- France

- /

- Trade Distributors

- /

- ENXTPA:RXL

Top Dividend Stocks On Euronext Paris

Reviewed by Simply Wall St

The French stock market has shown resilience, with the CAC 40 Index adding 0.25% despite global economic uncertainties and mixed signals from the eurozone's retail sales data. As investors seek stability amidst these fluctuations, dividend stocks on Euronext Paris offer a compelling option for those looking to balance income with potential growth. In today's market conditions, a good dividend stock is characterized by consistent payouts and strong financial health, making it an attractive choice for investors aiming to navigate economic volatility while securing steady returns.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.67% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.23% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.88% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 6.01% | ★★★★★☆ |

| Infotel (ENXTPA:INF) | 5.65% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.43% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.04% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.92% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.59% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.47% | ★★★★★☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

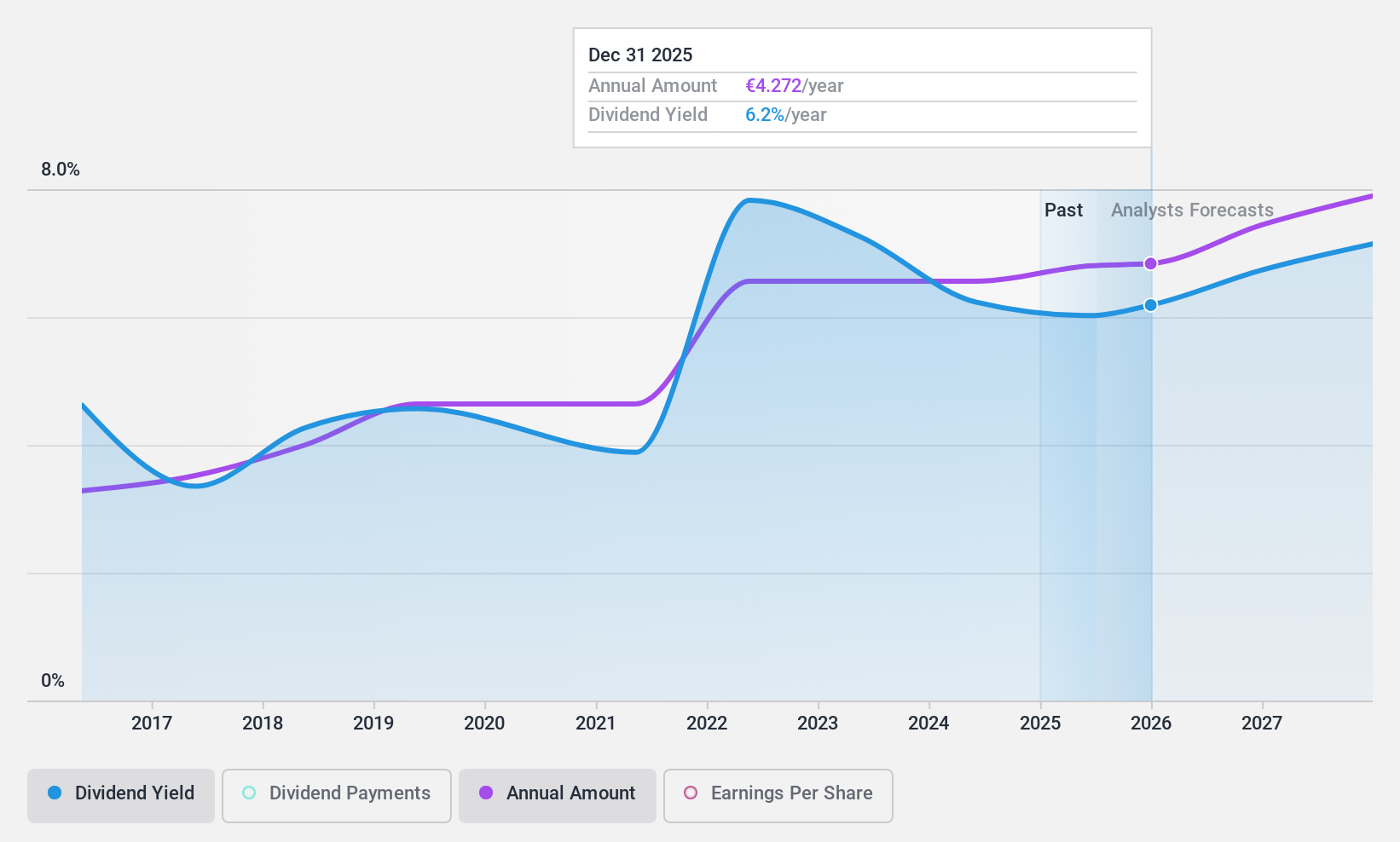

Amundi (ENXTPA:AMUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market cap of approximately €12.96 billion.

Operations: Amundi generates €6.09 billion from its Asset Management segment.

Dividend Yield: 6.4%

Amundi S.A. reported robust earnings for Q2 2024, with revenue rising to €887 million and net income reaching €333 million. The company approved a dividend of €4.10 per share, paid in June 2024. Despite a high dividend yield of 6.44%, Amundi's dividends have been volatile over its nine-year history, though they are covered by both earnings (69.3% payout ratio) and cash flows (56% cash payout ratio).

- Delve into the full analysis dividend report here for a deeper understanding of Amundi.

- According our valuation report, there's an indication that Amundi's share price might be on the cheaper side.

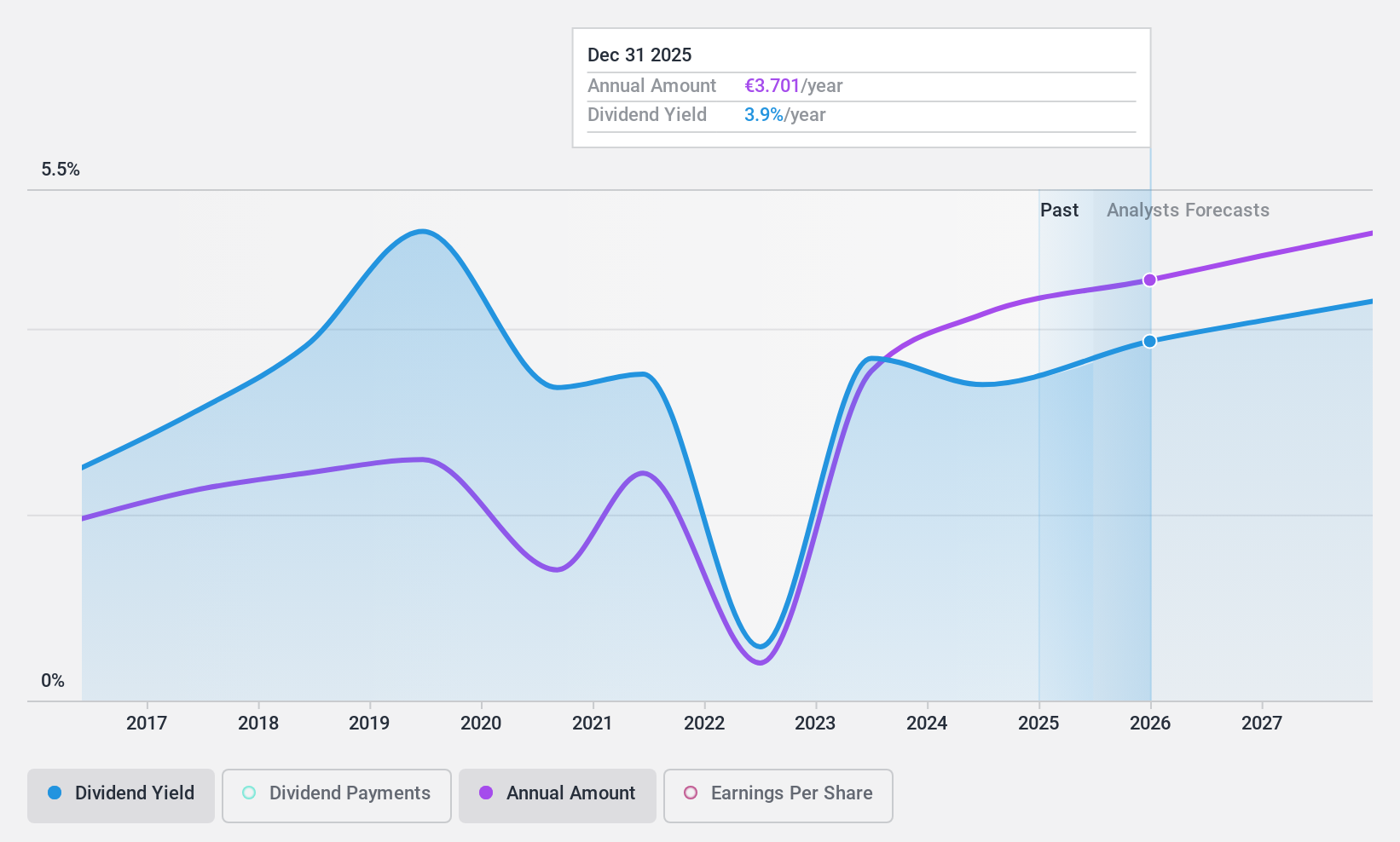

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. offers marketing, communications, and digital business transformation services across various regions including North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East with a market cap of €22.83 billion.

Operations: Publicis Groupe S.A. generates €15.35 billion in revenue from its Advertising and Communication Services segment.

Dividend Yield: 3.7%

Publicis Groupe's dividend payments have been volatile over the past decade, but they have increased overall. Currently, the dividend yield of 3.74% is lower than the top quartile in France. However, dividends are covered by earnings (54.7% payout ratio) and cash flows (64.2% cash payout ratio). Recent upgrades in revenue guidance and strong H1 2024 earnings (€773 million net income) indicate potential for sustained growth despite macroeconomic uncertainties.

- Dive into the specifics of Publicis Groupe here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Publicis Groupe shares in the market.

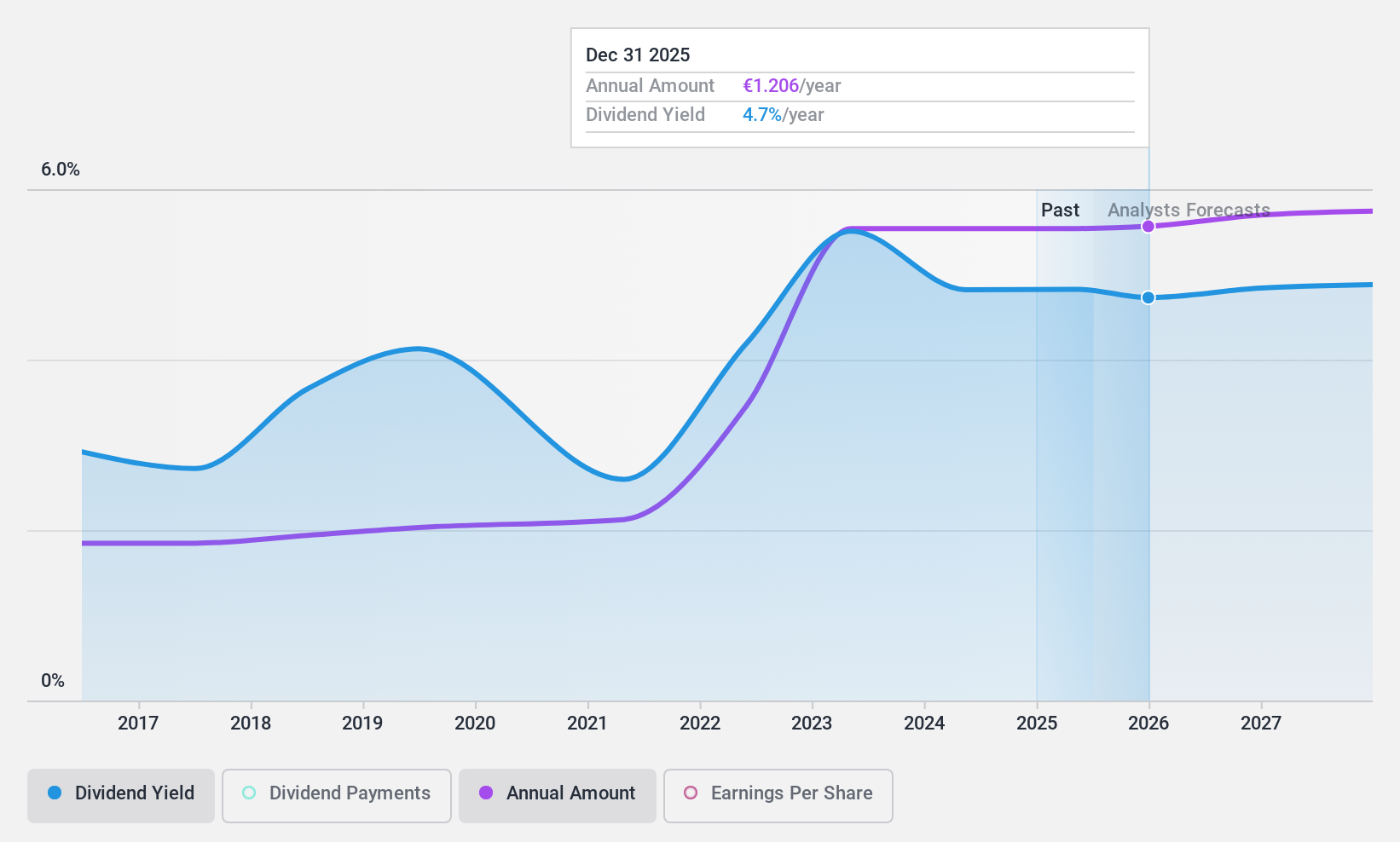

Rexel (ENXTPA:RXL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rexel S.A. and its subsidiaries distribute low and ultra-low voltage electrical products and services across residential, commercial, and industrial markets in France, Europe, North America, and Asia-Pacific with a market cap of €6.58 billion.

Operations: Rexel S.A. generates €19.02 billion in revenue from its wholesale electronics segment.

Dividend Yield: 5.4%

Rexel S.A.'s dividend payments have been volatile and unreliable over the past decade, though they have increased overall. The dividends are well-covered by earnings (51.6% payout ratio) and cash flows (39.8% cash payout ratio). Despite a high level of debt, Rexel trades at good value compared to peers and industry benchmarks. Recent buybacks (€169.33 million) and strategic M&A pursuits indicate proactive financial management, although H1 2024 earnings showed a decline in net income to €351.9 million from €428.4 million last year.

- Get an in-depth perspective on Rexel's performance by reading our dividend report here.

- The analysis detailed in our Rexel valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Delve into our full catalog of 35 Top Euronext Paris Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RXL

Rexel

Engages in distribution of low and ultra-low voltage electrical products and services for the residential, commercial, and industrial markets in France, Europe, North America, and Asia-Pacific.

Excellent balance sheet, good value and pays a dividend.