As European markets experience a mixed landscape with the pan-European STOXX Europe 600 Index rising on the back of positive developments in the U.S., cooling sentiment around artificial intelligence has tempered gains. Against this backdrop, dividend stocks offer a compelling investment option for those seeking steady income streams, especially in times of economic uncertainty.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.34% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.35% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.22% | ★★★★★★ |

| Evolution (OM:EVO) | 4.93% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.34% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 9.68% | ★★★★★☆ |

| Credito Emiliano (BIT:CE) | 5.16% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.71% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.69% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.59% | ★★★★★☆ |

Click here to see the full list of 225 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

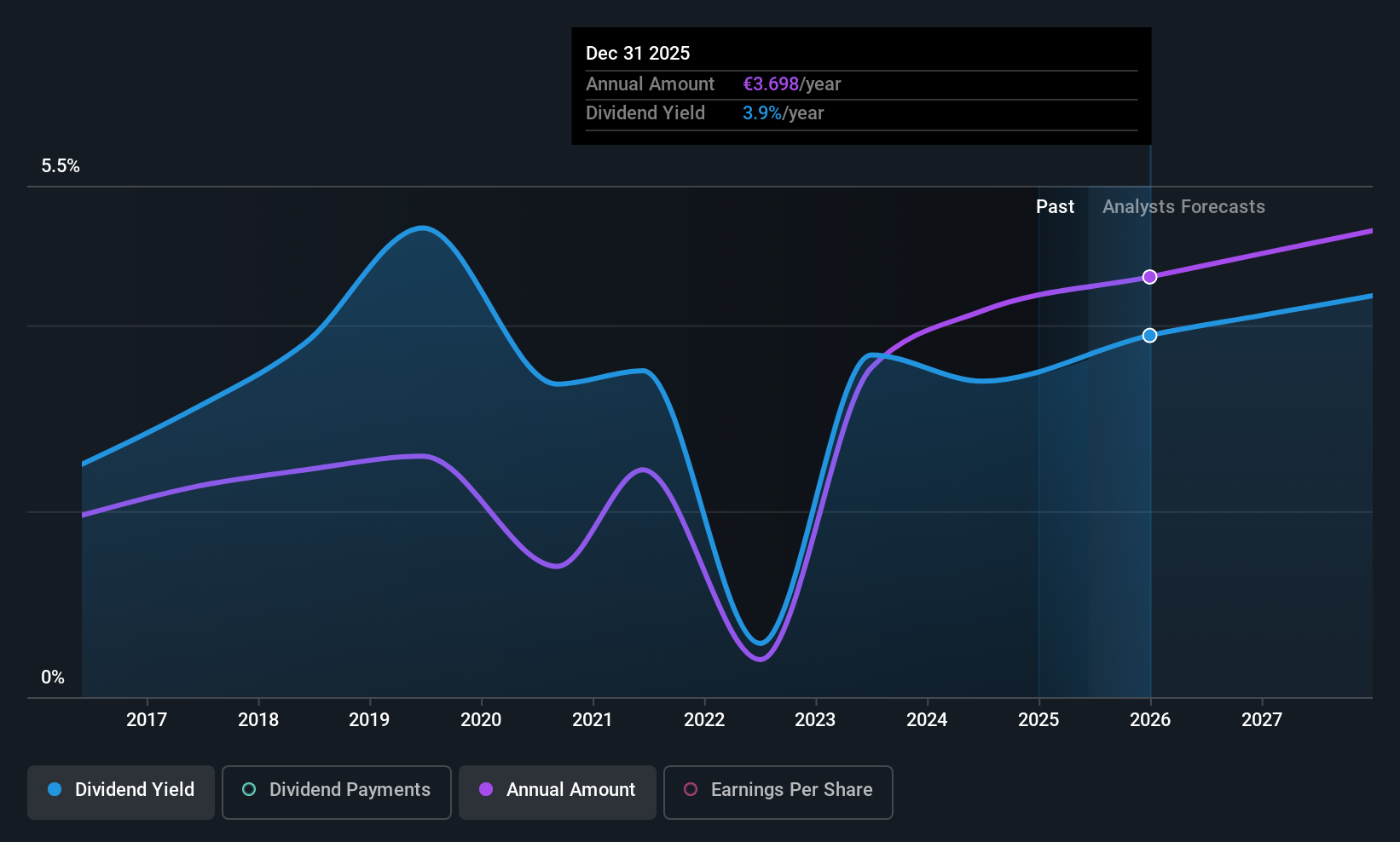

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. operates globally, offering marketing, communications, and digital business transformation services across various regions including North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East with a market cap of approximately €21.64 billion.

Operations: Publicis Groupe S.A. generates revenue primarily from its Advertising and Communication Services segment, which accounts for €16.86 billion.

Dividend Yield: 4.2%

Publicis Groupe's dividend payments, though covered by earnings (52.8% payout ratio) and cash flows (43.5% cash payout ratio), have been volatile over the past decade, with drops exceeding 20%. Despite this instability, the company is trading at a good value compared to peers and below its estimated fair value. Recent upgrades in earnings guidance suggest potential growth, supported by strategic executive appointments aimed at enhancing production capabilities through AI technology platforms.

- Navigate through the intricacies of Publicis Groupe with our comprehensive dividend report here.

- The analysis detailed in our Publicis Groupe valuation report hints at an deflated share price compared to its estimated value.

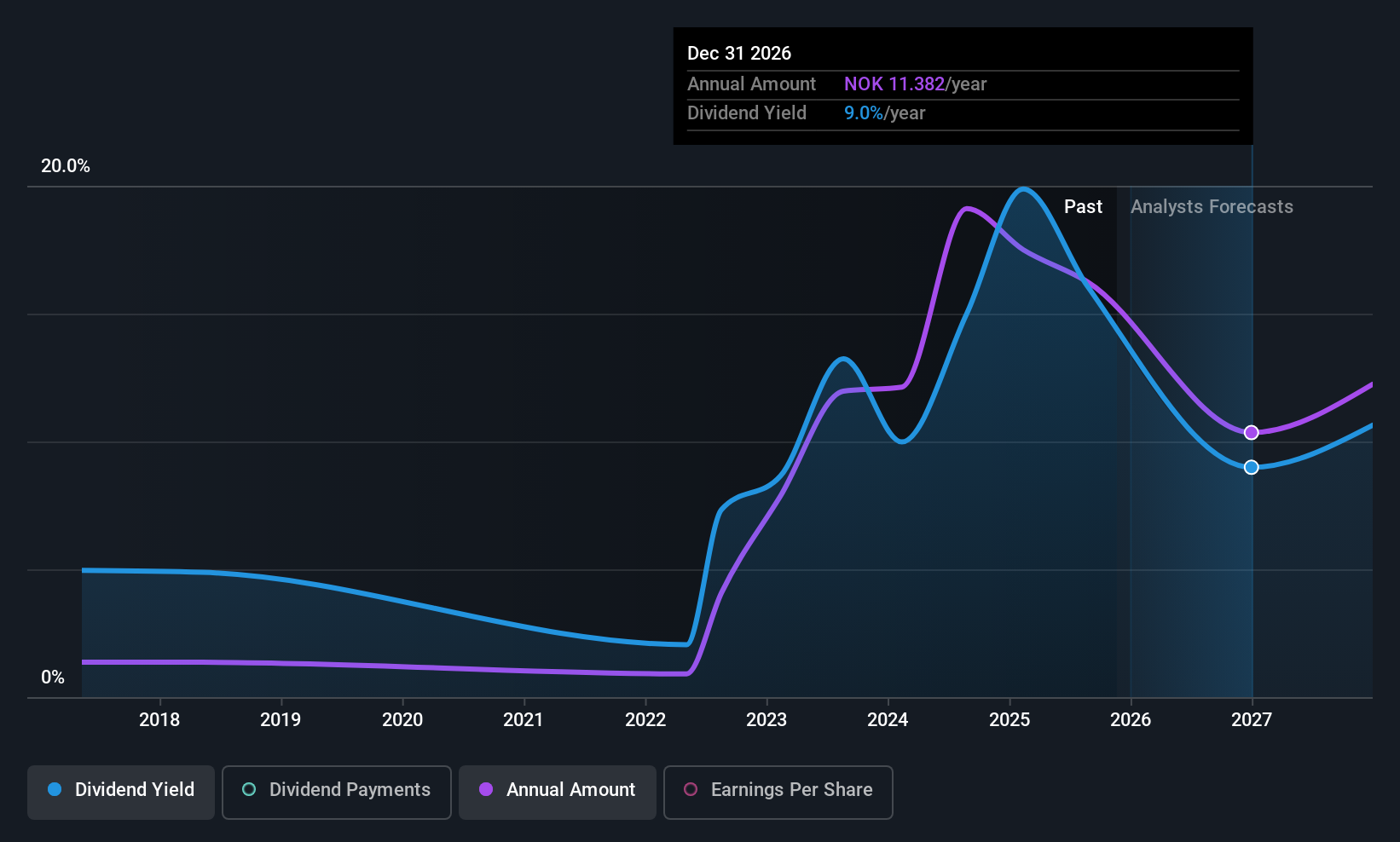

Odfjell (OB:ODF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Odfjell SE is involved in the transportation and storage of bulk liquid chemicals, acids, edible oils, and other specialty products across various regions including North America, South America, Europe, the Middle East, Asia, Africa, and Australasia with a market cap of NOK9.93 billion.

Operations: Odfjell SE's revenue is primarily derived from its services in transporting and storing bulk liquid chemicals, acids, edible oils, and specialty products across multiple global regions.

Dividend Yield: 14.2%

Odfjell SE's dividend yield is among the top 25% in Norway, yet its dividends have been unreliable and volatile over the past nine years. Despite a reasonable payout ratio of 59.4%, net income has declined, impacting earnings per share. The company trades significantly below estimated fair value but faces challenges with high debt levels. While dividends are covered by cash flows (81.9% cash payout ratio), their sustainability remains questionable given the unstable track record and recent financial performance declines.

- Delve into the full analysis dividend report here for a deeper understanding of Odfjell.

- The valuation report we've compiled suggests that Odfjell's current price could be quite moderate.

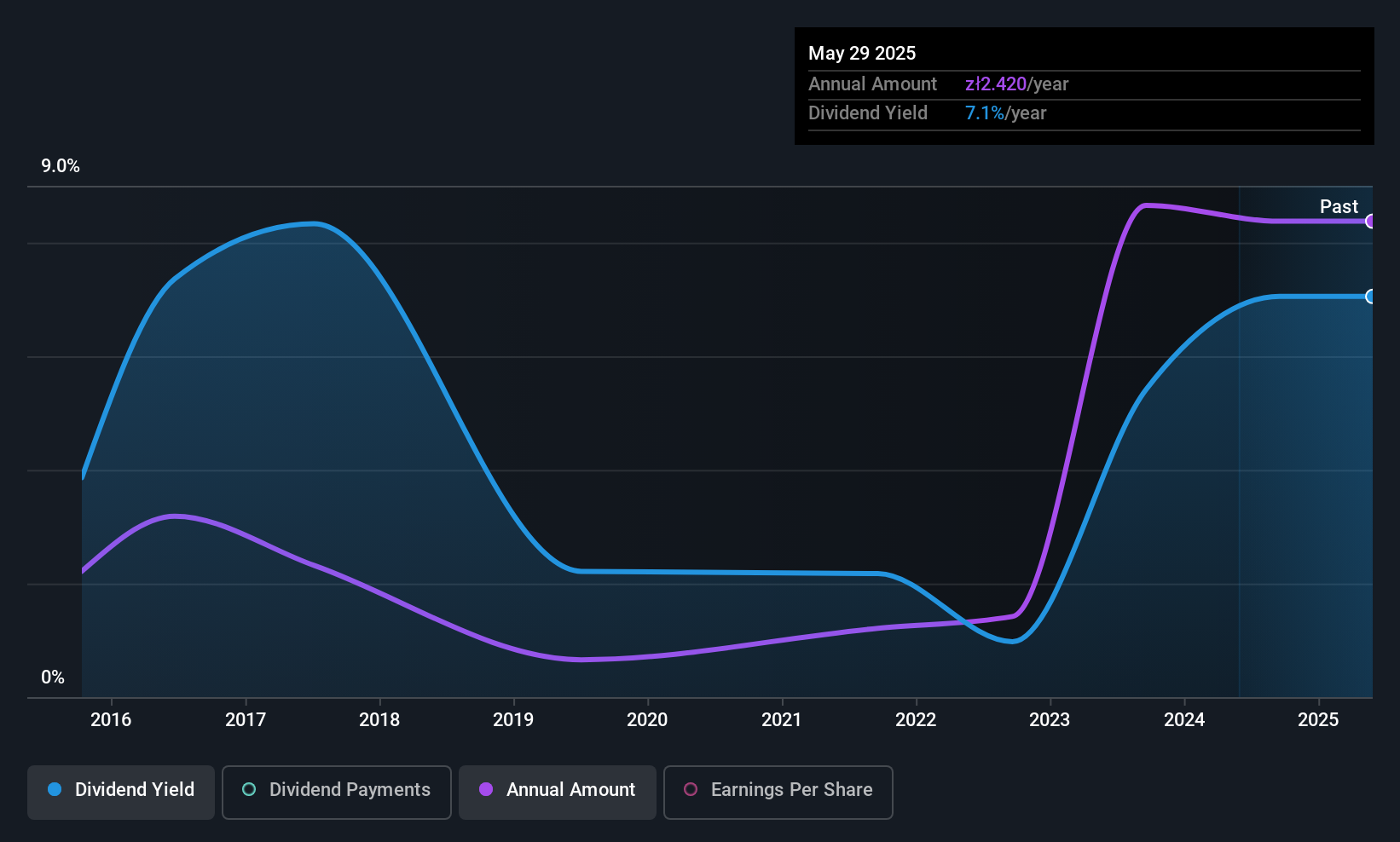

Votum (WSE:VOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Votum S.A. specializes in assisting road accident victims in securing compensation from insurance companies and has a market cap of PLN564.60 million.

Operations: Votum S.A.'s revenue is primarily derived from Bank Claims at PLN546.85 million, with additional contributions from Compensation Cases at PLN49.93 million and Rehabilitation at PLN32.50 million.

Dividend Yield: 5.1%

Votum's dividend payments are well covered by earnings and cash flows, with payout ratios of 28.6% and 16.3%, respectively. However, the dividend track record has been volatile over the past decade despite recent growth in payments. Trading significantly below its estimated fair value, Votum reported strong earnings growth with net income rising to PLN 79.47 million for the first half of 2025 from PLN 42.83 million a year ago, reflecting robust financial performance despite an unstable dividend history.

- Click to explore a detailed breakdown of our findings in Votum's dividend report.

- Our valuation report unveils the possibility Votum's shares may be trading at a discount.

Where To Now?

- Access the full spectrum of 225 Top European Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VOT

Votum

Votum S.A. helps victims of road accidents to obtain compensation from insurance companies.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives