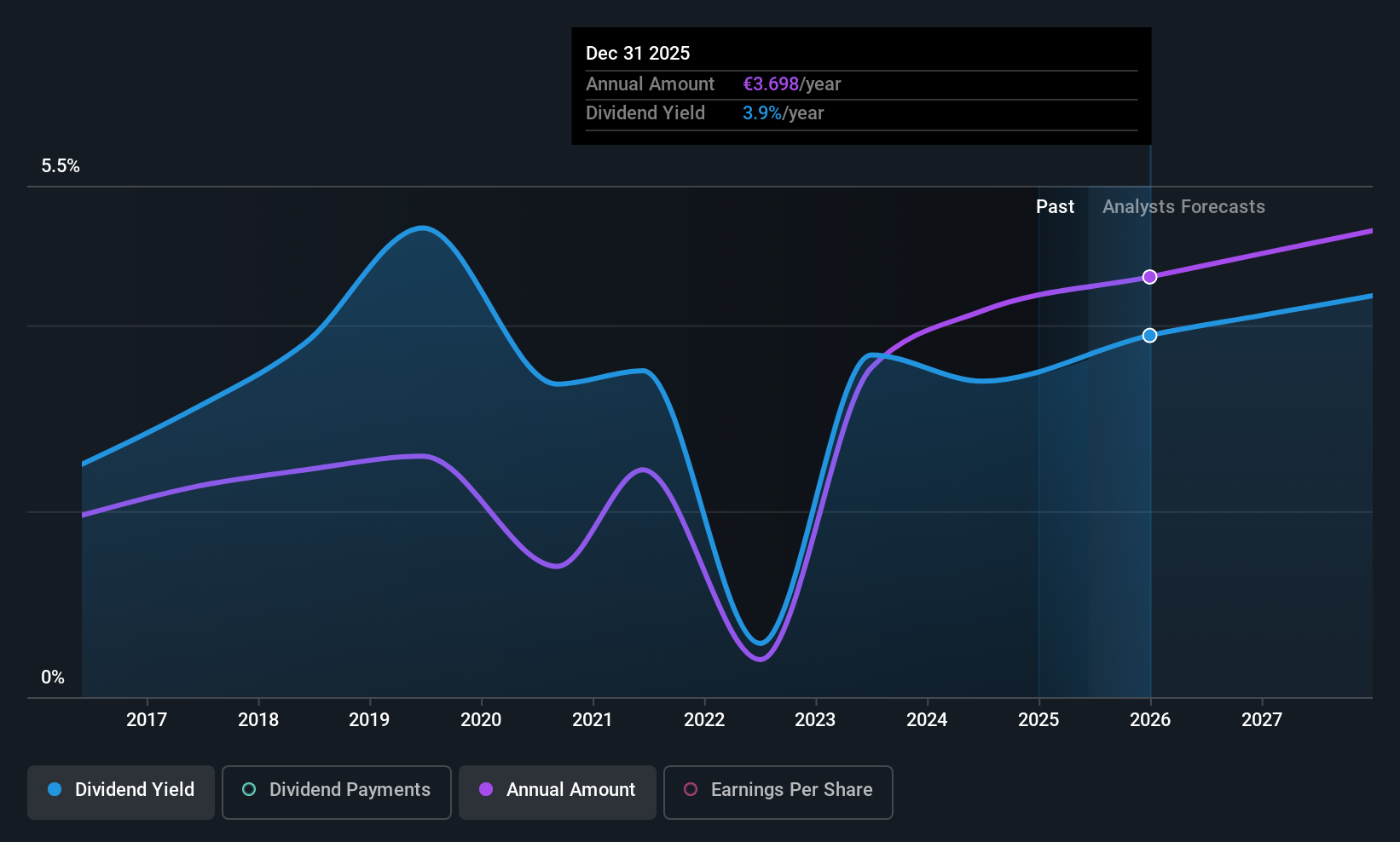

Dividend Yield: 3.7%

Publicis Groupe's dividend profile is marked by volatility over the past decade, despite recent growth in payments. The dividends are well covered by both earnings and cash flows, with payout ratios of 54.4% and 43.7%, respectively. Trading at a significant discount to its estimated fair value, Publicis offers a dividend yield of 3.69%, which is lower than the top quartile in France. Recent strategic initiatives include a €150 million share buyback program to support employee incentive plans without issuing new shares.

- Get an in-depth perspective on Publicis Groupe's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Publicis Groupe's share price might be too pessimistic.

Make It Happen

- Delve into our full catalog of 229 Top European Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PUB

Publicis Groupe

Provides marketing, communications, and digital business transformation services in North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives